Leverage in trading is often misunderstood — and sometimes feared. Many new traders avoid it altogether or use it without fully understanding the risks, which often leads to poor results.

What Is Leverage?

In simple terms, leverage lets you trade with more money than you actually have. Think of it like a loan from your broker — it increases the size of your trade so you can potentially earn more profit (but also risk more).

Let’s say you have $100 in your trading account. If you use leverage of 1:10, it means you can open a trade worth $1,000. That’s the power of leverage — it multiplies your trade size.

IQ Option Leverage Explained

When people say “IQ Option leverage” or ask “what is leverage in IQ Option?”, they’re talking about using borrowed funds (from the broker) to trade larger volumes. But here’s something important to know:

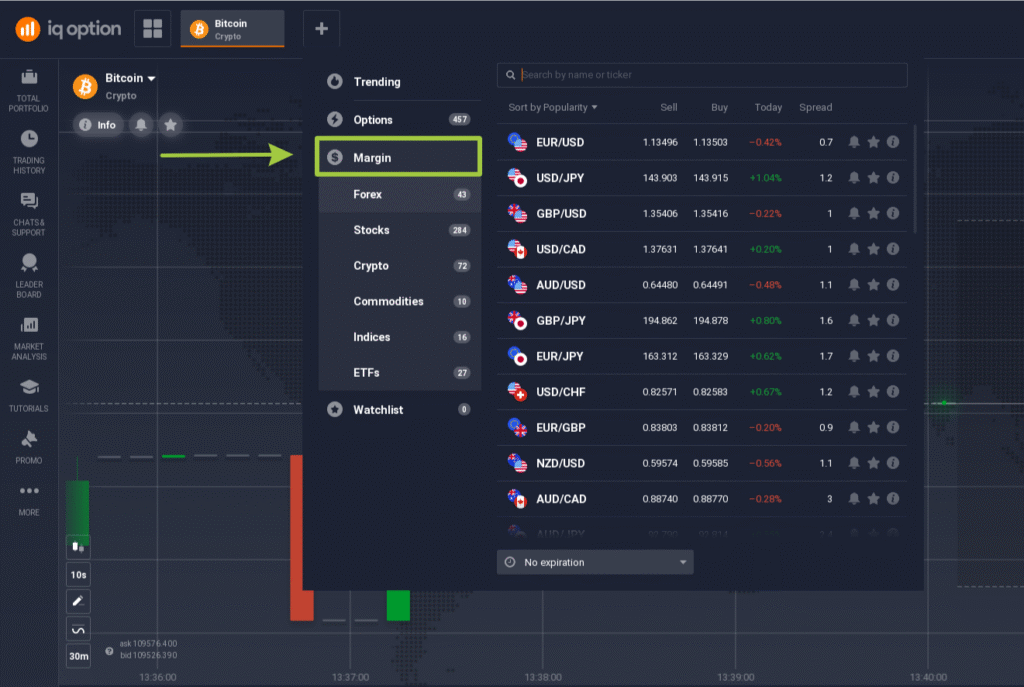

🛠️ IQ Option leverage is only available when you trade through the Margin engine.

To access it, open the Asset Selector, and choose the “Margin” tab. That’s where you’ll find assets that allow leveraged trading.

IQ Option Leverage & Margin

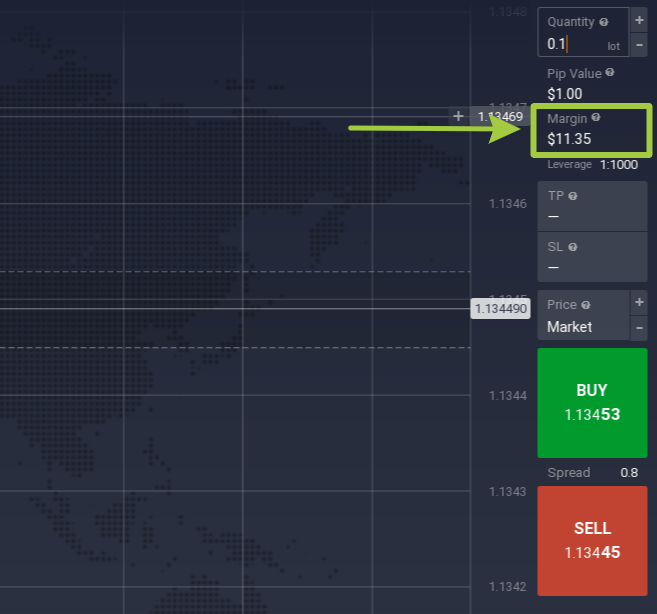

Leverage and margin always go hand in hand. Margin is the portion of your funds used to open a leveraged trade. Think of margin as the “deposit” that lets you borrow the rest of the position.

For example:

- You want to open a $1,000 trade using 1:10 leverage.

- You only need a $100 margin — the platform provides the remaining $900.

- If the trade goes in your favor, your margin is returned to you in full, and your profit is added to your account balance.

- If the market moves against your leveraged trade, losses are based on the full amount, and once they equal your margin, your position may be closed automatically — this is called a margin call.

To better understand this system, check out our detailed guide on How to Trade on Margin at IQ Option.

IQ Option Forex Leverage

Forex (foreign exchange) is one of the most popular markets for leverage. That’s because currency prices move in very small steps, so traders often use leverage to make those small moves more profitable.

On IQ Option, the forex leverage can vary depending on the asset you’re trading. For example:

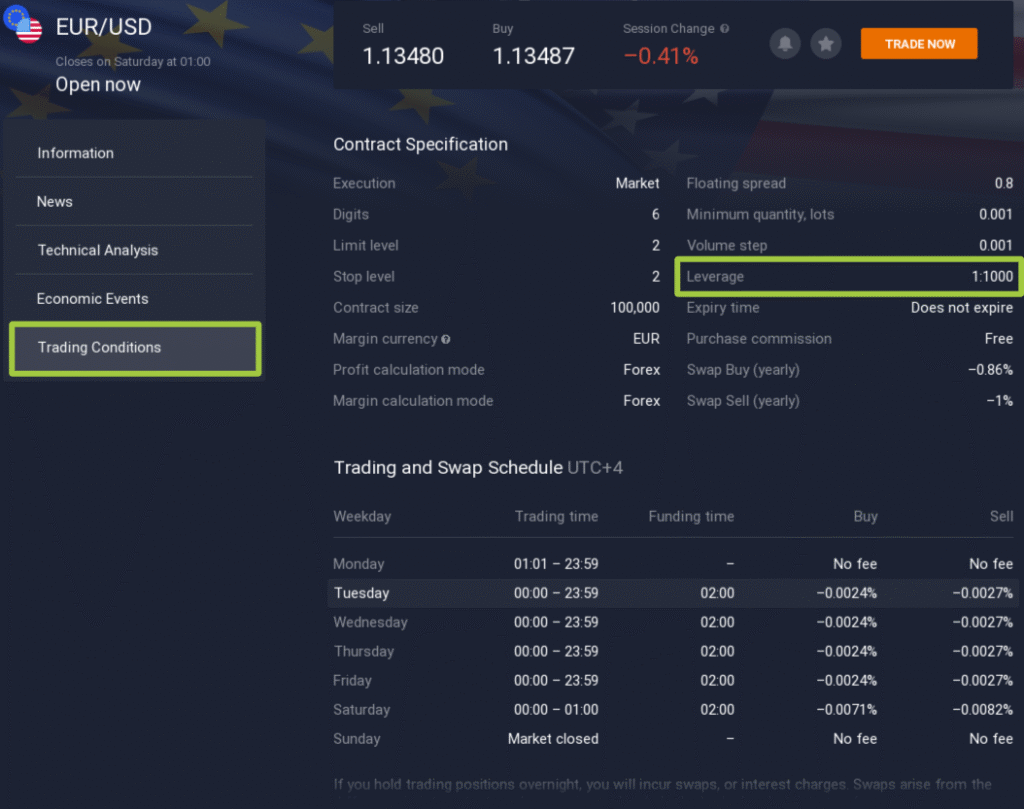

- Major currency pairs may offer higher leverage (like 1:1,000 on EUR/USD)

- Minor or exotic pairs might offer lower leverage (like 1:300)

✍️ Always check the available leverage for each trade before placing an order.

To do that, click on the “Info” icon next to the asset and go to the Trading Conditions section.

Why Use Leverage?

Here’s why traders use leverage:

- To increase potential profit from small market moves

- To access larger positions with less money upfront

- To diversify trades across different assets

But be careful: leverage also increases risk. If the market goes against you, losses can add up fast — even faster than your actual deposit.

How to Change Leverage on IQ Option?

On IQ Option, leverage is fixed and set by the platform based on the asset type and your region. This means you cannot manually change the leverage before placing a trade.

Instead, each asset in the Margin section comes with a predefined leverage level — so it’s important to check the details for each one before trading.

Tips for Using Leverage Wisely

Most new traders are scared of using leverage, but just like any tool, it can only do harm if used wrong. Here are a few tips on mastering leveraged trading:

- Use stop-loss: Always set a stop-loss to protect your funds if the trade goes the wrong way.

- Know your limits: Only use leverage you’re comfortable with — don’t risk more than you can afford to lose.

- Understand margin: Don’t forget that a small portion of your funds will be used as margin to open a leveraged trade. This amount is calculated automatically based on your investment.

Final Thoughts

Understanding the IQ Option leverage meaning is key to using this powerful tool effectively. Leverage can help you grow your trades — but only if used wisely. If you’re just starting out, take time to learn how it works. Practice on a demo account, understand the risks, and never trade with money you can’t afford to lose.