This year the US presidential election was fraught with a lot of anxiety and it is clearly reflected on the market. A raging pandemic caused a massive increase in mail voting numbers and for many Americans the election day came much earlier. Early voting was available weeks before the election day, depending on the state. The counting of all ballots held the election results unknown for several days after the official voting day, November 3, up until last weekend.

The outcome

According to the US election rules, the candidate has to receive 270 votes to win the election. As a preliminary result of the election race, Joe Biden won with a result of 290 votes. However, the final results will be announced on December 14, when the presidential electors of the Electoral College will turn in their votes. Moreover, Donald Trump, the current president of the United States, has not agreed with the election results and filed legal challenges disputing the election results and calling for votes to be recounted.

The market

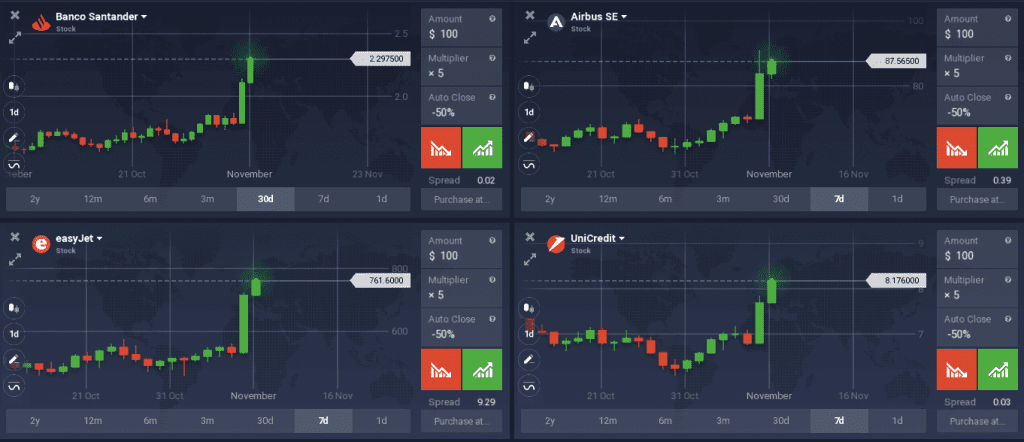

Though the final decision has not been settled yet, the markets have already reacted to Biden’s preliminary victory. The US dollar sharply decreased in price, while global stocks hit new highs on expectations for the US foreign policy reset: the trade policy under the new administration is expected to be less confrontational as Joe Biden seems to wish to repair ties with Europe and China. European stocks remain mostly on the rise also due to the news about the efficiency of the coronavirus vaccine that the pharmaceutical giant Pfizer released on Monday.

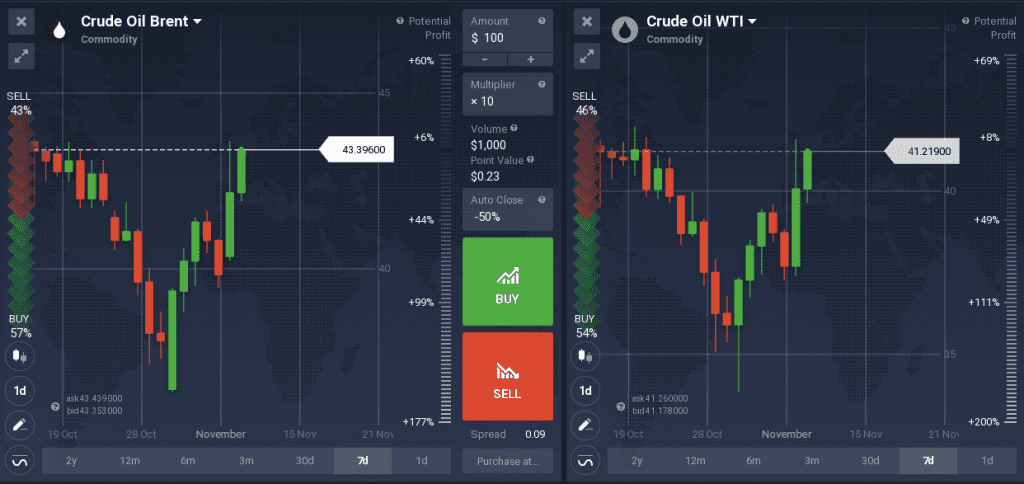

Crude Oil also seems to be climbing higher and the market volatility may continue since the election results are not finalized yet.

How to trade?

Times of uncertainty bring higher volatility to the markets and it creates more opportunity for traders, which both short-term and long-term traders may benefit from. However, it also increases the risks associated with trading, as the markets become more unpredictable. Stock and Forex traders may keep an eye on the market news in order to quickly adapt their strategy if the asset shows unfavorable performance. Traders may also utilize technical indicators to evaluate the asset performance.

The most important thing to remember is to utilize risk management strategies at all times. Setting investment limits and keeping a tight stop loss may help traders manage their capital and minimize risks.