A breakout trading strategy is a way of trading where you enter a position when price moves beyond a clearly defined support or resistance level. The idea is simple: when price escapes a range where it has been stuck, it often moves fast in the breakout direction.

Traders use breakout strategies to catch the start of a strong move rather than chasing it later. These setups appear in stocks, crypto, forex, and indices, and they work across different timeframes.

At its core, breakout trading focuses on price behavior, not predictions. You wait for the market to show its hand, then react.

What counts as a breakout?

A breakout happens when price moves outside a level it has respected multiple times in the past. That level might be resistance above or support below.

- A bullish breakout occurs when price breaks above resistance and holds.

- A bearish breakout occurs when price breaks below support and doesn’t immediately recover.

What matters is not just crossing the level, but closing beyond it. Many false signals happen when price briefly pokes through and snaps back.

Why breakout trading works

Breakouts work because markets store pressure.

When price trades in a tight range, buyers and sellers are in balance. Orders build up on both sides. Once one side gains control, price must move quickly to find the next area of balance.

This is why breakouts often come with:

- Sudden volume increases

- Large candles

- Fast follow-through

It’s not magic. It’s order flow being released.

How breakout trading works in real markets

In practice, breakout trading is about waiting, not forcing trades.

You identify levels where price has stalled before. You let the market approach those levels again. Then you wait for proof that the level has failed.

Once price closes beyond the level with strength, you enter with a defined stop and target. No guessing. No hope-based trades.

Step-by-step: how to trade a breakout

Step 1: Identify a clear support or resistance level

Look for areas where price has turned multiple times.

The best levels are obvious even without indicators. If you need to adjust the line repeatedly, it’s probably not a strong level.

Flat levels tend to work better than diagonal ones, especially for beginners.

Step 2: Wait for a clean break and close

Do not enter just because price touches the level.

A valid breakout requires a candle close outside the range. This confirms that price accepted higher or lower levels.

Many traders lose money by entering too early. Waiting for the close filters out a lot of bad trades.

Step 3: Confirm the breakout with volume

Volume is what separates real breakouts from traps.

A breakout should show above-average volume, ideally 1.5 to 2 times recent levels. This tells you other traders are participating.

Low-volume breakouts fail far more often.

Step 4: Choose your entry method

There are two common ways to enter breakouts.

1. Break-and-close entry

You enter immediately after the breakout candle closes. This gives early exposure but slightly higher risk.

2. Retest entry (more conservative)

You wait for price to come back and test the old level. If it holds, you enter. Fewer trades, better accuracy.

Horizontal Resistance Breakout

How to set profit targets for breakout trades

One of the most practical methods is the measured move approach.

You measure the height of the range price was stuck in, then project that distance from the breakout point.

Formula:

Target = Breakout level + Range height

Example:

If price moved between $90 and $100, the range is $10.

A breakout above $100 gives a target around $110.

This doesn’t mean price must stop there. It simply gives structure to your trade.

Expert Insight #1 (From real trading experience)

“The strongest breakouts usually come after long periods of nothing happening. If a chart feels exciting before the breakout, it’s often already extended.”

Quiet charts tend to produce cleaner moves.

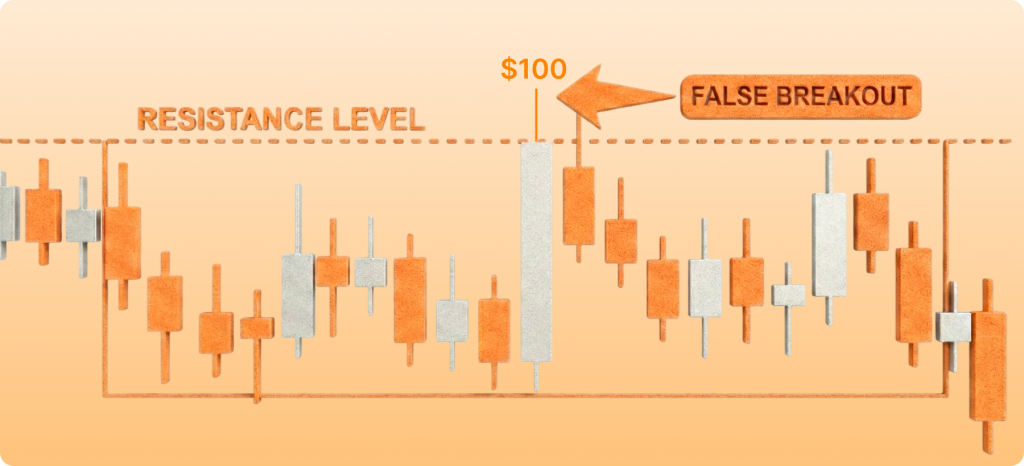

False breakouts: why they happen and how to avoid them

False breakouts happen when price breaks a level briefly, triggers entries, and then reverses back into the range.

They are common. In fact, most breakout attempts fail. This is normal behavior, not a flaw in the strategy.

The key is learning to spot weak breakouts early.

| Feature | Strong Breakout | False Breakout |

| Volume | Clear expansion | Flat or declining |

| Candle close | Near high/low | Long wick |

| Follow-through | Multiple candles | Immediate reversal |

| Trend context | With higher timeframe | Against trend |

If several warning signs appear together, staying out is often the best trade.

Image: False Breakout with Long Upper Wick

Best indicators for breakout trading

Indicators are optional, but a few can help confirm conditions.

RSI

A rising RSI supports a bullish breakout. Divergence is a warning sign.

ATR (Average True Range)

ATR expanding after a quiet period often confirms a real breakout.

Bollinger Bands

A tight squeeze followed by expansion often precedes strong breakouts.

Moving averages

Many traders only take bullish breakouts above the 200-day EMA to stay aligned with the broader trend.

Image: Bollinger Band Squeeze Before Breakout

How much capital do you need to trade breakouts?

Breakout trading doesn’t require a large account.

What matters is risk control, not account size.

- Stocks: $500–$2,000 is workable

- Crypto: smaller accounts can work but volatility is higher

A simple rule that protects capital:

Risk no more than 1–2% of your account per trade.

Losses are part of the strategy. Large losses are not.

Expert Insight #2 (Live market observation)

“Breakout traders fail not because their strategy is bad, but because they size too big when they’re wrong.”

Risk management keeps you in the game.

Common breakout patterns traders use

Some breakout structures appear repeatedly.

| Pattern | Description |

| Ascending triangle | Higher lows pressing resistance |

| Descending triangle | Lower highs pressing support |

| Range breakout | Flat highs and lows |

| Flag pattern | Sharp move followed by tight consolidation |

You don’t need to trade all of them. One setup done well is enough.

The psychological side of breakout trading

Breakout trading tests patience more than skill.

Most of the time, nothing happens. Then everything happens fast. This creates fear of missing out and impulsive entries.

The traders who last learn to:

- Wait for confirmation

- Accept missed trades

- Cut losses quickly

Once emotions are controlled, execution improves naturally.

Final thoughts

Breakout trading is about letting price confirm direction before you act.

When you focus on clean levels, strong closes, and controlled risk, breakouts become easier to manage and less emotional.

You don’t need to catch every move. You only need to be consistent when the right ones appear.