The FOMC minutes were released on Wednesday and point to two things; growth within the US economy and the danger of trade war escalation. The committed says that recent data suggests it will be appropriate to raise interest rates soon and that outlook for growth and inflation remain on target. What took the market by surprise was their view on trade war, they see it as a threat but not a substantial risk to the economy right now.

The FOMC says that the trade war is the biggest threat to the US economy and, by extension, to that of the world’s economy. Although the threat is real they qualified the remark with this statement; “IF a large-scale and prolonged dispute over trade policies developed, there would likely be adverse effects on business sentiment, investment spending, and employment.”

China and the US exchanged the latest shots in the trade war just today. The US added another 25% of levies to tariffs already in place, a move worth $16 billion that was immediately reciprocated by China. China upped tariffs on products ranging from fuel to steel products, autos and medical equipment. The good news is that these tariff increases were a known factor when the FOMC held their last meeting, the bad news is that the trade war is far from over.

Mid-level officials are meeting in Washington, D.C. this week to discuss a path forward for China and the U.S. but there is not much hope a resolution will be reached. Both sides still see themselves in a strong position and neither is ready to back down. Traders should expect to see the tit-for-tariff continue over the next few months at least.

Meanwhile, in the US, first time jobless claims fall to the second lowest level in 45 years. The data shows a continued downtrend in US unemployment claims that is expected to result in lower unemployment overall. The FOMC noted in the minutes that they expect to see unemployment fall below their target this fall as tight labor market conditions result in a surge in the participation rate.

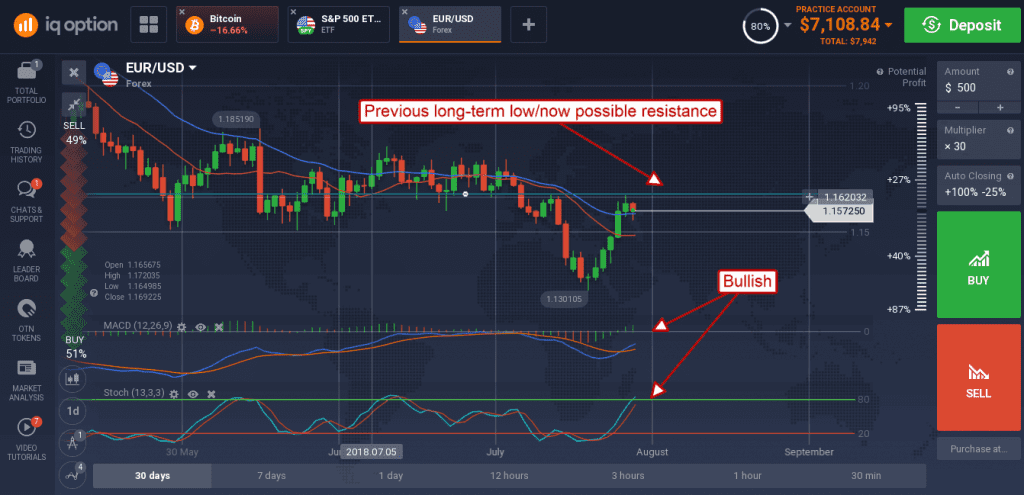

The EUR/USD fell on the FOMC news and is confirming resistance at the 1.6255 level. This is a level of previous support and may become strong resistance if EU data does not shine as brightly as that in the US. The indicators are pointing upward so another test of resistance is likely, a move above it would be bullish and may result in a move to 1.1800 or 1.1200.

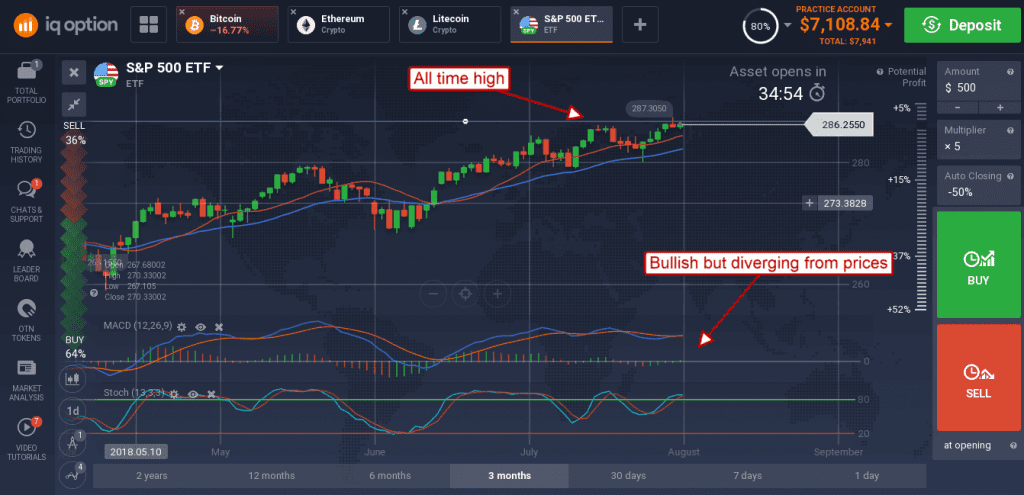

The US equity market held firm following the minutes release and looks like it may move up to set a new all-time high. The SPY S&P 500 Index Tracking ETF is sitting just below the current all-time and indicated higher.

The issue is that the indicators are weak and diverging from the 6-month high suggesting weakness within the market. If resistance is present at the all-time high it could result in a sharp move lower.