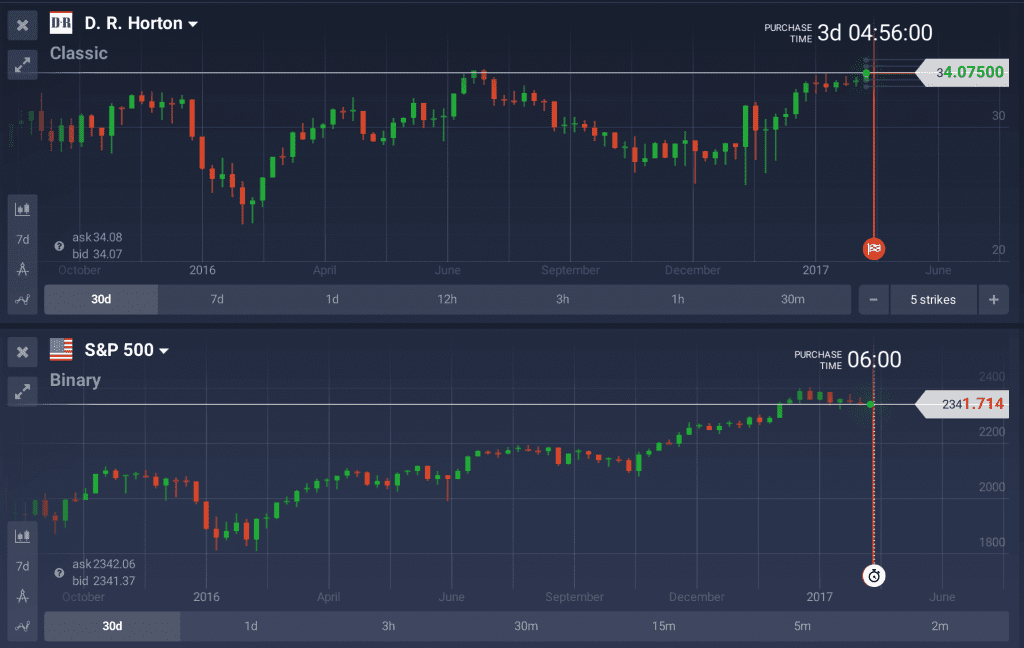

D.R. Horton (NYSE: DHI), based in Texas, is America’s largest home builder. The company is expected to release the earnings report on 20 April 2017 before market open. The event can trigger substantial price fluctuations.

D.R. Horton operates in the spheres of construction and sale of single-family houses. The company is represented by two segments, which are homebuilding (with over 97% of company’s revenue) and financial services. The financial services department operates via DHI Mortgage subsidiary and provides customers with long-term loans. The consensus EPS forecast for the quarter is $0.59. The reported EPS for the same quarter last year was $0.52.

Performance indicators

| 52 Week High-Low | $34.56 – $26.69 |

| Dividend / Div Yld | $0.40 / 1.19% |

| EV/EBITDA Annual | 9.87 |

| Consensus EPS forecast Q1/17 | $0.59 |

| Reported EPS Q1/16 | $0.52 |

| Forward PE | 12.30 |

Reasons to buy

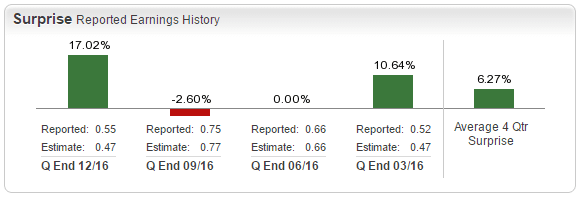

Positive earnings surprise. D.R. Horton managed to gladden its owners and potential investors with encouraging 17% earnings surprise in the last quarter of 2016. According to Zacks, the ability of the company to continuously provide positive earnings surprises and surpass experts’ expectations is the main factor in the positive stock re-evaluation. Being able to show stable growth, DHI stock is likely to appreciate.

Thought-out acquisitions. D.R. Horton diversified its operations and strengthened the portfolio of brands with a chain of acquisitions. From 2012 to 2015 the homebuilding departments of Breland Homes, Regent Homes, Crown Communities, Pacific Ridge Homes, and Wilson Parker Homes became a part of DHI business.

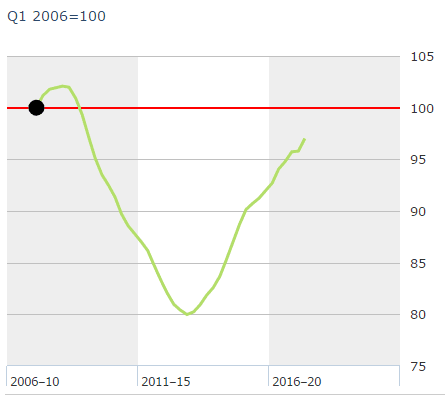

Intense investments in land. D.R. Horton made substantial land purchases, being able to invest even at the times of macroeconomic downturn. In the last two years, the company used the downturn as an opportunity to buy undervalued land and lots. Abovementioned acquisitions can be used to meet the demand in the upcoming periods. In fiscal 2016, the company spent over $2.7 billion on land and finished lots deals.

Cost-saving programs. D.R. Horton is good at keeping its costs under control. Top management of the company separates construction costs and SG&A (selling, general and administrative) expenses and addresses each group differently. Construction costs are managed with the help of cost-efficient home design and advantageous wholesale prices. SG&A costs are mitigated with the help of cost control and better fixed cost leverage. It should be noted that over the last four years the SG&A ratio decreased from 10.7% to less than 9% in 2017. Further improvements in the area of cost-efficiency are expected by the management.

Reasons to sell

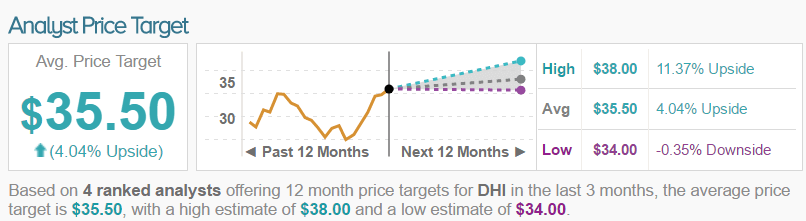

Underperforming the industry. DHI shares gained only 7.6% in the last one year, compared to Building — Residential/Commercial industry’s growth of 14.6%. Earnings and revenue estimates are important, but even more important is the company’s ability to grow and outperform the market.

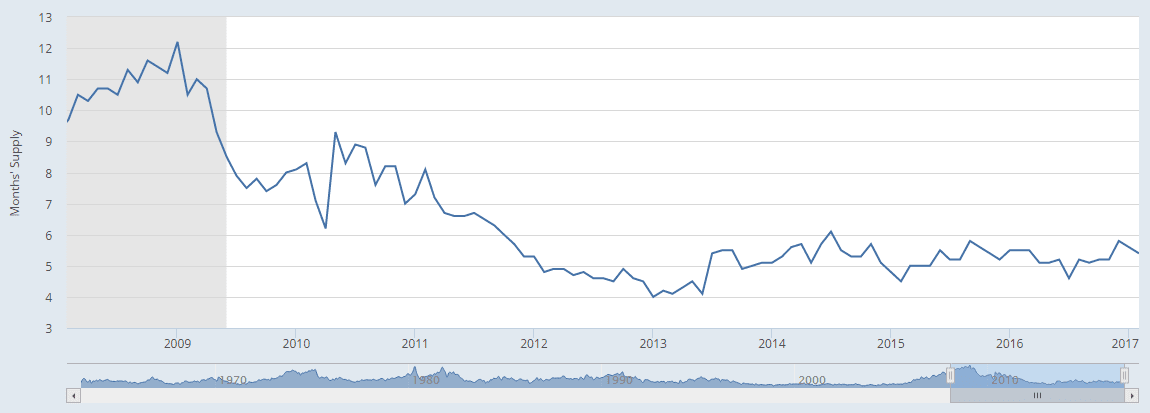

Limited supply. The downturn in the homebuilding segment limited the supply of new homes, pushing the prices higher. Labor market contracted, following the general downturn and decreasing the number of available workers. Many small companies have been pushed out of the market due to worsening business conditions. All of the above is a good enough reason for prices to go up, damaging the demand and decreasing the number of potential customers.

Rising costs. Homebuilders’ margins are at risk due to rising labor and land costs. The limited supply of skilled workers and limited availability of land lead to the inflation of prices.

Federal Government Actions. The federal government has announced a quarter percentage point increase in the benchmark interest rate. Expensive money makes mortgages and long-term loans less accessible to the general public. This fact can hurt top and bottom lines of the company.

Q2 performance estimates

D.R. Horton has demonstrated an impressive performance in the first fiscal quarter of 2017. Though not outperforming the industry in terms of stock price growth the company still managed to surpass the expectations of investors and earned a number of positive earnings revisions.

With moderate to positive valuation, DHI shares can be expected to grow in the second quarter. Whether the stock prices will go up or down at the date of the earnings report release is yet to be known. It will depend, among other things, on the actual performance of the company in the first fiscal quarter of 2017.