Fastenal, the company we’ve already reported in April, is back with the earnings report! The Minnesota-based distributor of industrial, safety, and construction supplies will reveal its financial performance data July 12 before market open.

As of now, the consensus EPS forecast for the quarter is $0.5. The reported EPS for the same quarter last year was $0.45. FAST shares can experience volatility spikes in the beginning of the trading session on Wednesday.

Performance indicators

| 52 Week High-Low | $52.74 – $37.70 |

| Dividend / Div Yld | $1.28 / 2.92% |

| EV/EBITDA Annual | 14.35 |

| Consensus EPS forecast Q2/17 | $0.50 |

| Reported EPS Q2/16 | $0.45 |

| Forward PE | 23.27 |

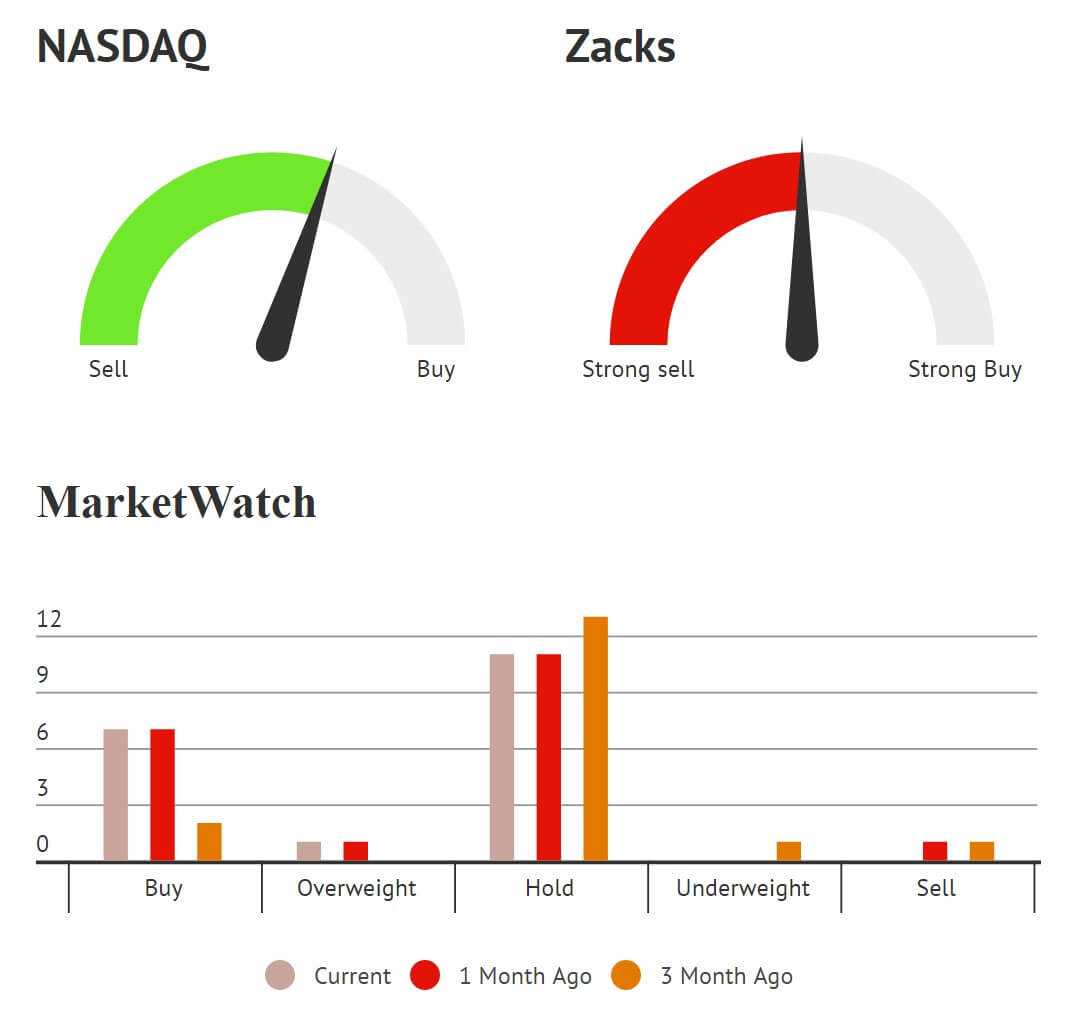

Analyst Estimates

Opportunities and strengths

FAST Solutions. Fastenal has adopted a distribution system that truly has a potential to revolutionize the construction and safety supply industry, as well as provide the company with additional revenue streams. Called FAST Solutions, it implies the installation of industrial vending machines at the customer’s facility and timely delivery of all required supplies. Vending machines serve the purpose of bringing down clients’ administrative and inventory costs, simultaneously reducing product consumption. Many Fastenal clients have already switched to vending machines from conventional procurement procedures.

In the first quarter of 2017 the company managed to sign 5 437 vending machines, an impressive 17% increase to the same quarter last year. As of March 31, Fastenal operated 64 430 industrial vending machines. The company also aims to achieve 22 000 signings by the end of the current year. Net sales through vending machines grow at a 10%+ quarterly rates. Fast Solutions is the sole most important factor behind Fastenal’s recent growth.

Mansco Acquisition. Many international companies grow through mergers and acquisitions. And Fastenal is not an exception. In March 2017, the company has completed the acquisition of Manufacturer’s Supply Company (Mansco), what is by today the largest deal in the company’s history. Mansco itself is present in the states of Michigan, Texas and Alabama. Both companies benefited from the deal, bringing their capabilities together and giving competitive advantages in the fields they have previously been poorly represented.

Onsite Locations. In order to tailor to the needs of the clients, Fastenal even creates onsite outlets to provide everything the customer might need in no time. The company installed 64 new onsite locations in the first quarter of 2017, a 33% increase from the previous quarter. All in all, 437 such outlets have been operating in the end of March 2017, an over 50% increase YoY. Innovative distribution solutions as onsite locations and industrial vending machines help Fastenal attract new customers and increase its top-line in a highly competitive market.

Product Diversification. Being only a fasteners supplier in the very beginning of its business life, the company managed to diversify the product mix beyond that and serve the needs of different clients. Now Fastenal has created the following divisions to address different types of business partners: an internal manufacturing division, government sales, Internet sales, metalworking and industrial vending.

Pathway to Profit. Selling extensively is not always a good choice, as some present-day companies now. When the market growth potential is limited, selling intensively is the way to go. In 2007 Fastenal introduce its cost-cutting initiative Pathway to Profit. The top management decided it is time to stop opening new stores and instead attract new clients to the existing ones, increasing profit per unit of area.

Threats and weaknesses

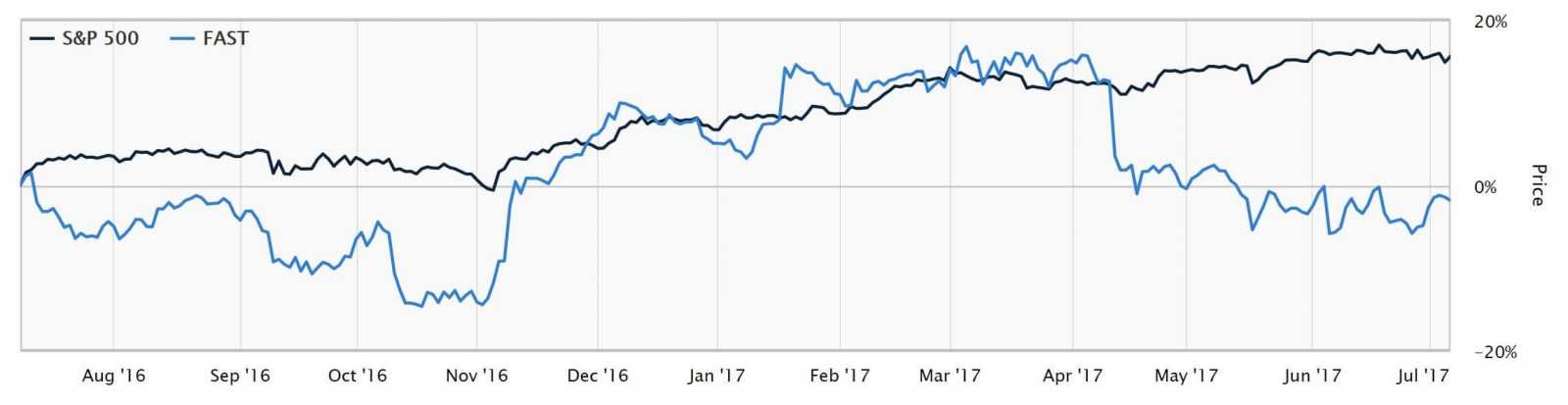

Stock Performance. FAST shares lost 7.6% year to date, which looks especially frustrating when compared to above par performance of retail-wholesale industry, which demonstrated 12.3% growth. Unfavorable EPS readings can bring the stock price even lower.

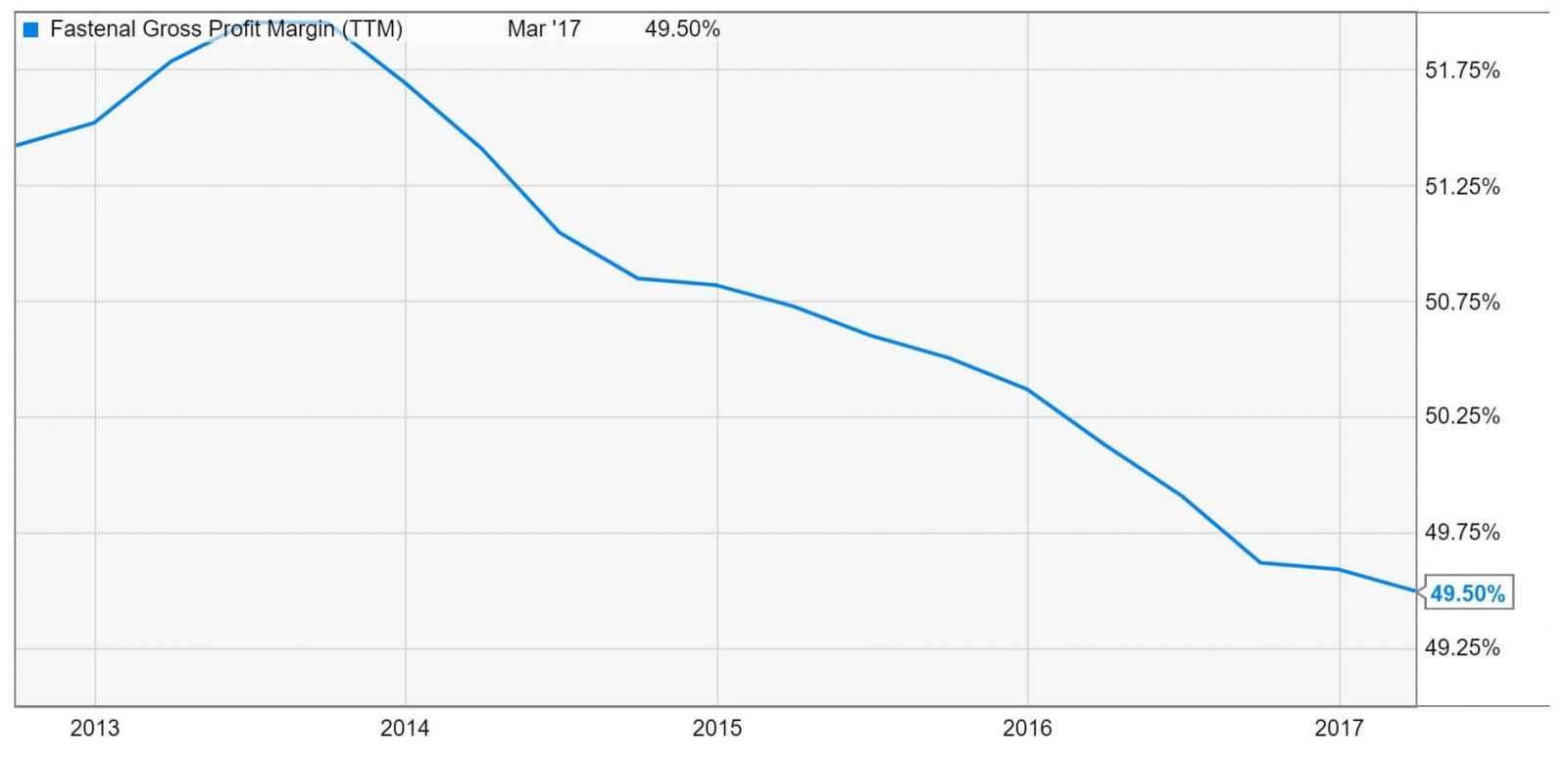

Falling Margin. Due to changing product and customer mix the company is getting less from each client than it did before. Gross margin contracted to 49.4 percent in the first quarter of 2017. As a comparison, this indicator was equal to 51.7 percent in 2013 and gradually declined since then. In the fourth quarter of 2016 gross margin dropped below the Fastenal’s average of 50% and since then remained in this zone.

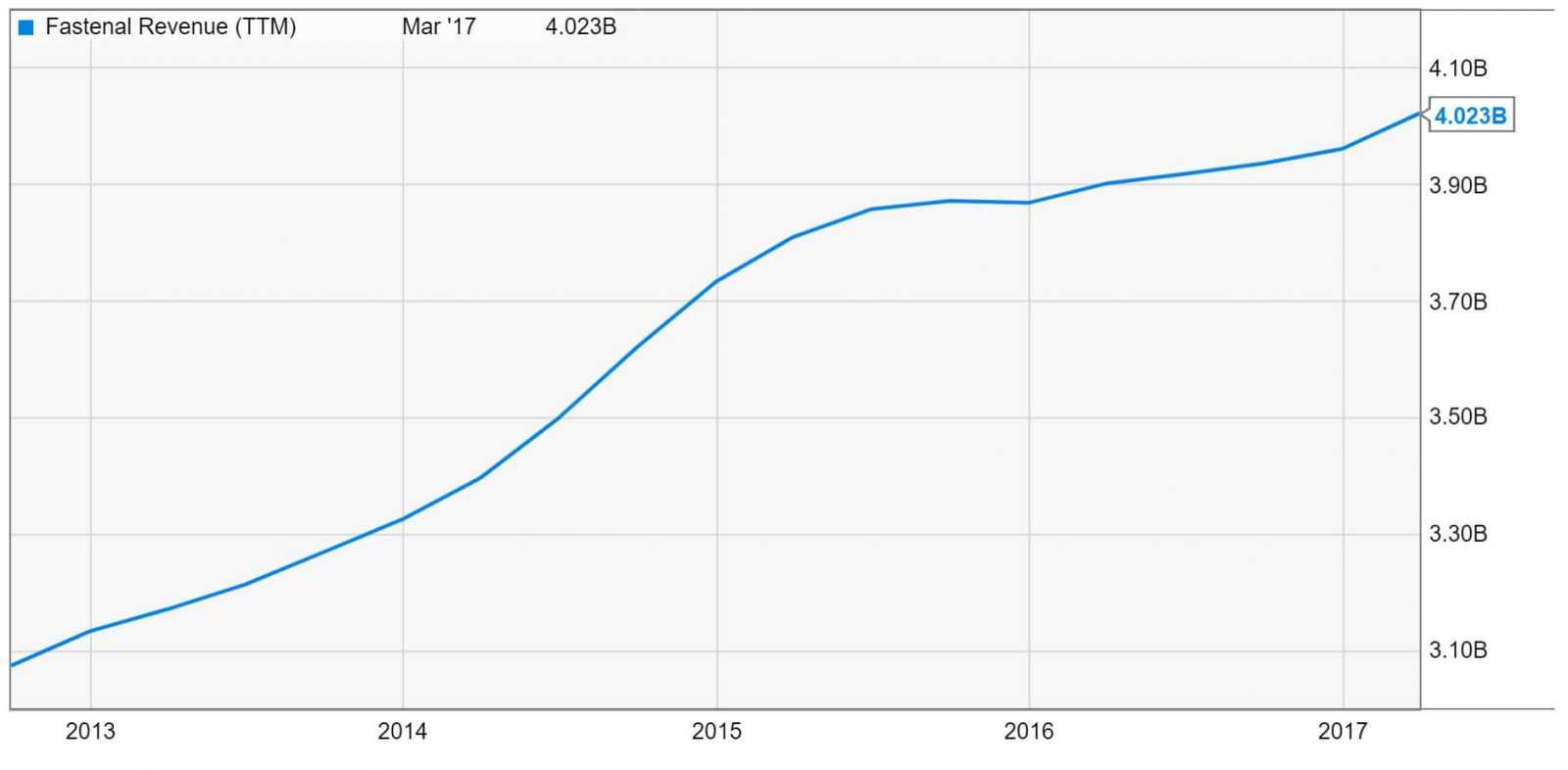

Soft Revenues. In fiscal 2014 top line of the company grew at an annual rate of over 12%. However, that was the last year when Fastenal managed to demonstrate double-digit growth, as in 2015 it reported 3.6% revenue growth, followed by even lower 2.4% in 2016. Several factors are behind the deterioration of the growth figures, however, weak demand from the oil and gas industry, as well as negative currency translation and industrial softness are among the most important ones.

Tough Competition. The industry Fastenal operates in is highly competitive. Both conventional brick and mortar and e-commerce retailers pose a serious threat to the company’s business and profitability. Decreasing market share and lower prices are among the most possible outcomes of stiff competition in the industrial supply industry.

Stretched Valuation. Price-to-earnings ratio, the most commonly used tool for company valuation, demonstrates that FAST shares are currently overvalued. The company has a 12-month trailing P/E ratio of 25.14. The same indicator averaged for S&P 500 companies is equal to 20.39. The stock is also overvalued when compared with its closest peers in the retail-wholesale industry.

What should we expect?

Fastenal may appear like a good long-term investment considering innovative distribution models and cost-cutting initiatives. However, the company failed to demonstrate substantial revenue growth over the last two years and can therefore lose a portion of its market value, should the financial performance of the reported quarter remain lackluster.

Ranked ‘Hold’ by Zacks, Fastenal can demonstrate both upward and downward stock price movement in the upcoming month and especially in the beginning of the trading session on July 12, when the earnings report will be released.