There are concrete points for growth & solid equity returns and at the same time there are concrete points for economic cycle reaching the peak. The wide dispersion of opinion, destroys trends, and volatility rises. Volatility is hear, and it will stay.

Last week, being long JPY did not paid off, I was correct to not maintain my long USD bias due to the tariffs drama, I was correct to only search to open long position at USDCHF at 0.9340 level, I was correct calling that USDCAD was in an uptrend that could experience a small bounce at 1.2956 level, I was correct that AUDUSD was in a well defined downtrend and any testing of 0.7810 or even 0.7850 level would be a nice level to open short positions, and I was also correct to note that EUR would weaken following ECB’s communication.

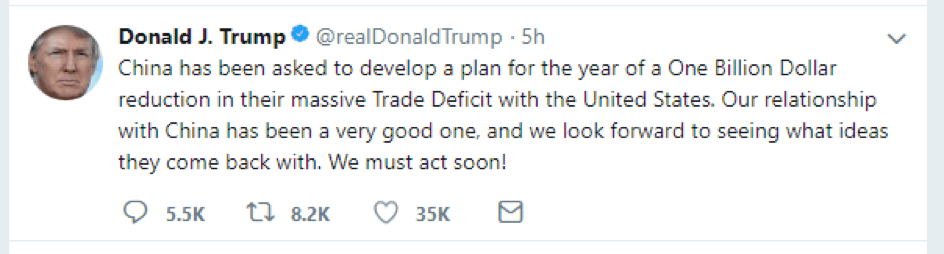

Nevertheless, I have very little confidence on my next weeks views. To my defence, please consider Trump’s post below .

If all this tariff talking, initiated at Trump’s campaign back on 2016, announced on 1st of March 2018, causing the designation of Cohn, is all about 1BillionUSD, I am definitely missing a lot.

Major last week’s events (apart from the many Central Bank’s Meetings)

- Designation of Gary Cohn, White House advisor, former Goldman Sachs executive, that was supposed to be the Globalist voice in the room

- CERA week for oil that I was wrong too not mention in previous week’s report

- The very high Friday’s Non Farm Employment change that boosted US equities.

Major scheduled this week events

- OPEC meeting on Wednesday

- Russia scheduled elections on Sunday

- Get prepared for FED’s meeting in 2 weeks

JPY

EURJPY did not moved lower as I was expecting. The pair hovered around the 200-Day Moving Average and ended the week by testing the 20-Day Moving Average. I am maintaining my short bias and will possibly add short positions in case the 131.85, 132.85 and 133.60 levels are triggered.

Friday’s Central Bank communication, reassured to keep current aggressive expansionary monetary policy in place, until inflation (CPI excluding fresh food) passes the 2.0% target.

Snapshot:

- 0% GDP growth, all time low unemployment at 2.4%

- Inflation at 1.0% (vs 2.0% target)

- 0,5% 10y Bond yields vs BOJ’s target of 0.00% level

Strengths of JPY:

- Last strong Current Account reading of 2.02T

- Decisiveness communicated by the Central Bank

- Any breaking news from the Trump’s tariff drama

Weaknesses of JPY:

- Geopolitical risk from North Korea is diminishing

- EURJPY did not manage to close the week bellow the 200-Day Moving Average

Watch:

- No market moving announcement is expected

CAD

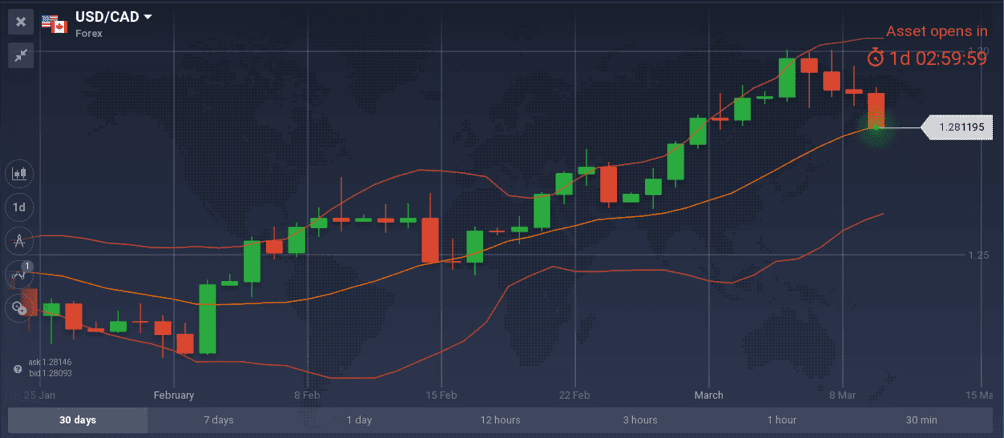

My view is that USDCAD is in a healthy uptrend that could potentially reach 1.31 or even 1.34 level. My last week’s call to regard 1.2956 level as a probable bounce-back level, proved totally correct.

The Central Bank simplistically continues to assume no change in trade deals at it’s models, and does not incorporate neither the range of outcomes of NAFTA talks nor Trump’s tariffs. Consequently, I cannot become more accurate with my views up until the 9th of April (Business Outlook Survey release is expected).

Snapshot:

- Inflation at 1.7% (vs 1.0%~3.0% target range). Expected to pick up as gasoline, electricity and minimum wage increase

- GDP at 2.9% annual, 0.4% QoQ.

- US crude oil inventories are rising again (last Wednesday’s reading was +2.4Mbarells), pressuring down both the price of oil and the correlated CAD.

Strengths of USDCAD, weakness of CAD:

- I am searching to go long in case the pair reaches the attractive 1.2690- 1.2716 level

- I am modeling the expected increase of inflation as a further weakening of CAD.

Weaknesses of USDCAD, strengths of CAD:

- My interpretation from the 8th of March communication of the Central Bank is that a rate hike at next month’s meeting (18 April) is highly expected

Watch:

- Wednesday’s OPEC meeting

- Wednesday’s (15:30 GMT) US Crude oil inventories release

AUD

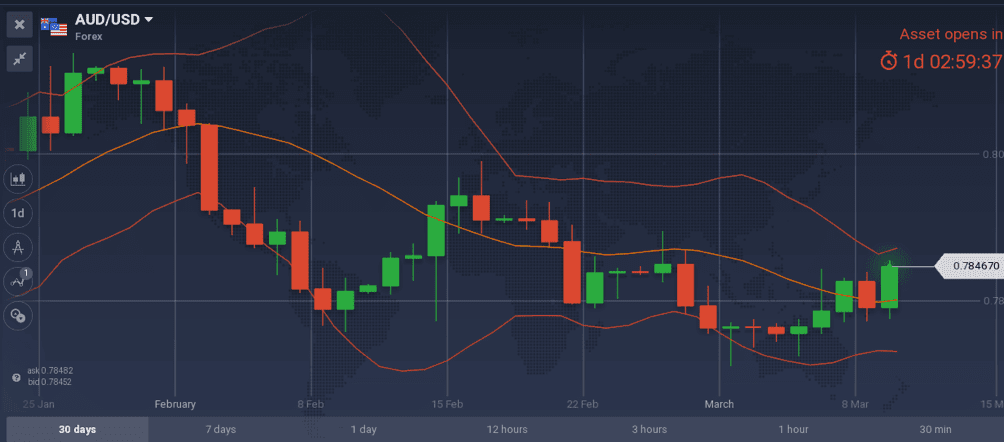

I believe that AUDUSD downtrend is well defined and that the current re-testing of 0.7810-0.7850 level is an opportunity to add short positions.

Last weeks monetary decision and communication were as anticipated, and did not change my views for a continuing waiting stance that could only be changed from a significant wage increase. Next release on Australian wages expected on the 16th of May. Note that markets are expecting the first rate hike no earlier than the first half of 2019.

Snapshot:

- Central bank ‘s interest rate is at 1.50% with no hike yet in this cycle.

- Inflation at 1.9% (vs 2.0~3.0% target), Unemployment at 5.5% and expected to decline

- GDP latest reading at 2.4% growth (2.8% was 2017 reading)

Strengths:

- The 0.7880 or even 0.7900 level could well be reached but again I treat them as opportunities to build further my short position aiming to 0.7640 level

- Increased trade balance

Weaknesses:

- Latest declined GDP reading

- Terms of trade are expected to decline

Watch:

- Early Wednesday’s releases (2:00GMT) regarding China’s Industrial production and Retail Sales. Any reading that is lower than the previous releases are favouring my scenario for weakening AUDUSD.

USD

My understanding for 2018 is that USD will eventually rise as economy is getting stronger and as bond yields are increasing. I am maintaining that view. On the other hand, Trump’s tariffs make things complicated. If I price them on face value, I should get rid of my long USD bias. Yet, how you can price on face value a communication like the one at the beginning of this report, where Trump is typing “one billion USD trade deficit with China” and could well mean another order of magnitude number?

My long call on USDCHF proved correct, but one should have opened his position 10 pips higher than the 0.9340-20 level I was advising.

Snapshot:

- US economy is growing at a healthy rate of 2.5%, unemployment is at 4.1% (Friday’s net 313K new jobs was a pleasant suprise), the biggest tax reform is already a reality and PCE (the inflation reading watched by the FED) is at 1.7%

- We are counting 5 hikes of 25bps since Dec ’15, resulting to a current FED rate of 1.50% which Ι expect to reach the peak of 2.75% ~3.00% in this cycle. 10Y Goverment Bonds are yielding above 2.84%.

Strengths of USD:

- 2nd reading of unit labour cost released last week (2.5% growth) shows that inflationary pressures are even bigger. Remember that the 1st reading of this release (2.0% vs 0.2% expected) triggered the February’s equity sell off.

Weaknesses of USD:

- Trumps tariffs drama and the breaking news it produces.

Watch:

- Monday’s 6.00GMT Goverment Budget reading.Any number above -40B is within my scenario.

- Wednesday’s 17.00GMT 10yGoverment Auction. I want to see an increasing yield to strenghen my scenario in favour of USD.

- Friday’s 14.00GMT 1st reading of cunsumer’s inflation expectations. A significant increase from last 2.7% reading is what I want to see.

- Next FOMC meeting is scheduled for the 21st of March and I am expecting the first rate hike for the year

EUR

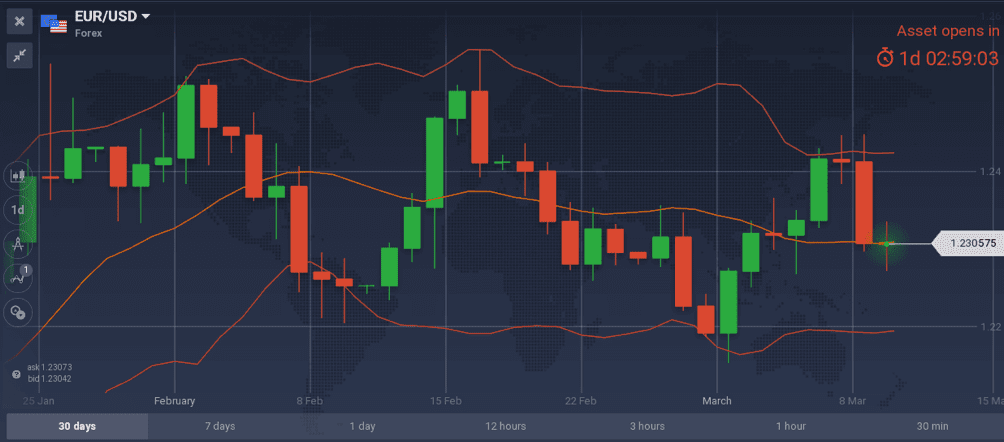

Last week I was wrong on the initial reaction of EURUSD to the Italian Elections. The pair has indeed opened with a gap that indeed closed within Monday, but the gap had an up direction, not a down one. My call for EURUSD weakening following ECB communication was totally correct.

I am maintaining my short bias on EURUSD.

Snapshot:

- European’s Economy is doing well. Actual GDP growth at 2.4% but the rosy picture seems to have already been priced at the 1.25 peak

Strengths of EURUSD:

- Any new episode of the US tariff drama strengthens the pair

Weaknesses:

- Decreased European current account, economic sentiment and PMI readings have found their ceiling, double top formation at the 1.2500 level.

- The result of Italian elections is a source of uncertainty

Watch:

- Tuesday’s 22.00GMT ZEW Economic Sentiment. My outlook is getting stronger if we see a decreased reading

GBP

The scenario in favour of a strengthening GBP is playing well. Last week’s PMI reading of 54.5 and the 30y Government Bond yield of 1.94% where above my thresholds. Yet, I am only willing to create a long position at GBPUSD at the much cheaper 1.3620 level.

Snapshot:

- 5% GDP growth, 4.4% unemployment and 3.00% inflation

- Note that UK is the only major economy that experiences higher inflation than the targeted 2%.

- Second rate hike on the 10th of May is probable.

Strengths:

- Macro announcements showing that the economy is strong

Weaknesses:

- Brexit negotiations and their outcome

Watch:

- 10y government bond auction on Thursday

- Next Monetary policy meeting on 22 March