How many trading approaches have you tested since the beginning of your trading journey? Some experts suggest that traders may need to try out at least 5 different trading methods to identify the most efficient one for them. Today we will look into swing trading – a trading approach that might suit traders with different levels of experience and potentially offer positive results on a variety of timeframes.

What Is Swing Trading?

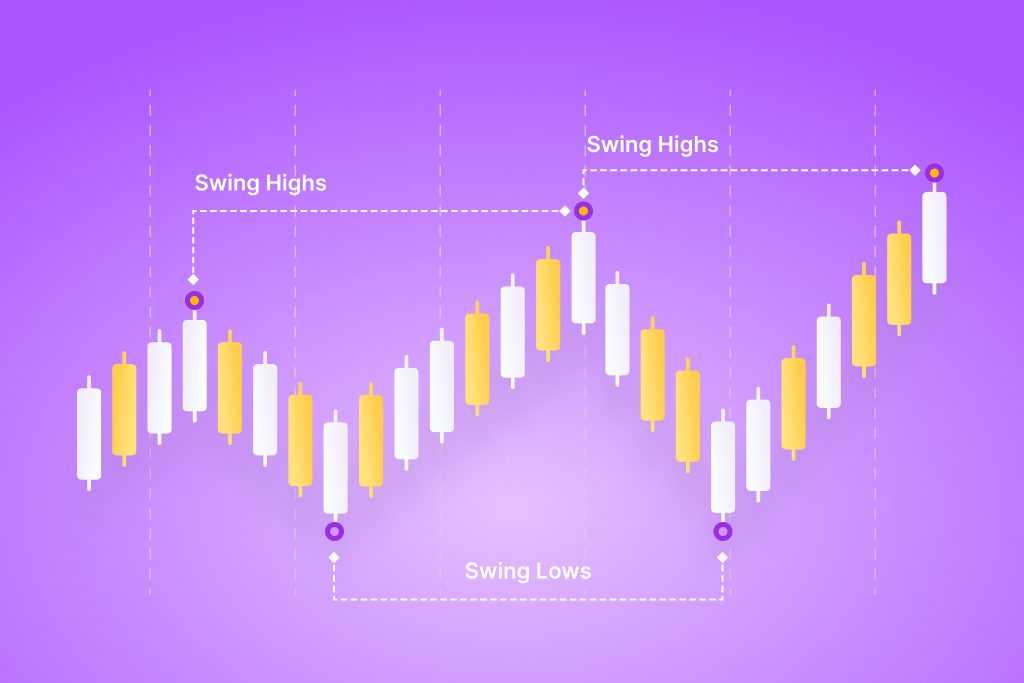

With this approach, traders attempt to catch market swings as the asset price fluctuates on short, intermediate or long-term timeframes. Swing traders usually keep their positions open for various time periods ranging from days to weeks or even months.

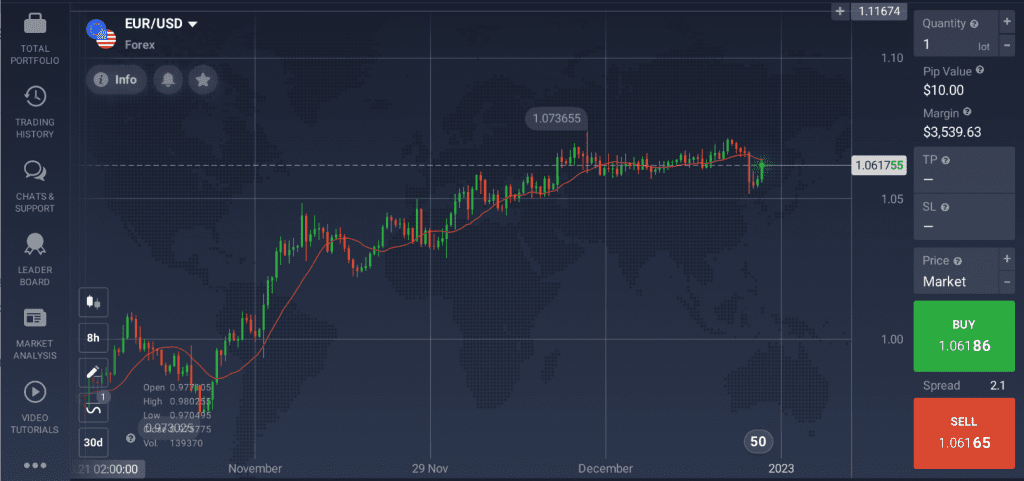

To anticipate upcoming swings, traders often turn to technical analysis of assets. Analyzing price charts and patterns might help them identify early signs of potential swings and catch the optimal time to enter a deal. You may use a variety of different instruments for technical analysis. Here are some of the basic technical analysis tools you may consider applying to your swing trading approach.

- The Moving Average (MA): a popular tool for identifying trend direction.

- Candlestick patterns: combinations of candles forming bullish or bearish patterns.

- The Moving Average Convergence Divergence (MACD): a powerful indicator to spot emerging trends.

- Fibonacci retracements: horizontal lines used to determine support and resistance levels.

Once traders spot a potential swing using technical analysis, they open either a long (BUY) or a short (SELL) position. Then they wait to see if the asset price will move in the anticipated direction. If it does, they may close the deal in profit as an example. If not, they might choose to get out of the losing position and look for other opportunities.

As the swing trading method involves a great deal of technical analysis, it may be a suitable option for traders who enjoy analyzing price charts and applying technical tools. This might be time-consuming, especially at first, when you are getting familiar with the trading platform and testing different instruments. However, after you pick the most effective tools and learn to identify potential swings, you might be able to spend less time in the traderoom monitoring price charts.

Swing Trading vs. Day Trading

Similarly to day trading, with the swing trading approach deals may be opened and closed within a short period of time. However, there are still a few differences between these two trading methods.

As day traders only trade short-term timeframes, they tend to focus on more volatile assets with frequent short-term price fluctuations. This means they better manage risks associated with long-term trades and have no overnight fees. However, there are some downsides as well: day trading requires quick decision-making and spending a lot of time in the traderoom monitoring asset prices.

When it comes to swing trading, assets with larger swings may be preferred. They might have less frequent price fluctuations – the most important factor is their intensity. It may take more time to get results with this method, as trades can stay open for days or weeks. Also, keep in mind that in case of longer timeframes, your trades may be exposed to overnight risks and fees. However, once you get some practice and learn how to swing trade forex, stocks and other assets, you might get your results quicker.

Q&A

Is Swing Trading Safe?

As with any trading method, there are risks involved. The financial markets can be volatile, so you should keep in mind the risks of swing trading and learn to manage them. With swing trading deals may stay open for longer periods of time. This means that asset prices might be affected by different factors overnight or during the weekend when the market is closed.

Using risk-management tools may help you manage risks and protect your capital from unpredictable price fluctuations. This is especially important when swing trading forex and stocks, which can be quite volatile.

Is Swing Trading Worth It?

Swing trading may be a useful approach for trading different assets on a variety of timeframes. However, it requires some knowledge of technical analysis to catch potential swings before they happen and make a move at the optimal moment. Once you get the hang of these technical tools and learn to manage potential risks of swing trading, it may turn out to be an effective instrument for growing your portfolio. But you should always keep in mind that there is no 100% guarantee of correct indications. So it may be wise to apply several tools to confirm your readings and get more precise results.