What is Day Trading?

Day trading is a short-term trading approach. Traders open and close the trades in the same trading day. Instead of keeping the assets for weeks or months, day traders seek to exploit small price fluctuations during market hours. It can include trading stocks, foreign currency, cryptocurrency, commodities or indexes.

This approach is appealing to individuals who desire more control over their transactions. It is suitable for those traders who love to see immediate results, not a long stay of holding. It is possible that day trading may bring quick profits, but it carries a high risk and demands discipline. This requires a proper strategy and dependable tools.

With the availability of easy-to-use platforms such as IQ Option, an increasing number of traders are turning to day trading as a flexible means of becoming engaged in the markets. This guide explains what day trading is, how it works and what you need to know in order to start.

How Day Trading Works

Day trading revolves around making money from small price movements within a day of trading. Traders will short or go long based on a setup identified with technical indicators, price action, or news. The idea is to rake in small profit margins that accumulate on many trades.

For example, a buyer may buy a stock at $50.00 after a breakout and sell it some minutes later for $50.40, hoping for a quick profit. A different trader may short a forex currency pair like EUR/USD in case there is a strong resistance level that holds and anticipate some pips of price action and then close out the position.

These transactions are typically entered on pre-defined strategies and supported by risk management rules, such as stop-loss and take-profit points. Day traders primarily avoid overnight positions to avoid exposure to news occurrences or market gaps that arise outside normal market hours.

Rapid implementation, tight spreads, and instant access to data are needed. IQ Option and similar websites provide the features for such trading, such as risk management tools and charting facilities.

What Markets Can You Day Trade?

Day trading can be applied to nearly any liquid market that offers price volatility. The most common markets for day traders include.

Forex (Foreign Exchange)

Forex is perhaps the most recognized method of day trading. And that’s due to its tight spreads and high liquidity. It can accommodate opening and closing positions at nearly any time.

Large currency pairs such as EUR/USD, GBP/USD and USD/JPY tend to be the target of day traders in the forex market. These tend to be the ones with the smallest spreads and highest volume. This reduces costs of transactions and improves execution. Forex trading is driven by macroeconomic information, geopolitical events and technical indicators. Scalping, breakout trading and news-trading are some of the most popular methods employed in this market.

Due to available leverage and ongoing price fluctuations, active forex day traders have many opportunities. However, it also requires proper risk control to avoid meaningful loss due to marginal price fluctuations.

Stocks

Stock day trading includes buying and selling publicly traded companies’ stocks on the same day of trading. Traders make a profit due to marginal price fluctuations.

Liquidity and volatility are of foremost importance while selecting stocks for day trading. Day traders look to buy “movers of the day”, high pre-market volume stocks or big price movers. Gap and go, momentum trading and reversal strategies are favorite ones.

Stock markets are dealt in fixed intervals, typically between 9:30 a.m. and 4:00 p.m. EST in the US. Traders must operate within this time interval and expect to see high volatility at the market open and close. Tools such as real-time news feeds, level 2 order books and candlestick charts are typically used.

Cryptocurrencies

Crypto markets provide 24/7 access, which is a characteristic not shared by other tradable assets. Traders who enjoy flexibility or wish to take advantage of volatility over the weekend appreciate this on-call availability. The most traded assets are Bitcoin (BTC) and Ethereum (ETH), yet other altcoins such as Solana (SOL), Cardano (ADA) and XRP also engage active traders.

Crypto day trading is driven by technical analysis and sentiment on social media, news, and market sentiment. Prices will be extremely volatile, going up and down by several percentage points within an hour. This volatility presents the potential for profit or loss.

Day traders use strategies such as support/resistance trading, moving average crossovers and RSI-based momentum trades. Because the market is newer, institutional control is less, and the likelihood of unpredictable moves based on retail sentiment is therefore lower.

Good risk management and stop-loss orders are crucial, especially in thin markets. Having platforms that are quick to execute and accessible from mobile can contribute to faster responsiveness in trading.

Commodities

CGold, oil and silver are among the best price drivers influenced by global events, demand and supply and macroeconomic trends. Commodities are traded day-in and day-out through contracts for difference (CFDs) to speculate on price action without taking possession of the asset.

Gold (XAU/USD) is often used as a safe haven and responds to inflation figures, central bank policy and geopolitical unrest. Oil (WTI or Brent) responds to OPEC reports, levels of inventory and global economic activity.

These are high-leverage markets and can trade explosively at a moment’s notice. Intraday traders will concentrate primarily on trend-follow signals, levels of breakouts and Fibonacci retracements. Volume spikes and news drivers propel them.

Due to price reactions that occur in real-time, news sensitivity and high-speed execution are critical. Commodity traders usually prefer commodities due to their predictability and fewer seasonal patterns compared to equities or crypto.

Indices

Day trading the S&P 500, DAX or FTSE 100 stock indexes allows speculating on the total performance of a set of stocks rather than one specific company. Day trading an index offers broad exposure, reduced idiosyncratic risk and smoother trends overall.

These tools are generally traded through futures or CFDs. Day trading focuses on key levels, macroeconomic releases like pre-opening sentiment and non-farm payrolls or CPI data, which can cause sudden price movements in indices.

As indices reflect market mood, they respond to technical levels in a more predictable manner than individual stocks. Trend reversal at levels of support/resistance or volume indicators to catch the change in momentum is one common strategy.

Index trading is appealing for its liquidity, lower gap risk than individual stocks and more convenient diversification. But volatility around economic reports and open/close sessions call for disciplined application and precise timing.

Common Day Trading Strategies for Beginners

New traders often begin with simple strategies that are easy to learn. These strategies help reduce emotion-based decisions and provide set rules for entry and exit rules.

- Breakout Trading – Breakout traders look for price levels that a market has failed to move beyond, typically support or resistance. When price breaks above resistance or below support on increased volume, it can signal the start of a new trend. The goal is to enter right after the breakout and ride the momentum.

- Reversal Trading – This approach aims to catch market turning points. Traders use indicators like RSI, MACD or candlestick patterns (such as dojis or engulfing formations) to identify when a trend may be losing strength. Reversals can offer fast, high-reward opportunities but also carry more risk.

- Scalping – Scalping involves making many small trades throughout the day to capture minor price movements. Scalpers often hold positions for just seconds or minutes. This strategy requires excellent execution speed, low transaction costs and a strict exit plan.

- Moving Average Crossovers – Traders use short- and long-term moving averages to spot trend changes. A bullish signal occurs when a short-term moving average (e.g., 9 EMA) crosses above a longer one (e.g., 21 EMA). The opposite signals bearish momentum. These crossovers help identify when to enter or exit trades based on trend direction.

- News-Based Trading – Economic reports, earnings announcements and geopolitical events can create rapid price movements. Traders prepare by watching economic calendars and entering trades just before or after key news releases. News-based strategies require quick decisions and a solid understanding of the asset’s typical reaction to specific events.

Each strategy has its pros and cons. Beginners are advised to practice them using demo accounts before applying them with real capital.

Essential Tools and Indicators for Day Trading

Day trading requires more than just watching price charts. Traders rely on a combination of tools and indicators to identify trade setups, manage risk and make decisions with greater confidence. A strong foundation in these tools can improve accuracy and discipline.

Charting Software

Good quality charting software must be used to examine price action. Highly customizable charts with different timeframes, drawing tools, and overlays to support technical analysis are offered by most brokers, including IQ Option.

Moving Averages

Moving averages smooth prices and reveal trends. Short-term (e.g., 9-period) and long-term (e.g., 50-period) moving averages are frequently used by traders to set momentum or to identify reversals based on crossovers.

Relative Strength Index (RSI)

RSI is a momentum indicator that reflects whether a tool is overbought or oversold. A reading above 70 may signal a possible pullback, and a reading below 30 signals possible upside.

Volume Indicators

Volume reflects the strength behind a price move. High volume during breakouts or trend continuations confirms stronger conviction. Tools like the Volume Oscillator or On-Balance Volume help traders gauge interest.

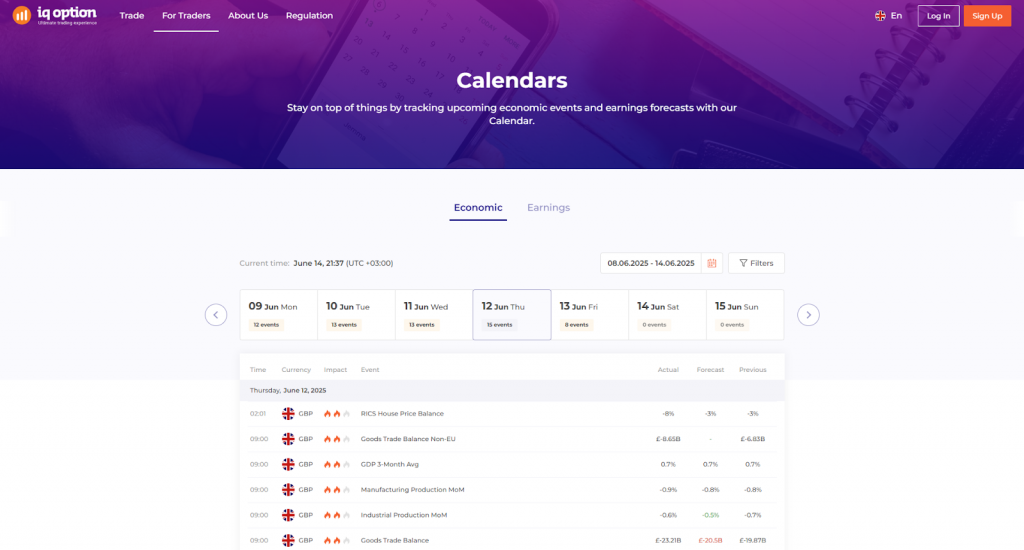

Economic Calendar

Staying up to date with news on the economy is important. Announcements of interest rates, inflation data or employment figures can provoke massive price action. Calendars are employed by traders in order to avoid times of increased risk or to execute high-volatility trades.

Risk Management Tools

Stop-loss and take-profit orders help to manage exposure and secure profit. Margin monitors and position size calculators are also employed to keep risk levels in line with trades.

Step-by-Step on How to Start Day Trading

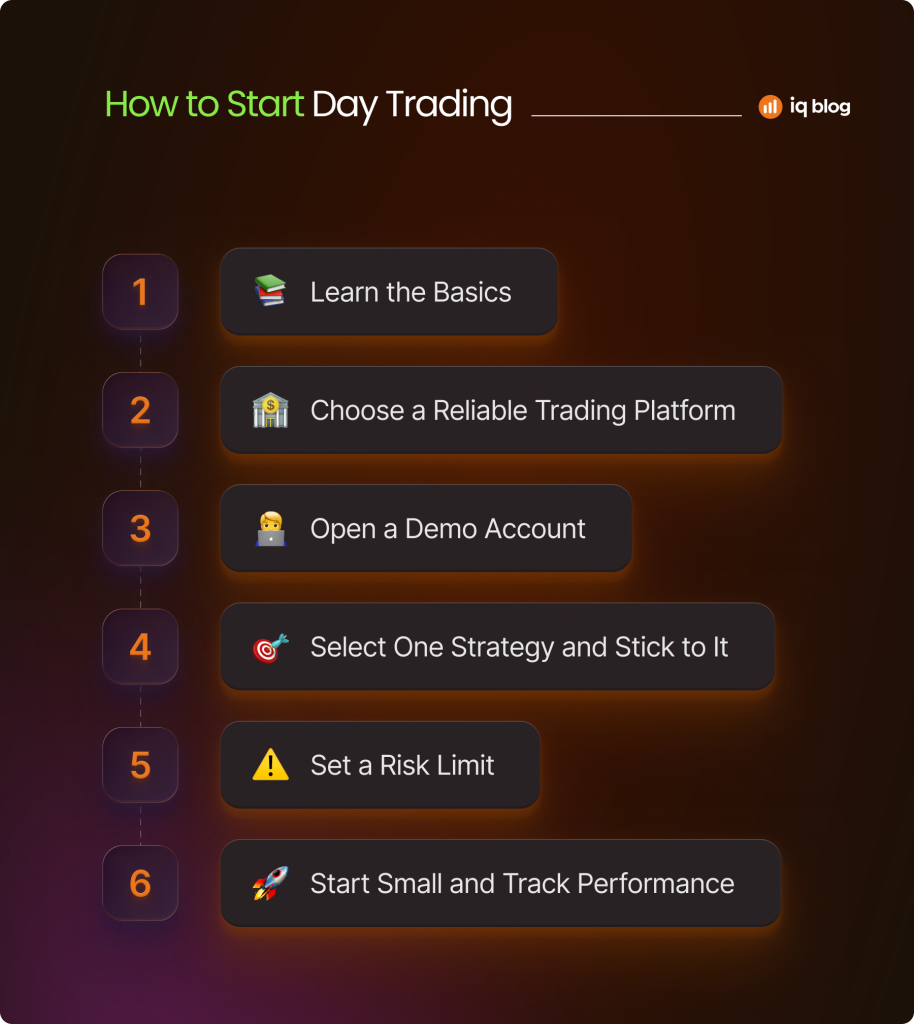

Day trading can be rewarding, but it requires proper preparation. Jumping in without a plan often leads to fast losses. Below is a practical roadmap to help beginners approach day trading with structure and reduced risk.

- Learn the Basics – Start by studying how financial markets function. Understand asset classes like forex, stocks, crypto and indices. Learn common trading terms such as bid/ask price, spread, leverage, margin and slippage. Explore how technical and fundamental analysis affect price behavior. Use free courses, video tutorials and beginner guides to build a knowledge base.

- Choose a Reliable Trading Platform – Your trading platform is your main tool. It should offer real-time charts, stable order execution, risk management features and asset coverage. IQ Option is designed to support beginners with a clean interface, mobile compatibility and built-in educational resources.

- Open a Demo Account – Practice in a risk-free environment before using real money. A demo account lets you test your strategy and learn how to manage trades under live market conditions. This step helps you make mistakes without consequences and builds familiarity with market behavior.

- Select One Strategy and Stick to It – Avoid the temptation to chase every method. Pick one entry strategy, such as a simple breakout or RSI-based trade and practice it repeatedly. Track how often it works, how long trades last and how often you follow your rules. Consistency matters more than variety when starting out.

- Set a Risk Limit – Good traders protect capital first. Decide how much you’re willing to risk per trade, typically between 1-2% of your total account. Use stop-loss orders to enforce this limit automatically. Avoid adding to losing positions and never risk more than you can afford to lose.

- Start Small and Track Performance – Begin with small trade sizes, even after moving to a real account. Review each session’s performance and note what worked, what didn’t and why. Keep a trading journal with screenshots and reflections, this habit is key to long-term improvement.

Common Day Trading Mistakes to Avoid

Beginners often face a steep learning curve in day trading. Avoiding common mistakes early can protect your capital and accelerate your learning process.

- Trading Without a Plan – Jumping into trades based on instinct or emotion leads to inconsistency, so every trade should follow a tested strategy with clear entry, exit and risk management rules.

- Ignoring Risk Management – New traders often risk too much on a single trade. This leads to quick losses and emotional decision-making, without set a risk percentage per trade and always use stop-loss orders to protect against major drawdowns.

- Overtrading – Trying to trade every price movement or staying in the market all day can lead to poor decisions, so we advice you to focus on quality setups, not quantity.

- Letting Emotions Drive Decisions – Fear, greed and impatience can override logic. Emotional trading often results in chasing losses, abandoning strategies or overexposing your account., so always be sure to take breaks and use small positions until your mindset stabilizes.

- Switching Strategies Too Often – Jumping between strategies after a few losses prevents long-term improvement. Stick with one method, refine it and track its performance before deciding to change direction.

Conclusion

Day trading offers a handy method to get involved in financial markets based on your choice.

With the appropriate tools, well-defined strategy and self-disciplined mind-set, short-term price fluctuations in forex, stocks, cryptocurrencies and virtually all other instruments can be taken advantage of by traders.

Though it demands attention and preparation, it also allows for flexibility and learning for those who are willing to approach it earnestly.

Being a beginner in this field, start with a demo account, concentrate on one strategy and give risk management top priority.

Regular practice and repetition over time can make you proficient in your skills and build your confidence as a trader.