A trading algorithm is an automated set of rules that decides when to buy or sell financial assets. Instead of relying on emotions or manual execution, algorithms use data, indicators and predefined logic to act in milliseconds. In 2025, they will be used by both institutional and retail traders, powered by AI, big data and advanced platforms that make automation more accessible than ever. This article explains what trading algorithms are, how they work, their types, benefits, risks and how beginners can start building one safely.

What Is a Trading Algorithm?

A trading algorithm, often referred to as an algo or automated trading system, is a computer program that follows a predefined set of rules to execute trades in financial markets. These rules are built around parameters such as price, volume, timing or other technical indicators. Once activated, the algorithm scans live market data and automatically places buy or sell orders when conditions match the programmed strategy.

At its core, an algorithm removes human emotion from trading decisions. Instead of hesitating, overreacting or chasing losses, the program executes consistently, no matter the market environment. This reliability is why algorithms dominate institutional trading, with studies showing that automated systems drive more than 70% of equity trades in the U.S..

Algorithms vary in complexity. Some are straightforward, like a moving average crossover system that buys when a short-term average crosses above a long-term one. Others rely on advanced mathematics, machine learning or even natural language processing to interpret news headlines and social sentiment in real time.

To function, every algorithm needs:

- Input data – market prices order book depth, economic reports or sentiment feeds.

- Rules/logic – predefined conditions, such as “if RSI < 30, then buy.”

- Execution engine – a direct connection to the broker or exchange that places orders.

- Risk controls – safeguards like stop-loss levels, position sizing or exposure limits.

In 2025, the rise of user-friendly platforms means that even retail traders can access algorithmic trading. Brokers like IQ Option and tools such as MetaTrader allow strategies to be automated with minimal coding. For professionals, advanced frameworks integrate AI to detect patterns humans cannot see.

How Do Trading Algorithms Work?

At a basic level, a trading algorithm works by converting a trading idea into a set of rules that a computer can execute without human intervention. The process follows a structured flow, starting with market data collection and ending with live order execution.

First, the algorithm receives real-time data feeds. These include price quotes order book updates, economic news or even alternative data such as sentiment from social media. The system continuously monitors these inputs, scanning for conditions that match the rules set by the trader or developer.

Next comes the decision-making logic. This is where the programmed strategy evaluates whether the conditions for a trade are met. For example, if the rule states “buy when the 20-day moving average crosses above the 50-day moving average,” the algorithm will trigger a signal the moment that crossover occurs.

Once a signal is generated, the execution engine takes over. The algorithm places the order automatically with the broker or exchange, often within milliseconds. Depending on its design, it can also split large trades into smaller ones to avoid moving the market, a technique known as order slicing.

Every well-built trading algorithm includes risk management layers. These act as guardrails, making sure the system does not overtrade or expose the account to unacceptable losses. Examples include stop-loss orders, maximum daily drawdown limits and restrictions on position size.

Finally, algorithms often include post-trade analysis. After each order is executed, the system records the trade details, entry point, exit point, slippage and profit or loss. This data is crucial for ongoing performance review and fine-tuning of the strategy.

To simplify, the workflow of an algorithm can be seen in five key steps:

- Collect data from markets.

- Scan for signals based on rules.

- Generate a buy or sell decision.

- Execute order through broker or exchange.

- Monitor risk and record results.

This structured process ensures that trades are systematic, consistent and free from emotional bias. Whether the strategy is simple or powered by AI, the underlying mechanics remain the same: rules in, trades out.

Different Types of Trading Algorithms

Trading algorithms vary in purpose and complexity. Some focus on catching simple price movements, while others rely on advanced data science. Here are the most common types, with details on how they work, where they are used and what to watch out for.

Trend-Following Algorithms

Trend-following algos are built around the idea that the trend is your friend. They try to capture ongoing price momentum by entering trades once a clear direction is established. These systems often rely on moving averages, breakouts and momentum indicators.

They perform best in markets with strong, sustained moves, such as during economic news releases or after earnings reports. However, they can struggle in sideways markets, where frequent false signals lead to whipsaws.

Example: A trader programs an algorithm to buy EUR/USD when the 20-day moving average crosses above the 50-day, with confirmation from rising RSI. The algo exists when the averages cross back down.

Mean Reversion Algorithms

Mean reversion assumes that prices eventually return to their average after moving too far in one direction. These algos monitor volatility bands, oscillators and moving averages to detect when assets are overextended.

They work well in calm or range-bound markets, where price tends to swing around established averages. The main risk is entering too early when a strong trend keeps pushing the price away from the mean.

Example: A stock drops 5% below its 20-day moving average, while Bollinger Bands show a two-standard-deviation move. The algo buys, targeting a return to the mean.

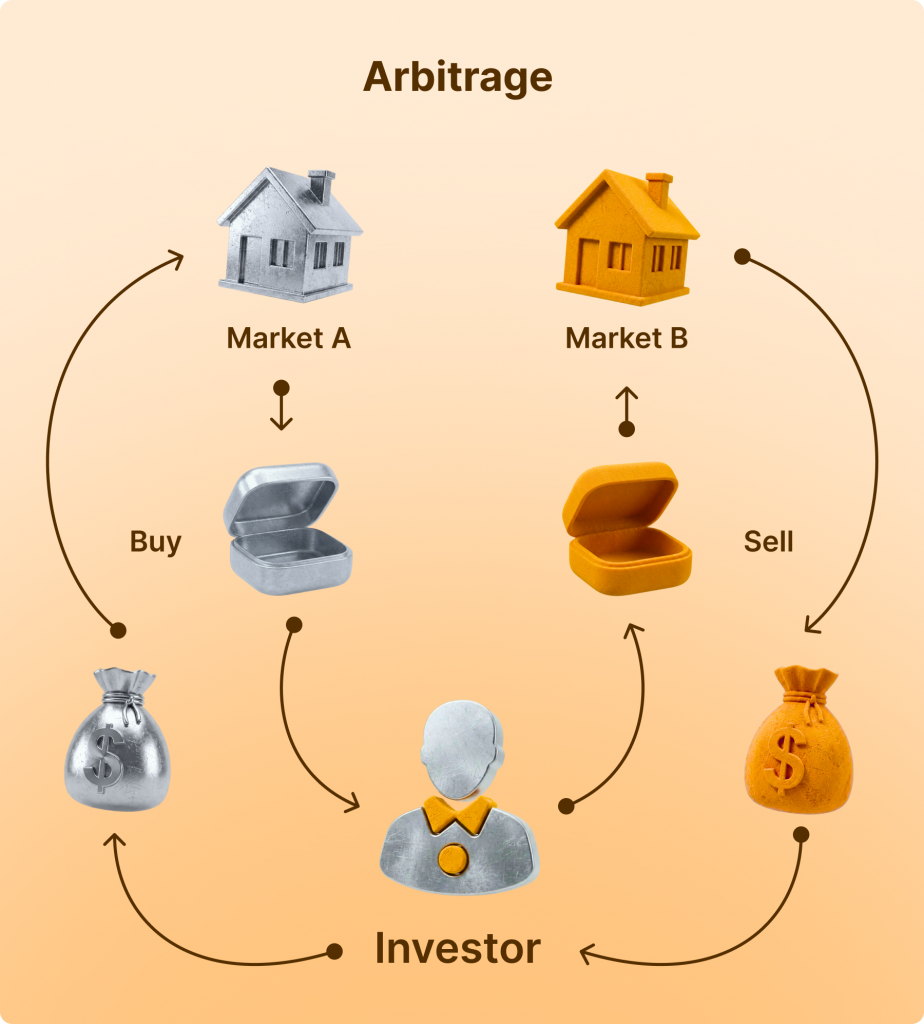

Arbitrage Algorithms

Arbitrage algos search for tiny price mismatches across related assets or exchanges. They execute trades almost instantly to lock in risk-free or low-risk profits. This is common in forex, crypto and derivatives markets.

The challenge is execution speed. These strategies require low-latency connections and are often dominated by large institutions. Still, retail traders may find opportunities in crypto markets, where price differences between exchanges are more common.

Example: Bitcoin trades at $29,950 on Binance and $30,020 on Coinbase. The algorith buys on Binance and sells on Coinbase simultaneously, capturing the spread.

Market-Making Algorithms

Market-making algos provide liquidity by constantly placing buy and sell orders around the current price. They profit from the spread between bid and ask, while adjusting orders dynamically as prices move.

These strategies are essential in less liquid markets, such as small-cap stocks or altcoins, where spreads are wide. The main risk is sudden volatility, where large price moves can wipe out the small gains collected from spreads.

Example: An algo quotes buy orders at $100 and sell orders at $100.10 for a stock. If both sides are executed, the algo pockets $0.10 per share.

AI and Machine Learning Algorithms

AI-driven algos represent the cutting edge of trading in 2025. Instead of relying on static rules, they process huge datasets, price history order flow, news sentiment and even social media to learn patterns. These systems adapt in real time, adjusting their parameters as market conditions change.

While powerful, they are also complex and require significant computing resources. Overfitting, where the model learns noise instead of true patterns, is a common risk.

Example: A neural network trained on years of S&P 500 data predicts intraday price direction with 60% accuracy. The algorithm uses these signals to place trades, refining its models as new data arrives.

Benefits of Trading Algorithms

Trading algorithms have grown in popularity because they solve problems that manual trading cannot. They bring speed, consistency and discipline to markets where seconds or even milliseconds make the difference between profit and loss. Below are the main advantages.

- Speed and Efficiency – Algorithms can process and act on information far faster than a human trader. They scan multiple markets, monitor hundreds of instruments and execute trades in milliseconds. This speed ensures better entry and exit points, especially in volatile conditions.

- Elimination of Emotions – One of the biggest challenges in trading is human psychology. Fear, greed and hesitation often lead to mistakes. An algorithm, however, follows its rules exactly as programmed. It does not second-guess decisions or deviate from the plan, which results in more consistent execution.

- Backtesting and Strategy Validation – Before risking real capital, trading algorithms can be tested against historical market data. Backtesting allows traders to evaluate performance, measure risk and refine strategies. This ensures that only robust systems are deployed in live markets.

- Diversification Across Assets – An algo can handle multiple strategies and asset classes at the same time. For example, it might run a trend-following system in forex while executing arbitrage trades in crypto. This diversification spreads risk and increases opportunities.

- Precision in Execution – Unlike humans, algorithms never tire or lose focus. They execute trades exactly as designed, down to the fraction of a second. This reduces slippage and improves overall profitability.

- Accessibility in 2025 – In the past, algorithmic trading was restricted to large institutions. Today, platforms like IQ Option, MetaTrader and Python-based APIs have made it accessible to retail traders. Many brokers provide plug-and-play solutions, allowing beginners to automate strategies without needing to code from scratch.

Risks of Trading Algorithms

While trading algorithms provide speed and consistency, they also introduce new risks. Understanding these risks is just as important as recognizing the benefits. In many cases, traders fail not because the idea was poor, but because they underestimated the limitations of automation.

- Technical Failures – Algorithms depend on technology. Power outages, internet disruptions or server crashes can stop a system mid-trade. Even a brief interruption may cause missed opportunities or unexpected losses. To reduce this risk, many traders use backup systems and cloud-based hosting.

- Over-Optimization – Backtesting can create a false sense of security. Traders may adjust parameters until the algorithm shows excellent past performance. This is called overfitting. The problem is that what worked in the past may not work in the future, leading to poor real-world results.

- Market Changes – A strategy that works in trending conditions may fail during choppy, range-bound periods. Algorithms cannot adapt unless they are designed with flexible logic or updated regularly.

- Hidden Costs – Execution is not free. Spreads, commissions and slippage can eat into profits. High-frequency strategies like scalping may look profitable in theory but collapse when costs are factored in.

- Lack of Oversight – Automated systems can run 24/7, but leaving them unchecked is risky. A bug in the code or an unexpected market event can trigger repeated losing trades. Professional traders monitor their algos closely and set limits to stop trading if losses exceed a threshold.

- Complexity and Barriers – AI-driven algos require large datasets, powerful hardware and advanced knowledge. Retail traders who dive into machine learning without preparation may end up with unstable systems.

How to Build a Trading Algorithm: Step by Step

Trading algorithms may look complex, but the process can be broken into six main stages. Each step moves you from idea to live execution in a structured, practical way.

Step 1: Define Your Objective and Market

The foundation of every algorithm is purpose. Decide what you want to achieve: intraday profits, hedging or long-term systematic trading. Once the goal is set, choose a suitable market. Forex offers liquidity, crypto delivers volatility, stocks bring structured data and commodities react to global supply trends. Picking the wrong market for your idea is the first pitfall to avoid.

Step 2: Design Clear Trading Rules

Algorithms follow rules, not intuition. Translate your idea into precise entry and exit conditions. Use indicators such as moving averages, RSI or Bollinger Bands or base logic on price action or statistical models.

For example: “Buy when the 20-period moving average crosses above the 50-period, with RSI above 55.” The clearer the rules, the less room there is for coding errors or confusion.

Step 3: Build the Algorithm

There are two ways to create the system.

- Coding: Python is the most popular choice, supported by libraries like Pandas and TA-Lib. Coding gives full flexibility but requires technical skill.

- Platforms: Tools like IQ Option let users design strategies with built-in functions or drag-and-drop logic. This option is faster and easier for beginners.

The choice depends on your resources and experience, but both paths lead to a functional algorithm.

Step 4: Backtest with Historical Data

Before risking money, test the system on past market data. Backtesting reveals how the algo performs in different conditions: trending, sideways or volatile. Key metrics include:

- Win rate (how often trades are profitable)

- Profit factor (gross profits ÷ gross losses)

- Drawdown (worst losing streak)

- Sharpe ratio (risk-adjusted returns)

A strong backtest shows consistency, not just a handful of big wins. If results look too perfect, beware of overfitting, tuning the algorithm too tightly to past data.

Step 5: Run Live Testing with Small Capital

After backtesting, move to forward testing. Start with paper trading (simulated trades) to see how the algo handles real-time data. Once it behaves as expected, deploy it with a small amount of real money. Monitor closely for slippage, transaction costs and latency. Even the best backtests cannot capture all live conditions, so this step acts as a real-world filter.

Step 6: Monitor, Refine and Scale

A trading algorithm is never truly finished. Markets evolve and systems must adapt. Regularly review results, update rules and fine-tune parameters. Many traders keep performance journals to compare expected versus actual outcomes. Once the system proves consistent, you can scale it up, either by increasing position size or by deploying across multiple instruments.

The Role of AI in Trading Algorithms in 2025

Artificial intelligence has transformed trading algorithms. What used to be simple rule-based systems now incorporate machine learning, natural language processing and predictive analytics. In 2025, studies from precedence research AI-driven algos are common across both institutional and retail trading.

- Smarter Pattern Recognition – Traditional algorithms follow fixed conditions, such as moving average crossovers. AI systems, however, learn from vast datasets. They identify hidden patterns in price action order flow and volatility that humans or static rules often miss. For example, a neural network can analyze years of stock data to recognize subtle signals that precede breakouts.

- Real-Time Sentiment Analysis – Markets move on news and AI excels at processing unstructured data. Natural language processing (NLP) enables algorithms to scan news headlines, central bank statements and even social media posts within seconds. By assigning sentiment scores, AI allows traders to anticipate market reactions faster than manual methods.

- Adaptive Learning – One of the biggest limitations of static algorithms is their inability to adapt. An RSI-based system may work during trending conditions but fail in sideways markets. AI systems can update themselves by retraining on recent data. This adaptability helps them remain profitable across changing environments.

- Risk Management Enhancements – AI is not only used for trade entries and exits, it also strengthens risk control. Some brokers integrate AI tools that monitor traders’ accounts in real time, flagging unusual patterns or overexposure. Institutions use machine learning to predict drawdowns and adjust position sizing dynamically.

- Accessibility for Retail Traders – AI in trading was once limited to hedge funds with large budgets. In 2025, retail traders will also have access to AI features through platforms like IQ Option, MetaTrader and specialized Python libraries. Pre-built models, cloud computing and low-cost APIs have reduced barriers. While not as advanced as institutional tools, they provide valuable insights.

- Limitations of AI in Trading – Despite the hype, AI has weaknesses. Models can overfit, mistaking noise for meaningful patterns. They also depend heavily on the quality of data. Biased or incomplete datasets produce flawed predictions. Moreover, AI cannot eliminate uncertainty. Black swan events like sudden geopolitical crises still catch algorithms off guard.

Summary

Trading algorithms have become a core part of modern markets. They allow traders to automate decisions, remove emotion and act on opportunities at speeds no human can match. From simple moving average crossovers to advanced AI-driven sentiment models, algorithms adapt to different goals and markets.

The key takeaway is that algorithms are tools, not guarantees. They offer clear benefits such as speed, consistency and diversification. At the same time, they come with risks like technical failures, overfitting and sudden market changes. Even the most advanced AI cannot predict every event, especially black swan shocks.

For beginners, the smartest approach is to start small. Define a simple strategy, test it on historical data and run it in demo mode before going live. Risk controls should always be built in, stop losses, capital limits and regular reviews are essential. With discipline and patience, trading algorithms can evolve from basic systems into robust setups that stand the test of time.

In 2025, platforms like IQ Option make algorithmic trading accessible to retail users. Combined with cloud services, APIs and AI tools, more traders than ever can create their own systems. But success depends less on the technology and more on how carefully it is designed, tested and managed.