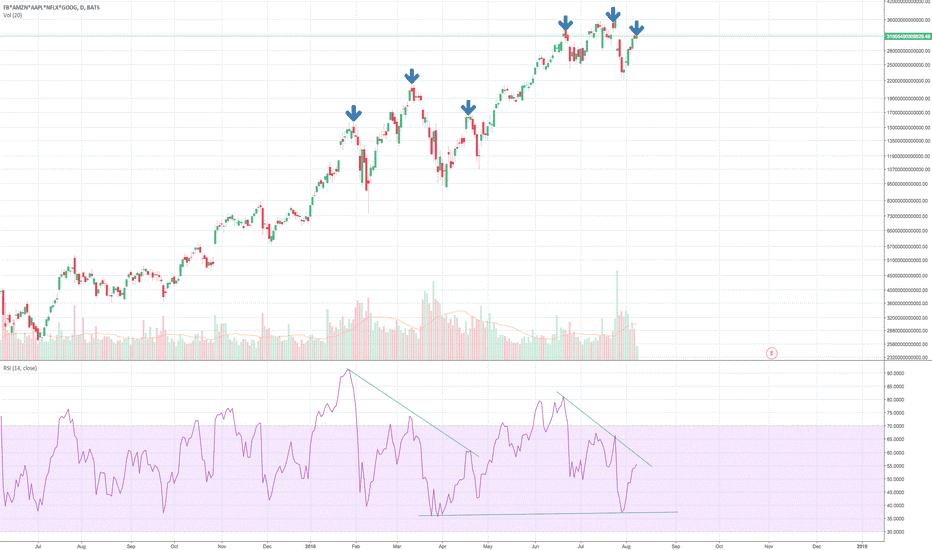

Although US economy performs very well this year, there are some signs that reveal problem in the foreseeable future. The retail sales for August of 2018 that released in 14/09/18 revealed the big problem of US economy, which is the low savings of consumers that do not permit US economy and US citizens to prosper. US citizens after the big financial crisis were found with big amount of loans balances that were forced to pay off and followed the era of deleveraging. This had as a consequence low consumer spending ,which accounts for 75% of US economy, lower fixed capital expenditures from the side of entrepreneurs, low productivity and because of the fall of interest rates near zero until the spring of 2009 and the beginning of quantitative easing from the Federal reserve bank the artificially increase of asset prices, the increase of home prices near the highs of 2008 this year and finally the increase of the global debt to global gross domestic product ratio to all – time highs.

Furthermore the US home market the last 5 months is in a declining trend, the wage growth is not so impressive from a historical standpoint and given that interest rates futures markets consider the raise of interest rates in 26th September of 2018 very sure, this time the macroeconomic environment does not contribute to the continuation of the rally for US market. Finally, the low saving rate of US economy is consistent with the big flattening of US yield curve, which indicates low productivity gains, lower growth prospects and lower inflation in the mid and long term. On the other hand a higher saving rate in an economy leads to a higher growth rate according to endogenous growth theory and this does not happen this time.

The following chart of US personal saving rate is very indicative:

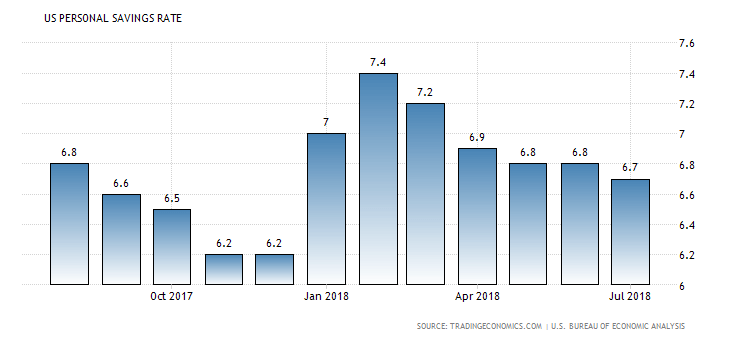

The US stock market continues its rising and stable trend, but only growth investing thrives and the outperformance of US utilities sector requires prudence and caution, because this is consistent with an imminent economic slowdown and also the small positive performance of US financial sector is consistent with the flattening of US yield curve, because investors are afraid of an imminent inversion of the yield curve, which will have as a result the fall of financial institutions stock prices, because banks traditionally lend long term and borrow short term.

Also, to the fact that only US stock market posts a positive performance year to date is the outperformance of Faang stocks, which account for the majority of S&P 500 index gains and are considered high growth stocks. So, as long as these stocks outperform and also Russell 2000 index does not fall to a correction territory the bull market will continue. The positive factors that point to the continuation of US bull market are the low interest rates from a historical perspective, the low inflation and the high expectations for US corporate profitability. Lastly ,the negative factors is the negative environment in European and Emerging equities markets, the last big widening of US trade balance deficit and the intensified trade war between USA and its trading partners.

The following chart of Faang stocks index chart is very revealing: