Much has been said about the potential of blockchain in reducing the frictions in value transfers through the removal of middlemen. A more profound application of blockchain, however, has emerged. It is the tokenization of the real economy, which is closely linked to the recent phenomenal rise of initial coin offerings (ICOs).

Definition

In a recent interview with Don Tapscott, Executive Director of the Blockchain Research Institute, CitizenHex CEO Benjamin Roberts gave a good overview of the token economy. Blockchain is called the Internet of Value. Various digital currencies exist on top of the blockchain, which is a transparent and immutable ledger of ownership and transfer about those digital currencies. These digital currencies, or tokens, can be used to represent ownership over real-world objects and properties outside of the blockchain. This is what we mean by tokenization of properties and the real economy.

Tokenization Technology

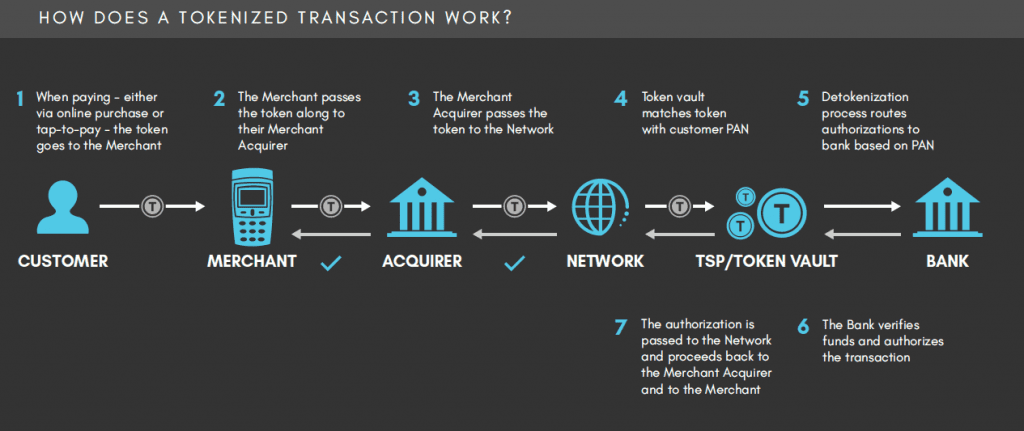

For tokenization to work, some kind of centralized infrastructure and institution needs to connect the tokens on the blockchain to the objects in the real world. This usually involves a range of professional entities, including appraisal firms, insurance companies, trustees and law firms. Collectively, these entities will conduct strict due diligence, verify the provenance, condition and insurance policy of the property, and perform independent valuation. Once these are proved satisfactory, the property can be listed on the blockchain platform whereby interested investors can submit bids on how many shares of the property they want to purchase and at what price. Different book building and auction mechanisms can be used by different platforms.

Tokenization has the potential to revolutionize the real economy. On the one hand, it can enhance the liquidity and transparency of large-value properties, such as prime real estate or famous art works. Owners of these properties can also obtain funding through partial tokenization of their assets. On the other hand, it democratizes access to these investment opportunities that are traditionally available only to high net worth investors. It provides cryptoholders fractional ownership of these assets and diversification across a wider range of asset classes.

Tokenization in Work

Notably, a number of recent ICOs is focused on tokenization of the real economy. One is called Maecenas, a new online art marketplace that gives ordinary art lovers the chance to buy shares in famous paintings. It is named after Gaius Maecenas, an early patron of the arts in Ancient Rome who democratized art by financing poor poets. By purchasing the ART tokens, ordinary investors can buy and trade shares of masterpieces (think Monet and Picasso) that are being listed on the Maecenas exchange. There is an estimated $3 trillion worth of fine art in safe storage, but only $65 billion are traded annually through traditional auction houses. The Maecenas platform has tremendous potential to vastly expand the liquidity of the entire art market.

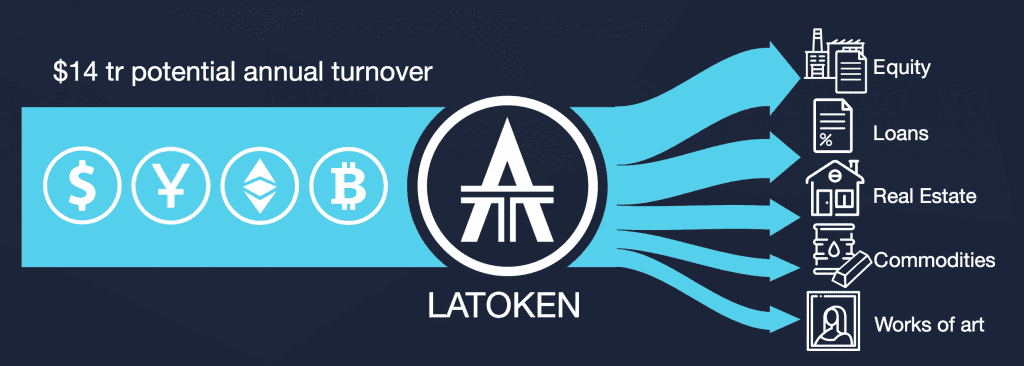

LAToken

Another example is the asset token platform LAToken. LAToken’s main currency for trading asset tokens is called LAT. By purchasing LAT, cryptoholders can get access to a wide range of tokenized assets. This includes equity shares (e.g. Apple, Amazon, Tesla), commodities (e.g. oil, silver, gold), real estate, and artwork pieces.

According to research by LAToken, the total capitalization of cryptocurrencies may exceed $5 trillion by 2025. 80% of it, or $4 trillion, may be asset cryptocurrencies linked to real world assets (e.g. equity, commodities, real estate, artworks). The trading volume of these asset cryptocurrencies may exceed their market capitalization by over 10 times, i.e. the trading volume could reach $40 trillion in 2025.

Therefore, the growth opportunity arising from the tokenization of the real economy is significant. Owners of illiquid and expensive assets (ranging from equities, debts, commodities, real estate, to artworks) can unlock the value and liquidity of their assets through tokenization on the blockchain. And such assets can be accessed by ordinary investors through fractional ownership enabled by asset tokens. It will not be long before tokenization technology penetrates into every corner of the real economy.