Do you hate waiting for the markets to re-open on Monday? Whether you’ve got a busy weekday schedule or you get the trading itch over the weekend, OTC trading could be your solution. It lets you capitalize on unique opportunities and enjoy the flexibility of trading outside regular hours.

Let’s dive into what is OTC and how this off-hours option could be just what you need.

What is the OTC market?

So, what does OTC mean in the financial market? OTC stands for “over-the-counter,” which is a fancy way of saying, “You’re not playing by the usual rules.”

Unlike regular trading sessions where everything’s scheduled down to the minute, OTC trading happens outside the standard market hours, often involving a direct deal between the trader and the broker, without going public.

OTC trading conditions

So, the quotes in OTC trading are unique to the platform because they don’t go through a public exchange. They’re influenced by a bunch of factors, like the values from the weekday trading sessions, the number of options bought, and the investment amount.

What does this mean for you? The potential to catch some unique trading opportunities that aren’t available during the usual market hours.

But beware: With great flexibility comes great responsibility — the market can be a bit more volatile during the weekend. Also, OTC assets have less trade liquidity due to low volume, which may lead to delays and wider spreads.

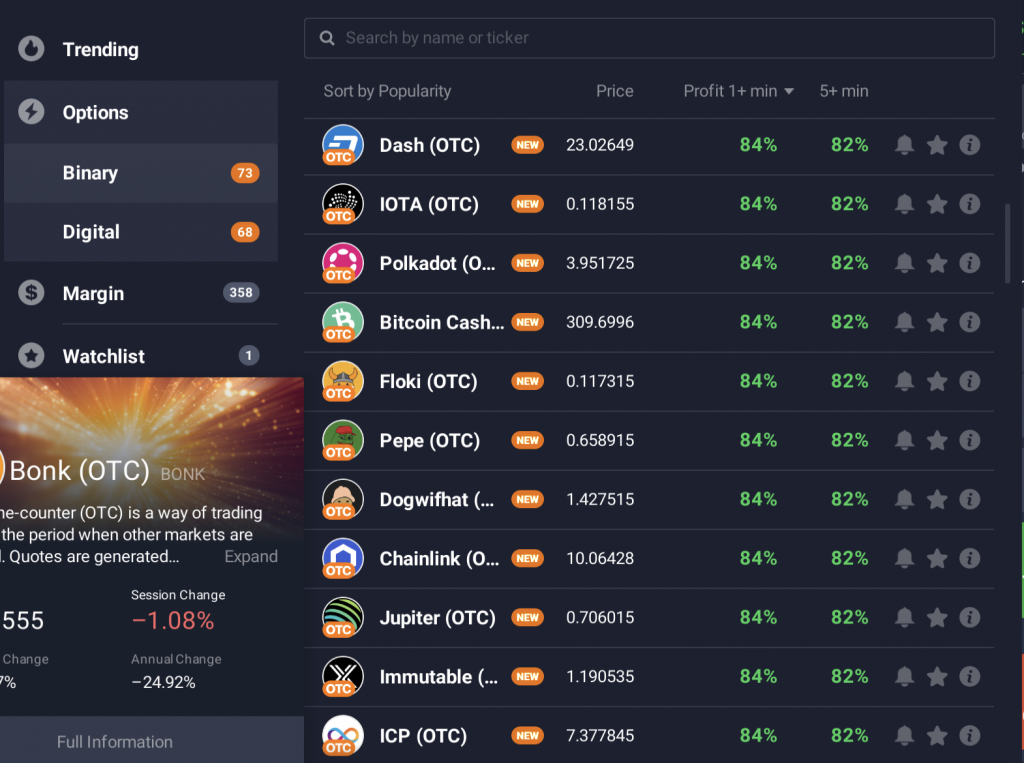

What assets are available for OTC trading on IQ Option?

IQ Option’s OTC trading platform lets you trade a range of assets during those off-hours. We’re talking Binary and Digital Options here. You know the asset is OTC when you see the “OTC” tag on it.

Here are the assets you can find on the platform:

OTC currency pairs (Forex)

| USD/JPY |

| GBP/JPY |

| USD/MXN |

Crypto OTC

| Bitcoin Cash | Polkadot | Beam | Celestia |

| Dash | TON | Dogwifhat | Graph |

| Pepe | Cosmos | Stacks | Pyth |

| NOT | Injective | Floki | ORDI |

| IOTA | Gala | ICP | Polygon |

| Sandbox | Decentraland | NEAR | Arbitrum |

| Bonk | 1000Sats | Immutable | Worldcoin |

| Jupiter | Chainlink | Ronin | Sei |

OTC Stocks & Commodities

| Amazon/Alibaba | Netflix/Amazon |

| Amazon/Ebay | Tesla/Ford |

| Alphabet/Microsoft | Intel/IBM |

| Microsoft/Apple | Meta/Alphabet |

| Nvidia/AMD | Gold/Silver |

OTC Indices

| US500 | EU50 | HK33 | US30/JP225 |

| US100 | JP225 | GER30 | US100/JP225 |

| US30 | AUS200 | SP35 | US500/JP225 |

| UK100 | FR40 | GER30/UK100 |

How to choose an asset for OTC trading

- If you like volatility: Go for over the counter crypto trading. The crypto market never sleeps, and neither will your trading opportunities.

- If you prefer stability: Stick to forex pairs or major indices. These tend to be less volatile, making them a potentially safer trade during off-hours.

- If you want to experiment: Try out the stock duels like Amazon vs. Alibaba. These pairs give you the chance to speculate on the relative performance of two industry giants.

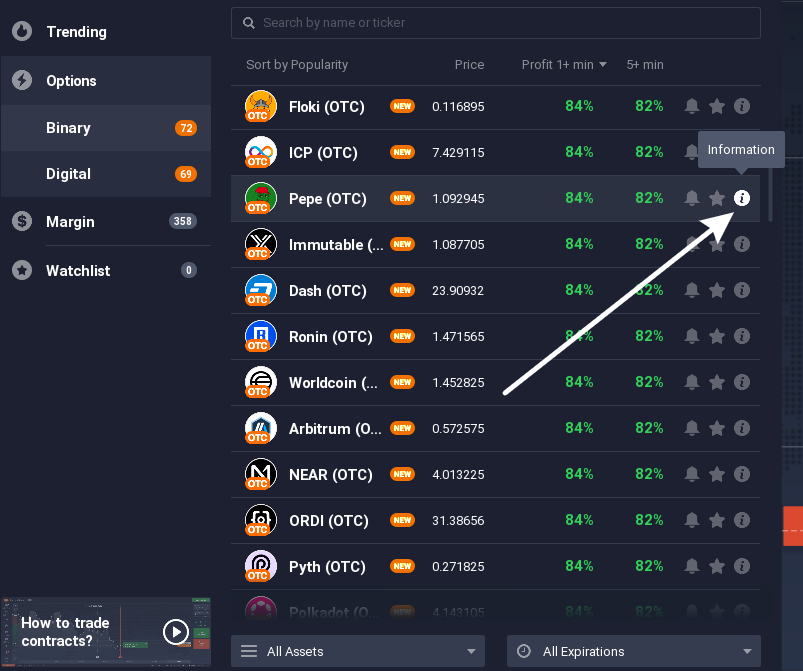

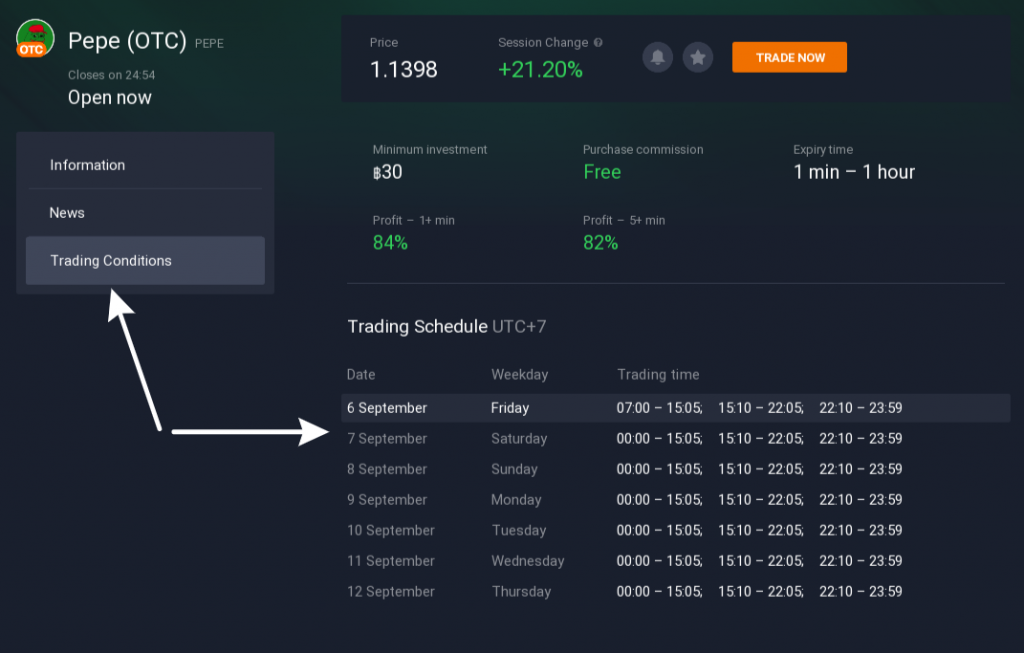

Whatever you choose, remember to check the OTC trading hours on the IQ Option platform so you know when these assets are available.

You can do so by clicking on the i icon next to the asset in the asset selector and going to the Trading Conditions section.

What indicators should you use when trading OTC assets?

Feel free to use any Binary Options indicators and strategies on the OTC market that you normally do.

But keep in mind, the market can behave differently during OTC hours, so don’t rely on just one indicator. Mix and match to find what works best for you. For instance, you might try the MA+CCI strategy.

OTC trading tips

Finally, some tips to help you thrive in the OTC market:

- Start small. The OTC market can be unpredictable. Dip your toes in with smaller trades before investing more.

- Stay updated. Keep an eye on the news, as events can have a bigger impact on the market during OTC hours.

- Check the schedule. Always double-check the IQ Option platform’s OTC schedule to know when your chosen assets are available.

- Don’t overtrade. The flexibility of OTC trading is a double-edged sword. Just because you can trade doesn’t mean you always should.

Conclusion

OTC trading on IQ Option offers a flexible way to trade outside of regular market hours, making it ideal for those with busy schedules or a weekend trading itch. It provides unique opportunities with a variety of assets, including forex pairs, cryptocurrencies, stocks, commodities, and indices.

However, the OTC market can be more volatile and less liquid, so it’s crucial to use a mix of indicators, start with smaller trades, and stay informed. By following these guidelines, you can make the most of the OTC market’s potential while managing the risks.