Signs of cracking have emerged within China’s budding economy as new tariffs threaten trade between the US and China. The latest round of tariffs is another burden on the Chinese economy that has economists and market watchers debating just how resilient that economy is. The tariffs have had a notable effect on business activity that, along with mounting debt, leaves the country little room to maneuver.

The Chinese financial leaders have pledged to support the slowing economy but that just means more debt. China’s economy is based on investment. Chinese GDP in 2017 was nearly 45% investment spending compared to about 25% for developed nations and that spending is fueled by public and private debt. Investment spending has been in decline over the past two years as the PBOC and other regulators attempt to curb public and private debt and that is where the problem is.

The PBOC and Chinese regulators may have to loosen policy in order to maintain growth targets. If they loosen policy that means national debt will continue to increase unabated and they can’t let that happen. It’s a Catch-22 situation the Chinese might not be able to get out of. China has indicated a willingness to negotiate although the nation pulled out of talks scheduled for this week. Many, including myself, believe there will be more tariffs levied before the trade-war is over.

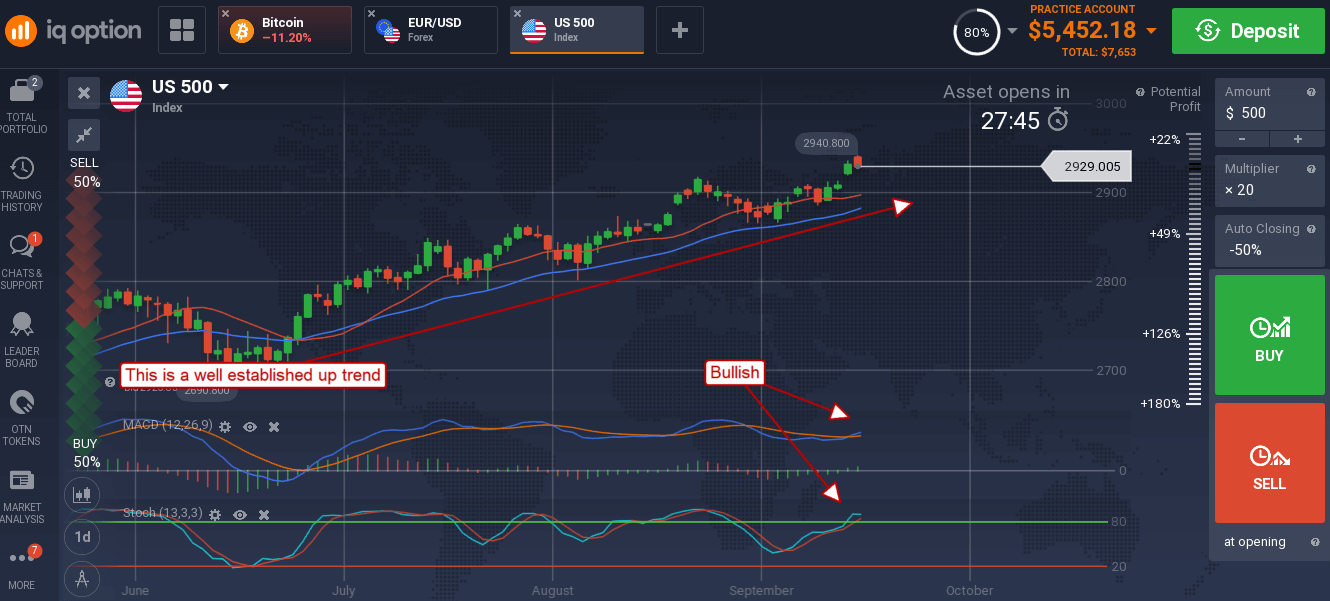

Meanwhile, the US economy is chugging along at an above average pace and driving the equities market to new all-time highs. The US S&P 500 moved up to set a new all-time high last week and the indications are good the move will continue. The MACD and stochastic are both moving up after forming bullish crossovers which is consistent with rising prices. The short-term moving average is moving higher as is the long-term, both indicating bullish trends prevail and the entire market is supported by positive earnings outlook.

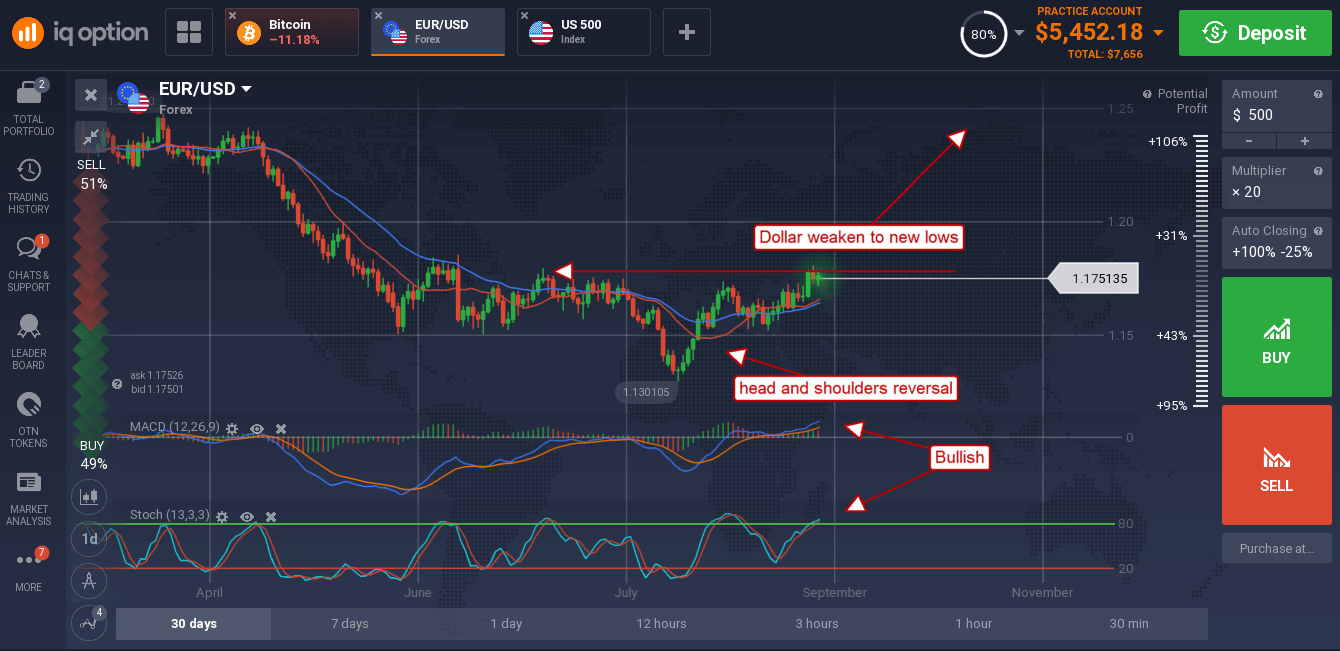

This week’s action may be affected by the trade war, but focus is more firmly affixed to the FOMC meeting on Wednesday and the PCE price index on Friday. The FOMC is expected to raise rates on Wednesday and give indication another hike is warranted soon, perhaps this year. The FOMC is also expected to indicate they are nearing the end of the rate-hiking cycle because inflation data over the past 6 weeks has shown containment. The PCE price index is expected to cool a bit from the previous month and may, along with the FOMC, send the dollar down to long-term lows.

The EUR/USD is about to break out of a head and shoulders reversal that could easily send it up to 1.200 over the next few weeks.