Five most important news to start your day. These events are very likely to influence the market and trigger exchange rate fluctuations. Read to stay informed.

Event: U.S. Nonfarm Payrolls (Jun)

Time: 12:30 GMT

Today the United States are to report Nonfarm Payrolls for June. This metric indicates the number of people who have joined or left the workforce in one month. The more jobs are being created in the country, the more money will an average consumer possess and therefore spend. Consumer spending is the driving force behind economic development and therefore can significantly influence the exchange rate of the national currency.

Today the United States are to report Nonfarm Payrolls for June. This metric indicates the number of people who have joined or left the workforce in one month. The more jobs are being created in the country, the more money will an average consumer possess and therefore spend. Consumer spending is the driving force behind economic development and therefore can significantly influence the exchange rate of the national currency.

The exchange course of the USD is expected to react to the figures reported today. A higher than expected reading will drive the exchange rate of the American currency up, while a lower than expected reading will mean the American currency can lose a portion of its value. The forecast for June is 179 000, more than a 40 000 increase from the previous month.

Event: U.S. Unemployment Rate (Jun)

Time: 12:30 GMT

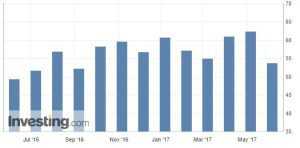

Today the United States Bureau of Labor Statistics is expected to reveal the data regarding country’s unemployment rate. Employment is one the key indicators to assess the health of the national economy. Higher employment usually correlates to expanding economic output and improving business conditions. Falling unemployment rate has marked the beginning of an upward trend in the US.

The exchange course of the USD is expected to react to the figures reported today. A higher than expected reading will drive the exchange rate of the American currency up, while a lower than expected reading will mean the American currency can lose a portion of its value. The forecast for June is 4.3%, the same as the previous month.

Event: Canada Ivey Purchasing Managers Index (PMI)

Time: 12:30 GMT

The Ivey Purchasing Managers’ Index (PMI) the activity of purchasing managers in Canada. The main purpose of the PMI is to provide key decision makers — company owners and managers — with adequate and up-to-date information on business conditions. The PMI value fluctuates between 0 and 100. A reading above 50 represents expansion of the manufacturing sector, below 50 — a contraction. If the manufacturing is expanding, the general economy is expected to do the same and vice versa. The PMI of 50 apparently indicates no change.

The Ivey Purchasing Managers’ Index (PMI) the activity of purchasing managers in Canada. The main purpose of the PMI is to provide key decision makers — company owners and managers — with adequate and up-to-date information on business conditions. The PMI value fluctuates between 0 and 100. A reading above 50 represents expansion of the manufacturing sector, below 50 — a contraction. If the manufacturing is expanding, the general economy is expected to do the same and vice versa. The PMI of 50 apparently indicates no change.

The exchange course of the CAD is expected to react to the figures reported today. A higher than expected reading will make the Canadian dollar appreciate, while a lower than expected reading will mean the CAD can lose a portion of its value.

Event: Bank of England Governor Carney Speaks

Mark Carney, the Governor of the Bank of England (the central bank of the United Kingdom), will deliver his speech today. The Bank of England controls short term interest rates and can therefore influence the exchange rate of the GBP.

An insight into future monetary policy can seriously affect the exchange rate of the British currency. An increase in interest rates will drive the cost of GBP up, while a decrease will make the currency depreciate.

U.K. Manufacturing Production MoM (Jun)

Time: 8:30 GMT

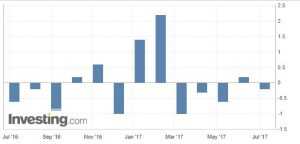

The Office for National Statistics is just about to deliver data on manufacturing production in the UK. Production growth can be perceived as a sign of expanding economy. Negative figures, on the contrary would mean the economy of the United Kingdom is experiencing certain problems and can disappoint the investors in the near future.

The Office for National Statistics is just about to deliver data on manufacturing production in the UK. Production growth can be perceived as a sign of expanding economy. Negative figures, on the contrary would mean the economy of the United Kingdom is experiencing certain problems and can disappoint the investors in the near future.

A higher than expected reading will positively affect the cost of the GBP, while a lower than expected reading will make the exchange rate of the GBP go down.