One of the most important economic parameters for investors globally will be announced at the end of this week – Monthly US CPI figures for April 2017, announced Friday 12th May 2017.

This will provide vital indications to market participants of the strength of the US economy currently and give an indication of what we can expect from US economic performance into the remainder of 2017.

Wall Street analyst consensus expectations are for both core and headline CPI for April 2017 to be 0.2% higher month on month.** This forecast is based on a number of factors, predominantly those which led to one off downside factors to inflation during the month of March 2017 which have now had some retracement upward. Year-on year the forecasted expectation is for an increase in Core CPI of 2.0% – in line with the 2.0% year on year increase reported for March 2017.**

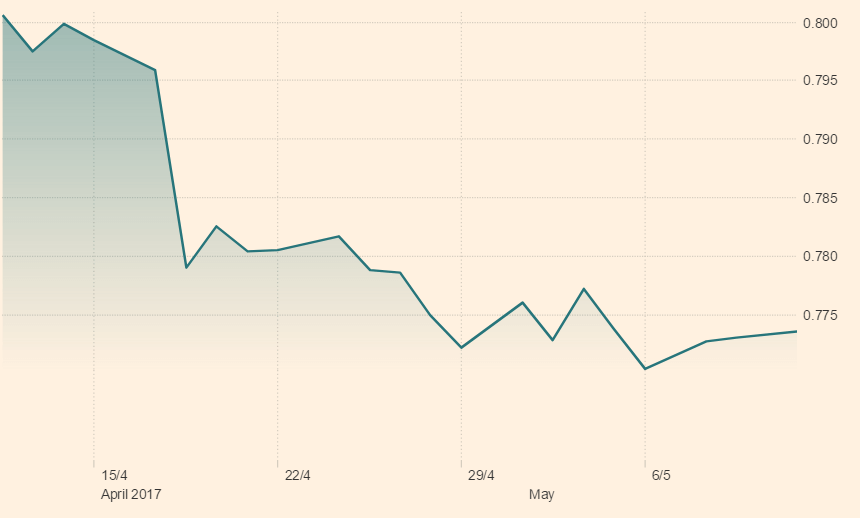

When it comes to the dollar the core CPI figure will be closely watched this week by investors across all asset classes and markets. Higher levels of inflation will add to dollar strength and contribute to the current expectation of a rate hike in June of this year as well as indicate a more aggressive rate hiking policy from the Federal Reserve for the remainder of 2017 – impacting FX, fixed income and equity markets significantly.

Core CPI showed a 0.1% month on month fall for March 2017 – a downward surprise that marked the first fall since January 2010. * In addition for March the US economy reported that core goods prices fell 0.3% month on month – another surprise that marked the largest decline in the figure in over a decade. *

Although many of these price declines are considered one offs by market and economic analysts there are certain elements that will sustain over the medium term at least – dampening upcoming CPI figures. For example, a large part of the decline in core goods was due to declines in transportation goods prices and this factor is expected to sustain into the medium term – as US vehicle prices are being forced lower due to industry supply outweighing demand. **

In addition March core services suffered a sharp decline due to a 7% fall in wireless telephone service prices. * This factor is expected to show improvement for April given that the drop in these prices was due to an arbitrary change in quality requirements for wireless telephone services that was imposed on service providers. **

Meanwhile, the energy sector is expected to contribute to positive movement in non-core CPI for April – with retail gasoline prices drifting to higher levels over the month. ** The natural gas market has also achieved a retracement in prices from March into April – contributing to rises in energy CPI.*

Given that certain elements of the decline in March CPI figures were due to transitory factors, we can expect a moderate amount of improvement in the performance of core and headline US CPI for April 2017. **

* Past performance is not a reliable indicator of future performance.

** Forecasts are not reliable indicator of future performance.