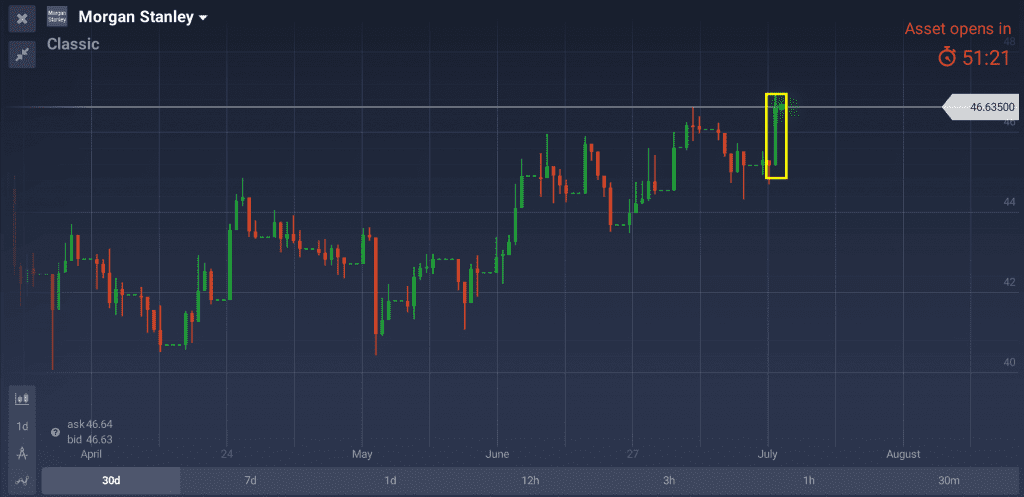

Morgan Stanley (NYSE:MS) not only reported higher than expected earnings but also demonstrated greater trading revenue than Goldman Sachs Group (NYSE:GS), its prime competitor.

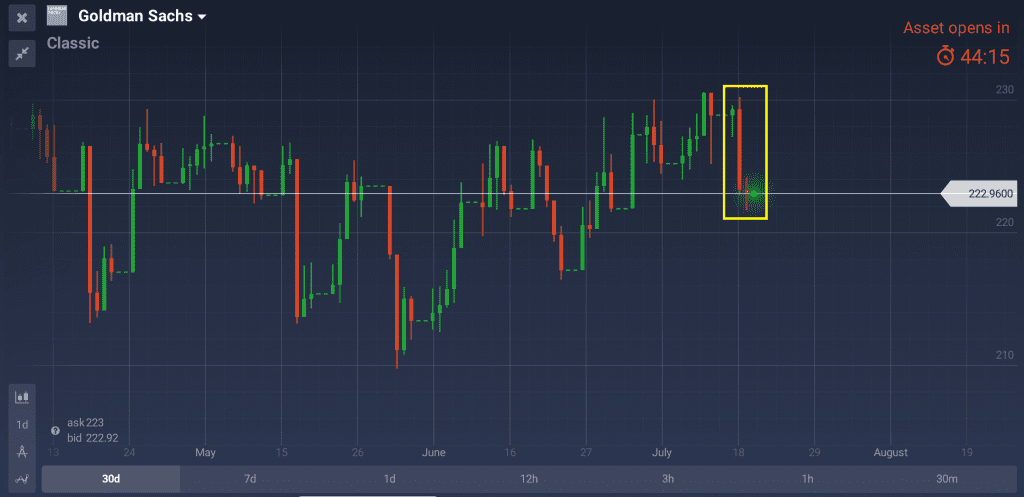

The company reported an 11% increase in profit, fueled mostly by increased revenues in the spheres of corporate advice, securities underwriting, equity trading etc. Morgan Stanley even managed to outshine Goldman Sachs Group in one of its least successful segments — bond trading. While GS reported $1.2 billion in earnings, MS disclosed the figure that is $100 million higher.

Analysts on average expected the MS’ earnings per share for this quarter to be 76 cents, only 1 cent higher than the last quarter last year. In reality, the company demonstrated an impressive EPS of 87 cents per share, beating even the bravest estimates.

Morgan Stanley shares soared 3.9% in the beginning of the trading session, reaching the $46.95-mark. All in all, Morgan Stanley shares surged 6.8 percent since the beginning of 2018. KBW Bank index, that serves as a benchmark of the banking sector, only grew 4.2 percent during the same time period.