Let’s start with a simple question: what is a spread in trading? Think of it like this — when you go to a currency exchange booth, there’s one price for buying and a different price for selling. The small gap between those two numbers is called the market spread. In trading, it works the same way.

Spread Definition

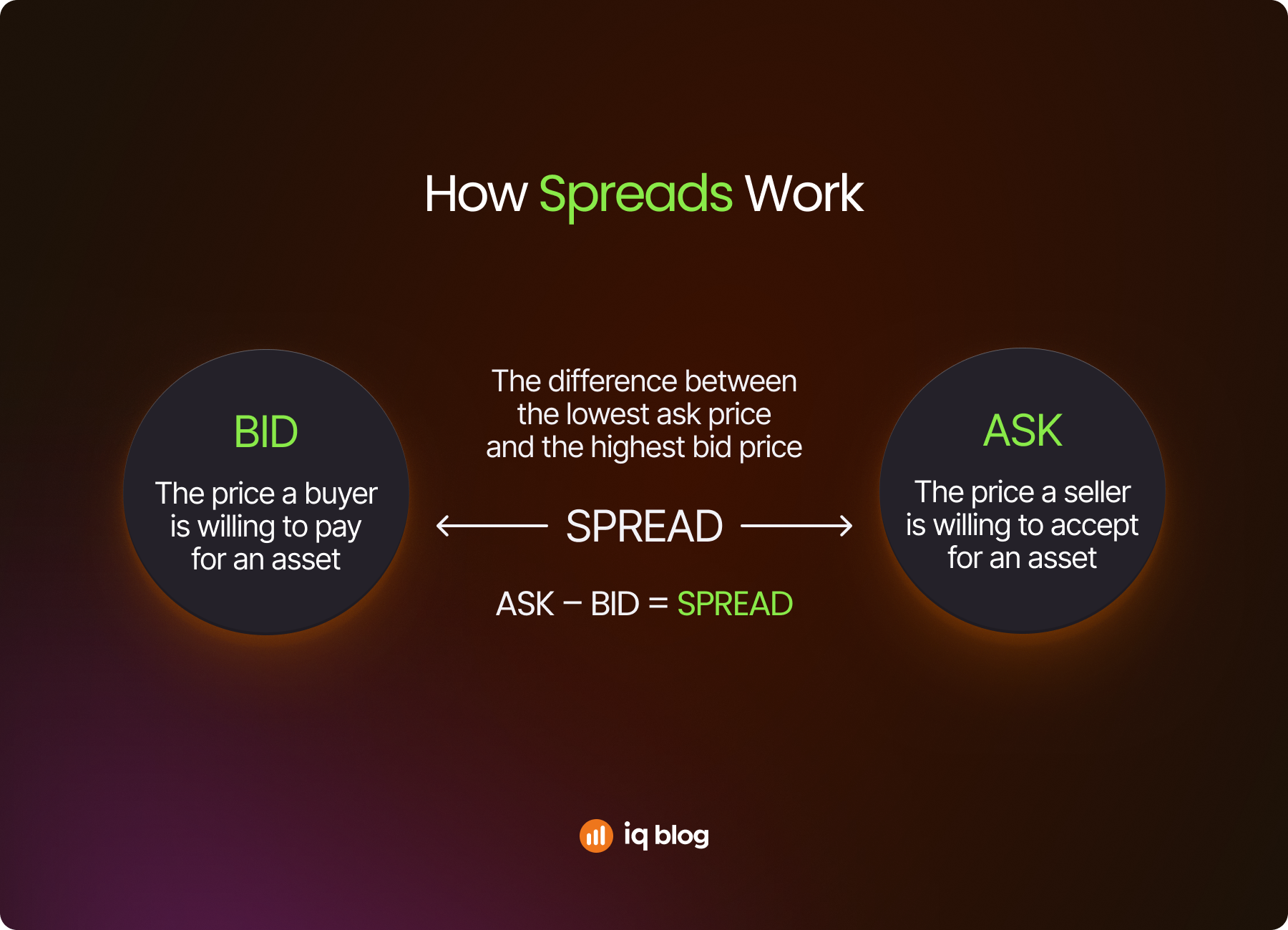

Spread is the difference between the buy (bid) price and the sell (ask) price of an asset. This gap is where brokers — or the market makers providing liquidity — make money, and it’s also a cost that traders need to keep in mind.

So when you hear people asking what are spreads, they’re really talking about the small cost built into every trade you make. If you pay the ask price to buy something and then immediately sell it at the bid, you’d lose that amount — unless the market moved in your favor.

Understanding what is spread in finance is essential for navigating complex instruments like CFDs, forex, and stocks. The role of market spreads extends beyond just fees; it’s also a reflection of market efficiency, trader behavior, and systemic liquidity.

How Spreads Work in Trading

So, what are spreads in trading? A trading spread involves buying and selling the same or related asset, usually simultaneously, to profit from the gap between the highest price a buyer is willing to pay and the lowest price a seller will accept.

For example, if you’re trading a stock and the bid price is $100 while the ask price is $100.50, the spread is $0.50. If you buy at the ask price and immediately sell at the bid price, you’ve lost $0.50. This cost must be overcome by favorable price movement for your trade to become profitable.

They are influenced by multiple factors including market type, instrument, trading volume, and economic conditions.The market spread is always present and is a key component of trading costs.

Key Roles of Spread in Finance:

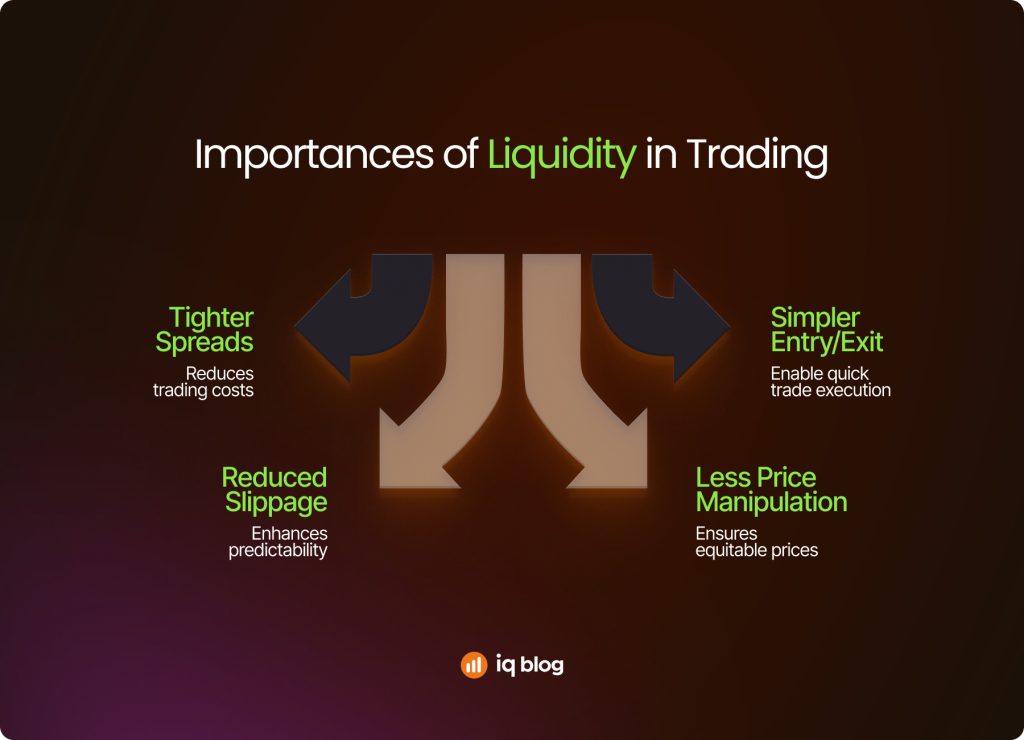

- Help show how easy it is to buy or sell something (market liquidity) and how smoothly the market is working

- Act as a hidden cost in every trade — you always have to pay it

- Reflect the mood of the market — tighter ones mean confidence, wider ones mean worry (market sentiment)

- Influence how quickly and easily your trades get filled and whether they make money

- Used in advanced strategies where traders try to profit from price gaps between similar assets

- Help traders guess short-term moves or longer-term trends

- Highlight important price levels where buyers or sellers might step in

✍️ Everyday traders deal more with whether spreads are fixed or changing. The trading platform you use and the type of account you have will affect this. If you’re a fast trader (like scalper), wide spreads can eat into your profits. But if you hold trades longer, they matter a little less.

Market Factors Affecting Spreads

Market Conditions Impact

Just like the weather affects how you dress, market conditions affect how your costs behave. When the market is calm and predictable, they tend to be small. But during chaotic times — like a big news event, financial panic, or other economic announcements — market spreads can grow fast. This is because uncertainty makes everyone more cautious, and that increases trading costs.

They can also act up during the very start or end of a trading session, when things are less predictable.

Market Volatility and Spreads

Market volatility is a fancy way of saying “how much prices bounce around.” If prices are moving a lot in a short time, spreads usually get bigger. That’s because brokers need to protect themselves from losing money if prices jump suddenly.

So, if there’s an unexpected announcement — say, the central bank changes interest rates — don’t be surprised if your costs may widen. This is why many traders keep an eye on the economic calendar to anticipate high-impact events.

Market Liquidity Effects

Market liquidity is all about how easy it is to buy or sell something without changing its price too much. If lots of people are trading, that means there’s high liquidity — and that usually keeps spreads tight.

But if you’re trading something unusual or unpopular, there might not be many buyers or sellers. That’s when spread in finance gets wider, and trading becomes more expensive.

Supply and Demand Factors

Just like at the grocery store, supply and demand play a big role. If everyone wants to buy an asset and not many want to sell, the spread might tighten. But if the opposite happens — more sellers than buyers — the costs can stretch out.

Understanding this balance helps you get better at understanding market dynamics.

Market Sentiment Influence

Market sentiment is basically the mood of the market — whether traders are feeling confident or worried. When confidence is high, trading is active and spreads shrink. Bearish sentiment, however, usually causes traders to hesitate or exit positions, lowering liquidity and increasing costs.

✍️ This is especially noticeable in fast-moving markets like cryptocurrency.

Types of Spreads

To deeper understand what is spread in finance, let’s break down its types.

Bid-Ask

The bid-ask is the most common and easy-to-understand type of spread. It’s simply the difference between what buyers are willing to pay and what sellers want to get.

For example, if someone wants to buy at $9.98 and another wants to sell at $10.00, the difference is 2 cents. That’s the cost you’d need to overcome to make a profit.

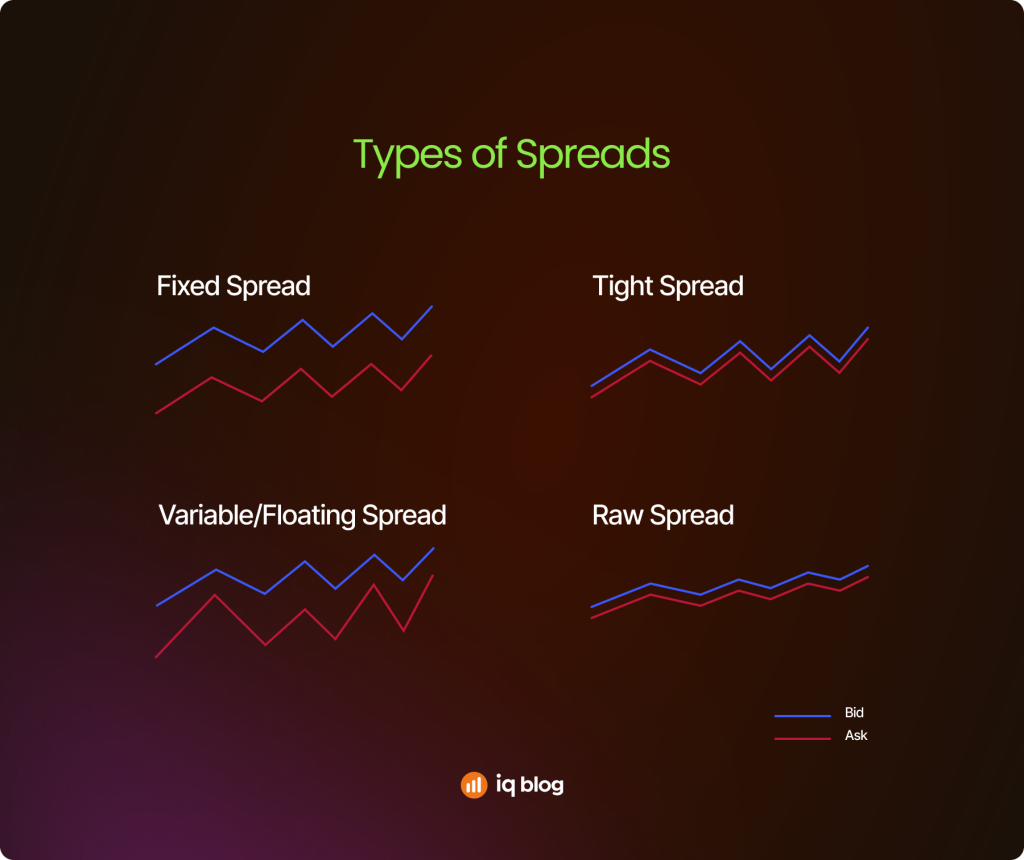

Fixed

With the fixed one, the gap between the buy and sell price stays the same, no matter what’s happening in the market. Even if the market is moving quickly, the spread doesn’t change.

Advantages

- You know exactly what your cost will be before entering a trade

- Helpful during news events or sudden market changes

- Good for beginners who want predictable fees

Disadvantages

- Can be slightly more expensive during calm, stable markets

- Some brokers may offer slower execution when the market is fast-moving

Variable (Floating)

Variable ones move up and down based on market activity. When the market is calm, the costs tend to be lower. But during major news events or low liquidity periods, they can get much wider.

Advantages

- Usually cheaper during quiet trading times

- More accurate reflection of real-time market pricing

- Favored by advanced traders for flexibility

Disadvantages

- Harder to plan exact costs in fast-moving markets

- Can widen suddenly during breaking news or big announcements

Raw

Raw spread in finance is the real market prices without any markup. Brokers offering the raws usually charge a small commission instead. This gives traders ultra-tight pricing but adds a separate fee.

Advantages and Disadvantages

- Pros: Very tight, better pricing, especially for high-volume traders

- Cons: You’ll pay a commission on each trade; may not be ideal for beginners

Forex Spreads

What is a Forex Spread?

When you trade currencies (like the euro against the US dollar), you’ll notice there are always two prices: one for buying and one for selling. The difference between those prices is called the forex spread. It’s the built-in cost you pay every time you make a currency trade.

Let’s say the EUR/USD pair is priced at:

- Bid: 1.1050

- Ask: 1.1053

That’s of 3 pips — the tiny units that currency movements are measured in.

How to Calculate

The formula is: Spread = Ask Price – Bid Price

In our example: 1.1053 – 1.1050 = 0.0003 (or 3 pips).

Low Spread Currency Pairs

Some currency pairs have more trading activity than others — like EUR/USD, USD/JPY, and GBP/USD. These are called major pairs, and they tend to have low spreads because they’re traded so frequently. Less common currency pairs usually have bigger costs, which makes trading them more expensive.

Forex Spread Measurement

Forex spreads are usually measured in pips (short for “percentage in point”). One pip is typically the fourth decimal place in a currency quote. So when someone says “2 pips”, they mean 0.0002.

Fixed vs Variable Spreads in Forex Trading

When trading forex, you’ll often get to choose between fixed and variable market spreads. The fixed ones stay the same no matter what’s happening in the market. The variable ones change based on supply, demand, and news events.

- Fixed — good for planning your costs ahead of time.

- Variable — might be cheaper during calm periods but can spike during volatility.

What you choose depends on your trading strategy and how much market movement you can handle.

Asset Classes in Spread Trading (CFDs)

When figuring out what is a spread in trading, it’s important to know that its size can vary depending on the asset you’re trading.

Stock Spread Trading

It’s is all about taking advantage of price differences between two related stocks. For example, if you think Company A will outperform Company B, you could buy A and sell B at the same time. You’re not betting on the whole market — just the gap between these two stocks narrowing or widening.

Commodity Spread Trading

In commodity markets, traders often use calendar spreads — that means buying a futures contract for one delivery month and selling another for a different month. For example, you might buy oil for January and sell oil for March.

This approach is called an intracommodity spread, and it’s helpful when you want to trade based on supply and demand expectations over time, rather than predicting whether the price of the commodity will go up or down.

Cryptocurrency Spread Trading

It involves taking advantage of price differences between cryptocurrencies or across exchanges. Since crypto is still relatively new and often volatile, the costs can change quickly.

For example, Bitcoin might be priced slightly higher on Exchange A than on Exchange B. Traders can buy on the cheaper exchange and sell on the more expensive one to lock in a profit — this is known as arbitrage.

CFD Spread Trading

When we answer the question “What are spreads in trading?”, we often mean CFD trading (Contracts for Difference). With CFDs, you don’t own the asset. You’re just speculating on its price movement. Spreads are the main cost in most CFD trades — especially if you’re using a commission-free broker.

CFDs are available on a wide range of assets: forex, stocks, indices, commodities, and crypto. Market spread size depends on what you’re trading:

| Asset Class | Spread Characteristics |

| Major Forex Pairs | Tight thanks to high liquidity and constant global demand. |

| Stocks & Commodities | Wider, especially during major news events or periods of low liquidity. |

| Crypto | The widest, reflecting high market volatility and rapid price swings. |

✍️ Because CFDs are leveraged, even small spread changes can have a big impact on your results. It’s important to understand how costs vary between instruments and what kind of account you’re using.

Costs and Calculations

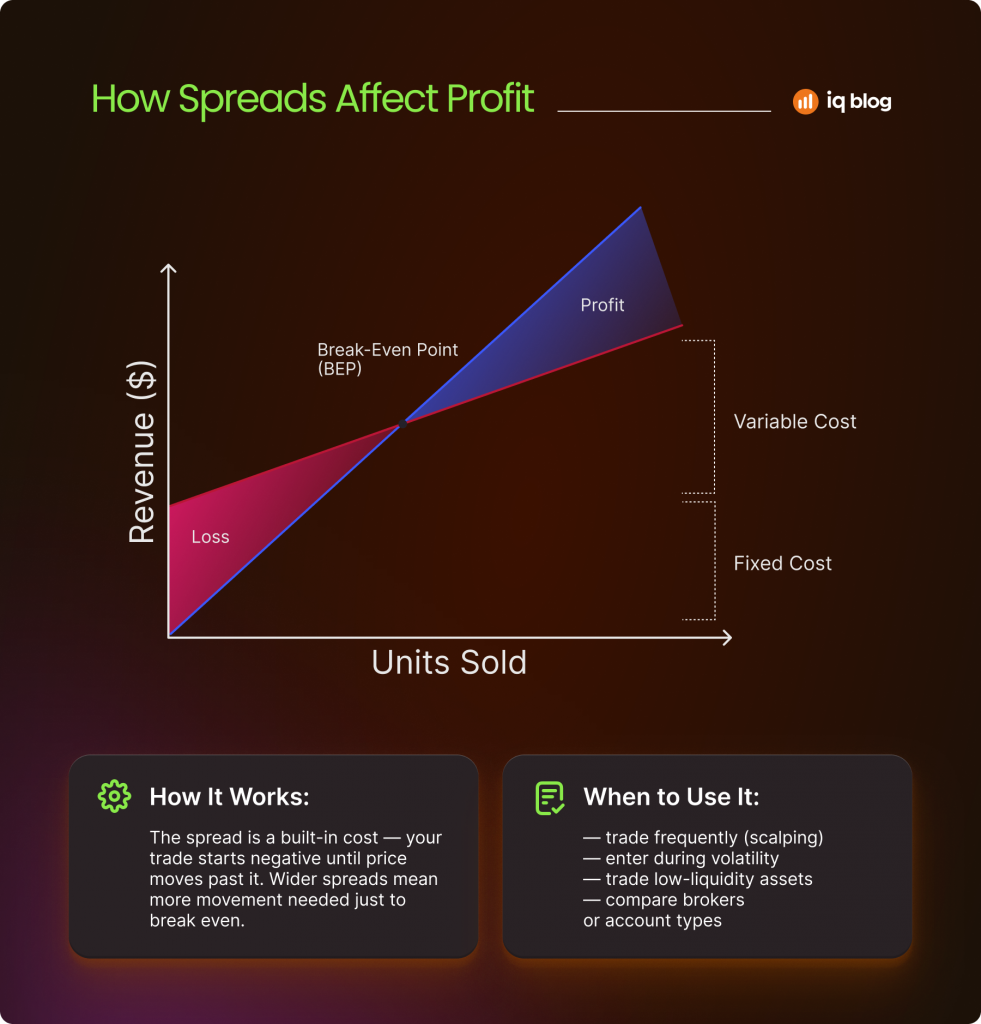

How Spreads Affect Trading Profits

Trading spreads act like a built-in fee. The wider it is, the more price movement you need just to break even. For example, if we’re talking 5 pips, the market has to move 5 pips in your favor before you start seeing any profit.

Combined with the margin requirement — the minimum amount needed to open a leveraged trade — they form a key part of your overall trading cost structure.

This is especially important for traders who open and close many trades during the day — even small changes can add up over time.

Charges Explained

Some brokers advertise zero commissions, but that doesn’t mean trading is free. Instead, they earn money by including their fee inside the trading spread. You’ll still pay — it’s just less obvious.

Other brokers charge a separate commission and offer tighter spreads. Which one is cheaper? It depends on how often you trade and how big your trades are.

Calculation Methods

There are a few different ways to calculate or understand spreads depending on the market:

- Pip-based: Most common in forex — the difference between bid and ask is shown in pips.

- Dollar-based: Used in stocks or crypto — just the number of cents or dollars.

- Percentage-based: Common for bonds or credit and debt products — expressed as a percentage.

This helps you understand your real costs and avoid surprises when managing your trades.

Spread Risks and Risk Management

Understanding Risk

Trading spread risk is the chance that it changes against you after you enter a trade. For example, you might open a position when the spread is small, but it suddenly widens — making it harder for your trade to reach profit.

True Spread Risk

This is when you think the cost is stable, but it changes quickly. It’s common around news events or when the market gets very quiet and fewer people are trading. In this case, you may get a worse price than expected when entering or exiting a trade.

Market Exposure Management

Managing your market exposure means controlling how much money you have at risk at any time.

✍️ You can reduce exposure by:

- Trading smaller amounts

- Using stop-loss and take-profit orders

- Avoiding times when the costs are likely to rise (like big announcements or weekends)

Risk Management Strategies

Here are some easy but effective ways to protect yourself from risks:

- Trade during active hours: Trading spreads are usually tighter when the market is busy.

- Avoid high-volatility news releases unless you’re specifically trading them.

- Stick to major assets: They tend to have better liquidity.

- Know your broker’s rules: Some brokers increase spreads during certain hours — know when and why.

Trading Execution and Platform Considerations

Trade Execution Process

Every trade you place has to be processed — this is called execution. Fast and accurate execution helps you get the price you expected. But if execution is slow, the price may change before your trade goes through — and you might end up with a worse deal.

This is especially important when trading spreads change quickly, like during big news events. A delay of even a few seconds can mean missing your planned price.

Trading Platforms and Spreads

The trading platform you choose affects your costs. Some platforms offer tight spreads with commissions, while others include the fee inside this amount (no commission). ECN platforms give you access to raw market pricing, but they usually charge a small fee per trade.

Here’s a table comparing EUR/USD spreads — including their type and typical amount — offered by several popular brokers.

| Broker/Platform | Spread Type | Typical EUR/USD Spread |

| IQ Option | Floating | ~0.6 pips at min |

| eToro | Floating | ~1.0 pips |

| Plus500 | Floating | ~1.3 pips |

| Exness | Floating | ~0.4–0.7 pips |

| Octa Forex | Floating | ~0.8–0.9 pips |

Order Types and Spread Impact

There are different ways to enter a trade:

- A market order means your trade gets filled at the current price, but you’ll always pay the spread.

- A limit order, on the other hand, lets you set the price you want — and it might help you avoid the spread cost if someone takes your offer.

Trading Style Considerations

Your personal trading style also affects how much you pay per trade. If you’re a scalper making dozens of small trades a day, even tiny spreads matter a lot. But if you’re a swing trader holding positions for days or weeks, they don’t affect you as much.

External Factors Affecting Spreads

So, what are spreads’ behavior depending on the market conditions?

Interest Rates Impact

Changes in interest rates can shake up the market and cause spreads to change. When a central bank raises or lowers rates, it affects the value of a currency or financial instrument. These changes usually bring in a rush of traders — and that can either tighten or widen the costs.

For example, when interest rates go up, more people might want that currency, increasing trading volume and possibly tightening the spread. But right before the decision, they may widen because of uncertainty.

Monetary Policy Effects

Monetary policy includes decisions like printing more money, setting reserve requirements, or using tools like quantitative easing. These actions affect how much money is in circulation and how confident traders feel.

✍️ If the policy boosts confidence and volume, trading spreads might shrink. But if it causes fear or confusion, they can widen quickly as traders back off.

Economic Events and Spreads

Major news stories — like inflation and other economic factor reports, job numbers, or political decisions — can have a big impact too. When news breaks, prices can move fast. Traders rush in, and brokers often increase the costs to protect themselves from sudden swings.

That’s why many traders avoid trading right during high-impact news events. Waiting just a few minutes can help you avoid unexpected costs from spikes.

✍️ Keep an eye on the calendar. Knowing when key events are scheduled can help you plan trades more wisely — and avoid trading when spreads are unstable.

Frequently Asked Questions

What is a good spread in forex?

A good one is usually between 0.1 and 2 pips for major currency pairs like EUR/USD or USD/JPY. Look for forex brokers that keep the values moderate during peak hours.

Is higher or lower spread better?

Lower ones are better because they mean lower trading costs. A high one means you need the price to move further in your favor just to break even. This can make trading more difficult and expensive, especially for short-term strategies.

In forex, how much is one spread?

One spread is just the difference between the bid and ask price. For example, if EUR/USD is quoted at 1.1000/1.1002, the spread is 2 pips. If you’re trading a standard lot, each pip is worth about $10 — so the cost of that trade would be $20.

How do spreads affect forex profits?

You need the market to move in your favor by at least the size of the spread before you can start making money. The bigger it is, the harder it is to profit quickly.

What causes spreads to widen?

- Market uncertainty or breaking news

- Low liquidity (not many buyers or sellers)

- Off-market hours like nights or weekends

- Economic events or announcements

Brokers may widen the number to manage risk when conditions are unstable.

How is market exposure managed in spread trading?

Managing exposure means controlling how much you’re risking on each trade. Good ways to manage exposure include:

- Setting stop-losses to limit potential losses

- Using smaller position sizes

- Avoiding overtrading

- Staying away from volatile markets

What are options spreads?

It’s a trading strategy where you buy and sell options contracts together — often with different strike prices or expiry dates. These are used to limit risk, lower entry cost, or create a structured payoff profile. So for options, it’s not transaction cost but a spread trading strategy.