US Personal Consumption Expenditures, PCE, shows inflation is on the rise, setting the US dollar up for big gains. The headline income and spending figures, 0.3% and 0.4%, are as expected but, the expectation is for inflation to hit the 2% target in the medium term or sooner, leading the FOMC to raise interest rates faster than currently indicated.

PCE prices, the Fed’s favored tool for measuring inflation, rose less than a tenth over the past month but does not reveal the bigger picture. The bigger picture has core-PCE prices, ex food and energy, up 0.2% in March and 1.9% YoY, very near to the Fed’s target. With inflation trending higher it is certain 2.0% will be reached over the next quarter or two.

With inflation trending higher the market is expecting interest rate hikes from the FOMC. The current expectation has the FOMC holding rates steady at the meeting this week and then raising them again in June. Further out they are expected to raise rates at least one more time this year with a 50/50 chance of hiking three times by December.

Anything in the FOMC statement (no press conference this meeting) that leads the market to up the chance of a 4th hike in 2018 will send the dollar shooting up versus major world currencies. Why? Because no other central bank is expected to tighten policy over the next twelve to eighteen months while the FOMC is expected to tighten not once, not twice, but as many as 6 times.

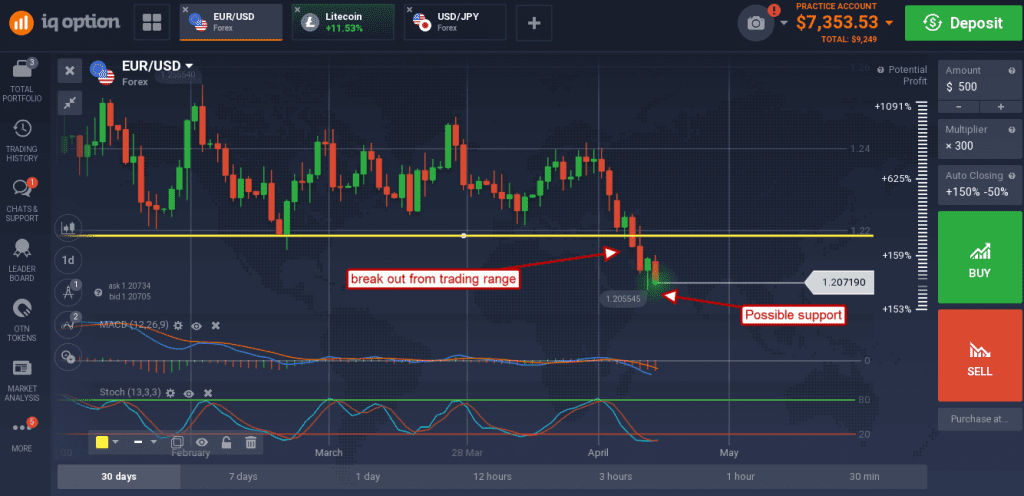

The EUR/USD wobbled a bit on the news, there were some positive revisions (lower inflation) to the previous two months that offered some support near 1.2080 but it was short-lived. The pair moved lower within the next hour to set a new intraday low and may go lower should the FOMC sound hawkish in their statement. The indicators are both bearish but oversold, suggesting there may be support at the bottom of Friday’s candle, near 1.205%. A break below this level would be bearish and could go as low at 1.200 or 1.1900.

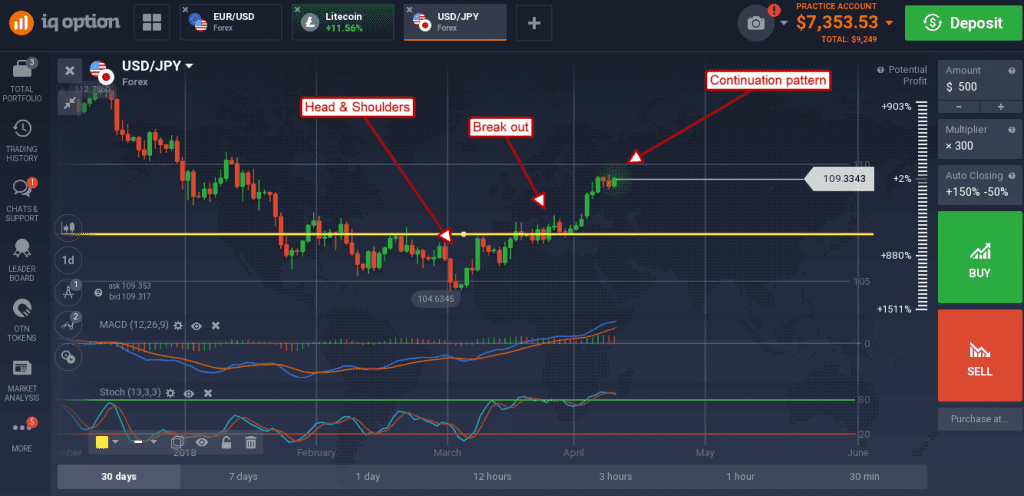

The USD/JPY is looking very bullish with today’s data. The pair is forming a green candle within its near-term consolidation, congestion band and ready to continue the uptrend. The uptrend is driven by two things, the FOMC outlook and the BOJ outlook (not hawkish at all) and likely to take this pair back up to the 113.00 level. The indicators are consistent with a pullback in prices, so a move higher is needed to trigger a bullish trade. A break above 109.50 would be bullish.

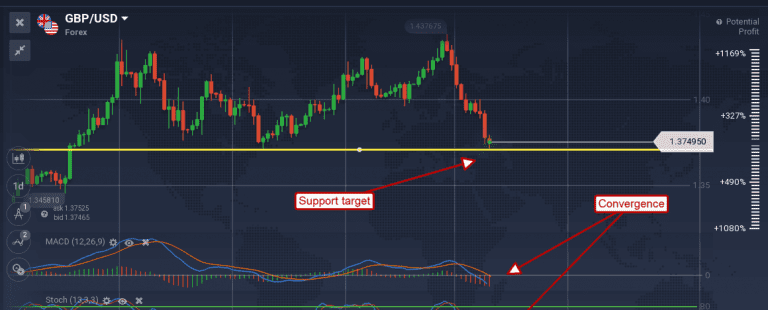

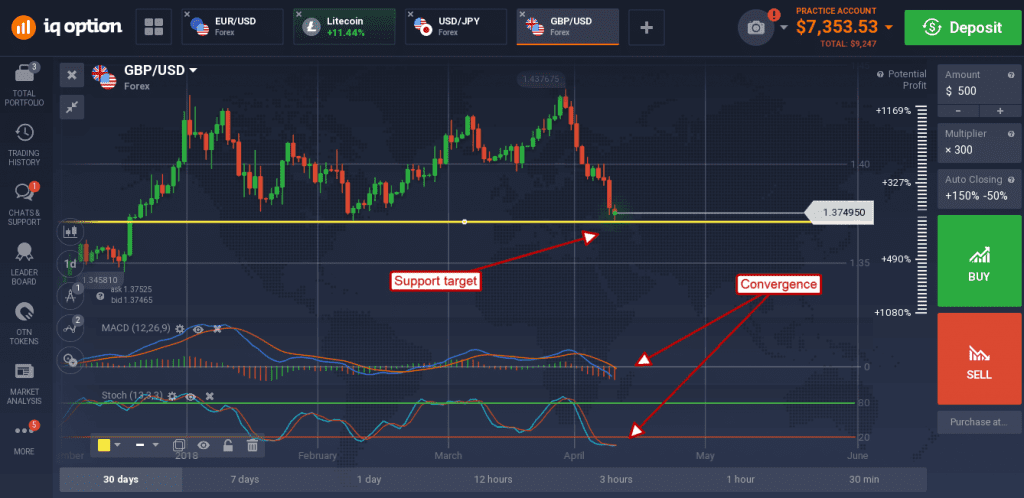

The USD gained versus the British pound, taking the GBP/USD down to a key support level. This level is consistent with the March low and will be an important pivot point this week. The pair is down on rising US inflation and FOMC expectation and may break through support on hawkish sounding FOMC statements.

The caveat is that the BoE will be meeting again in a few weeks and are expected to raise rates. This may lend support to the pound but, if 1.3715 is broken, a move lower to 1.3600 should be expected.