Amazon shares plummeted on Monday, sending the stock market into a sell-off on the first day of trading for the second quarter of 2018. The market tumbled as U.S. President Donald Trump criticized Amazon for the third time in less than a week, accusing the company of not paying its fair share of taxes.

Investors fear new regulation

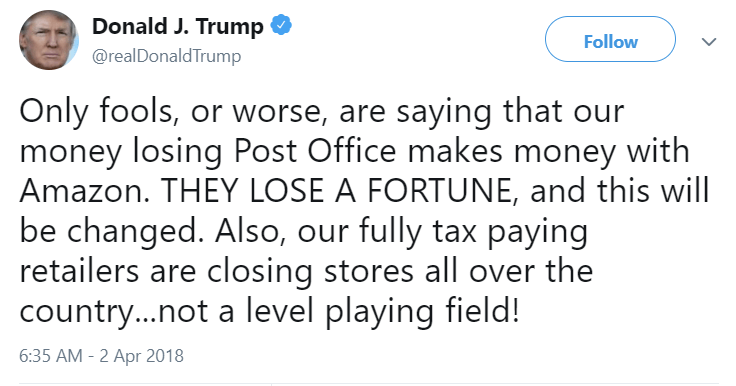

Trump’s mounting discontent with Amazon has been apparent over the last several years but now resurfaced in a series of tweets. On March 28, Trump tweeted about his concerns with Amazon, stating that the tech giant pays “little or no taxes to state & local government” and is taking advantage of the U.S. Postal System. The tweets were in response to a report from Axios, which wrote that Trump was “obsessed” with taking down Amazon. Trump blasted Amazon again a few days later, demanding that it pay “real” taxes.

The latest attack on Amazon came after a number of news outlets reported that, in actuality, the company has helped offset some of the Postal Service’s losses. According to Forbes, a decline in mail volume coupled with increasing numbers of retiring employees have caused the Postal Service to see less revenue than before. In his tweet, Trump rejected these arguments and implied regulation would be on its way in the near future.

Given that Amazon is one of the leaders in tech stock, a drastic change in regulation could impact the entire market. On the whole, Trump’s remarks on potential regulation has many investors approaching stock with caution.

Tech in trouble

Since Axios’ first report on March 28, Amazon has experienced a loss of $60 billion in market value. Overall, Monday was a brutal day for most tech stock. Following a Bloomberg report that Apple plans to switch to its own chips, Intel (INTC) plunged 6%. Tesla (TSLA) dropped by a little over 5% after the company announced a large recall regarding a bolt issue. Adding to Tesla’s troubles was an April Fool’s prank by Elon Musk, who jokingly tweeted that Tesla had gone bankrupt. Meanwhile, Facebook is still trying to recover losses caused by its recent data scandal involving Cambridge Analytica.

In addition to the current state of tech stock, investors are also concerned about a possible trade war between the U.S. and China due to increased tariffs. Considering all of the factors at play, the next few weeks will be major for Wall Street.