A trading signal is an alert or indicator that tells traders when to buy or sell a financial asset. Signals are generated from technical analysis, fundamental data or automated systems and they help traders make faster, more informed decisions. In modern markets, signals can come from chart patterns, moving averages, news events or even AI-driven algorithms scanning millions of data points in real time. They are widely used in forex, stocks, crypto and options trading.

This guide explains what trading signals are, how they work, the main types available and how traders can use them effectively in 2025. We will also look at the benefits, risks and tools used to apply signals in real trading strategies.

What Is a Trading Signal?

A trading signal is a predefined trigger that suggests taking action in the market. It indicates when to buy, sell or hold an asset based on specific conditions. These conditions may come from technical indicators, chart patterns, news announcements or algorithmic models. The goal is to remove guesswork and provide traders with clear entry and exit points.

Trading Signals can be manual or automated. Manual signals are generated by analysts or experienced traders who interpret data and share recommendations. Automated signals come from software, trading bots or AI systems that scan markets and issue alerts without human involvement.

In practice, signals often include:

- The asset to trade (e.g., EUR/USD, Bitcoin, Tesla stock)

- The direction (buy or sell)

- The entry price or range

- Stop-loss and take-profit levels

- The time frame (short-term, intraday or long-term)

Because markets move quickly, many traders integrate signals directly into their platforms. This allows instant execution or notifications, ensuring opportunities are not missed.

Types of Trading Signals

Trading signals can be classified into several main categories, each offering a unique way of interpreting the markets.

Technical Signals

Technical signals come from price charts and indicators. Traders use tools like moving averages, RSI or MACD to identify trends and reversals. Chart patterns such as flags, triangles or double bottoms also serve as signals. For example, if EUR/USD breaks above a strong resistance level with heavy volume, a technical signal may suggest buying, with risk managed through a stop-loss just below that level.

Fundamental Signals

Fundamental signals are based on economic data and financial reports. A central bank rate hike can signal strength in a currency, while a company exceeding earnings expectations may trigger bullish signals in its stock. For instance, when the Federal Reserve signals tighter monetary policy, traders may interpret it as a reason to go long on the U.S. dollar while reducing exposure to gold.

Sentiment Signals

Sentiment signals focus on market psychology. They measure how optimistic or fearful participants are, often using surveys, options positioning or AI tools that scan financial news and social media. If sentiment suddenly turns positive on Bitcoin across multiple platforms, it can act as an early indicator of a price rally, even before technical confirmation appears on charts.

Price Action Signals

Price action signals rely on raw price movements without extra indicators. Traders read candlestick formations, momentum and reactions at key support and resistance levels. A classic example is a breakout from consolidation. If Tesla stock repeatedly tests $250 and finally closes above it with strong momentum, price action traders may take that as a signal to buy.

Algorithmic or AI-Based Signals

Algorithmic or AI-based signals represent the most advanced form in 2025. Machine learning models analyze historical and live data simultaneously, adapting to new conditions faster сthan humans can. High-frequency systems generate signals based on microsecond liquidity shifts, while retail platforms now offer AI-driven alerts integrated directly into trading apps. For example, an algorithm detecting unusual volume spikes in S&P 500 futures, combined with correlated movements in bond markets, could generate a buy signal far faster than manual analysis.

How Trading Signals Work in Practice

A trading signal is only valuable if it can be applied effectively in real conditions. In practice, signals guide traders through the process of identifying opportunities, defining risk and executing trades.

Most signals are structured around three key elements: the asset to trade, the direction of the trade and the entry price or range. Many also include protective levels such as stop-loss and take-profit points. For example, a signal might recommend buying EUR/USD at 1.0950 with a stop-loss at 1.0920 and a take-profit at 1.1020. This gives the trader a clear plan before the trade even begins.

Signals can be delivered in different formats. Some come as notifications from platforms or mobile apps, while others are generated automatically by trading software that executes orders without human intervention. A growing number of traders in 2025 use AI-enhanced signals, which scan markets in real time and adjust recommendations based on volatility or breaking news.

The effectiveness of signals depends on discipline. Traders who follow signals mechanically without proper risk control often face losses. A successful application requires combining signals with money management, position sizing and continuous evaluation of performance. In other words, the signal is the starting point, but the trader’s execution and discipline determine the outcome.

Benefits and Risks of Trading Signals

Trading signals can be powerful tools, but they are not without limitations. On one hand, they provide structure, speed and clarity for traders navigating fast-moving markets. On the other hand, relying too heavily on them or using poor-quality signals can lead to losses. Understanding both sides is essential before incorporating signals into a trading strategy.

Benefits of Trading Signals

- Clarity in execution – signals provide defined entry, exit and stop-loss levels.

- Time efficiency – they save traders from scanning dozens of assets manually.

- Discipline – following predefined signals reduces emotional and impulsive trading.

- Accessibility – beginners can use signals as a starting point while learning the market.

- Automation – many signals can be linked to trading platforms for instant execution.

Risks of Trading Signals

- Unreliable quality – not all signals are backed by strong analysis or data.

- Market shifts – conditions can change quickly, making a valid signal outdated.

- Overreliance – traders who depend only on signals may lack the skills to adapt.

- False expectations – some providers exaggerate accuracy, misleading beginners.

- Algorithmic flaws – even AI-driven signals can misinterpret noise as trends.

How to Use Trading Signals Effectively

Trading signals work best when they are part of a broader plan rather than used in isolation. A good signal tells you what to do, but it is the trader’s discipline that decides the outcome.

The first step is to choose reliable sources. Free signals found on social media often lack quality, while signals from regulated brokers or established providers are usually backed by stronger analysis. Traders should verify the track record before following.

Next comes risk management. Even the best signals fail sometimes. Using stop-loss orders, controlling position size and limiting daily exposure ensures that one bad trade does not wipe out an account. Many traders risk no more than 1 to 2 percent of their capital on a single signal.

Another key is confirmation. Traders often combine signals with their own analysis before acting. For example, a buy signal on EUR/USD may be more trustworthy if both technical indicators and sentiment analysis point in the same direction.

Finally, signals should be tested in demo accounts before applying them with real money. This allows traders to check consistency and learn how signals behave in different market conditions. Over time, traders adapt signals to fit their own style, rather than following them blindly.

Trading Signal Tools and Platforms

In 2025, trading signals are delivered through a wide range of tools and platforms. Modern technology has made it easier for traders to access signals directly where they trade, often with instant execution.

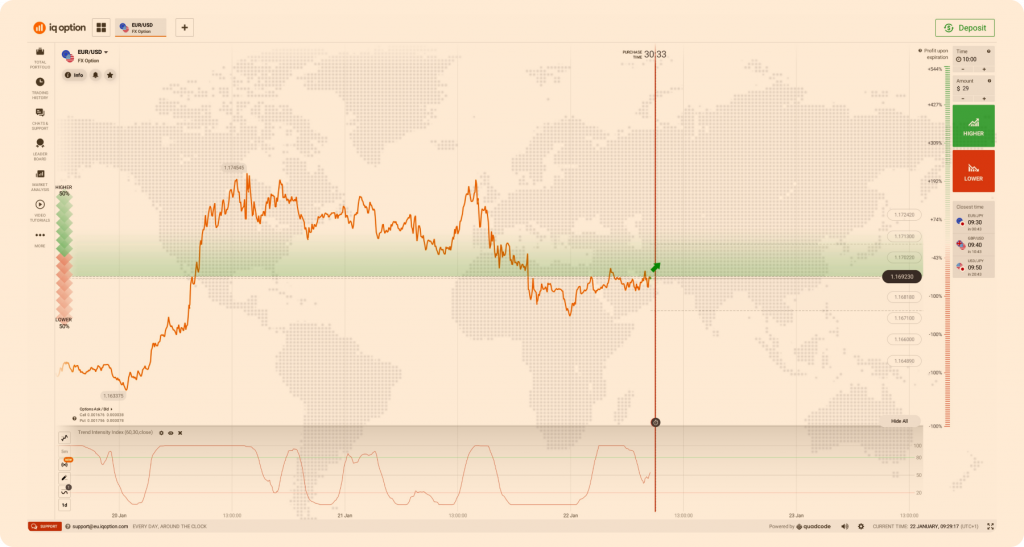

- Broker Platforms – Many brokers, including IQ Option, provide built-in signal services. These can be technical alerts, AI-generated insights or trade ideas shared by in-house analysts. The advantage is convenience, as signals are integrated with order execution.

- Charting Software – Platforms like TradingView remain popular because they allow traders to create or subscribe to custom indicators. Users can build scripts that generate signals based on moving averages, RSI, MACD or unique trading rules.

- Signal Apps and Services – Dedicated apps push notifications directly to traders’ phones. Some operate on subscription models, offering signals for forex, crypto or stocks. The quality varies widely, which makes reviewing performance history important.

- AI and Algorithmic Tools – Artificial intelligence has become a game-changer. In 2025, AI-driven scanners process news, economic releases and price data simultaneously. These tools can generate signals in real time, spotting opportunities before manual traders notice.

- Community-Based Platforms – Social trading networks allow users to follow or copy the trades of experienced traders. While not signals in the traditional sense, they provide actionable insights that beginners can use as learning tools.

Trading Signals in 2025: Trends and Outlook

Trading signals have changed significantly in recent years. In 2025, they are faster, more specialized and powered by advanced technology. Several key trends stand out.

AI-Driven Signals

Machine learning models now process massive amounts of market data, from price action to global news. These adaptive systems learn from past behavior and generate signals with greater accuracy than static methods.

Platform Integration

Signals are increasingly built directly into trading apps and broker platforms. This allows traders to act instantly on alerts without switching between tools, reducing delays that could cost profits.

Specialized Signals by Market

Signals are no longer generic.

- In forex, they highlight policy changes and macroeconomic events.

- In crypto, they track liquidity flows and on-chain activity.

- In stocks, they focus on earnings surprises and sector trends.

Community and Social Trading

Platforms that combine shared strategies with AI verification are growing. Traders can follow experienced investors while filtering out unreliable signals. This hybrid model blends automation with human expertise.

Final Thoughts

Trading signals have become an essential part of modern trading. They help traders cut through noise, identify opportunities and act with greater confidence. From simple technical triggers to advanced AI-driven alerts, signals are now available across all asset classes and trading styles.

Yet signals are not magic formulas. They carry risks and no signal is correct all the time. The difference between success and failure lies in how traders use them. Signals work best when combined with risk management, confirmation from other analyses and a disciplined approach to execution. Blind reliance, on the other hand, often leads to costly mistakes.

In 2025, signals are smarter, faster and more specialized than ever before. Traders who treat them as tools and not shortcuts can benefit from their insights while keeping control over their decisions. Used wisely, trading signals can support both beginners looking for guidance and professionals seeking efficiency in fast-moving markets.