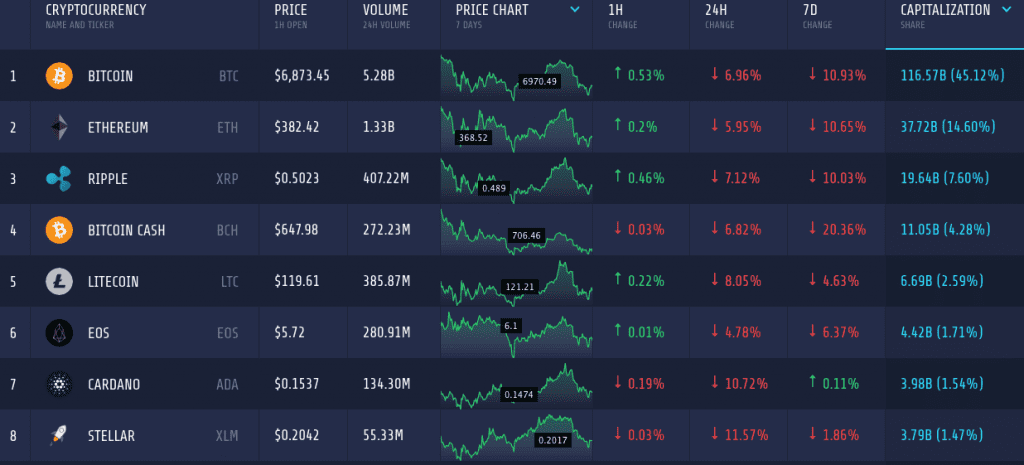

The notorious cryptocurrency market is again in a downturn again. It shed around $20 billion in last 24 hours as the total market cap went down to $257 billion. Almost all the coins have turned red and some are even shedding in double digits. Lack of trust among the traders due to the US regulatory chaos is one of the leading reason for this bear.

Stellar

Stellar one of the coins which gained massive popularity lately. To the investors, the coin returned an excellent amount for their investments. However, in the last 24 hours, the coin took a massive downturn with a depreciation of 11.5 percent. But due to the dominance of the bull on the weekly chart, the week-on-week loss is less than 2 percent. It holds $3.7 billion in market cap and is the 8th largest coin in the market, in terms of market cap.

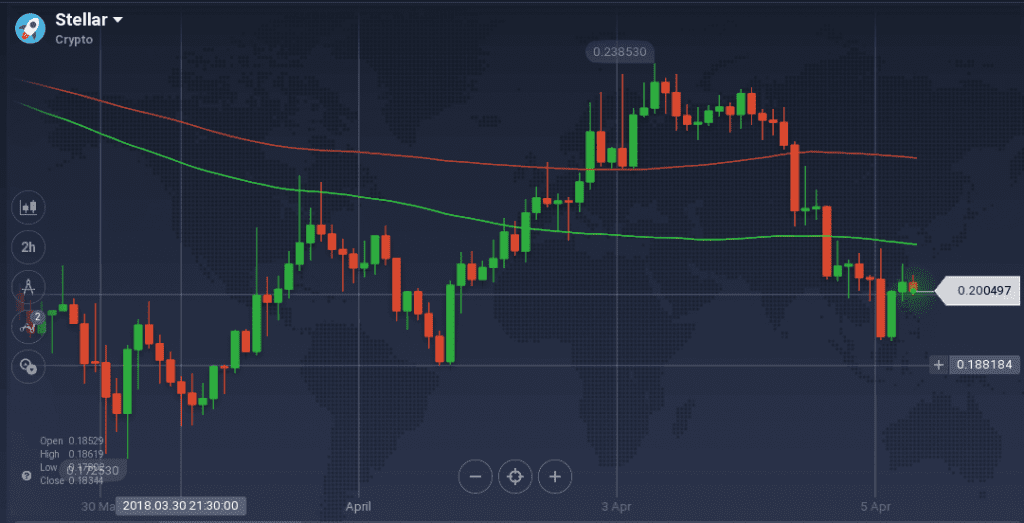

After a drop in the value to $0.177, XLM rebounded, and with two consecutive upward rallies, it touched $0.238. Resistance at $0.214 resulted in a pullback as the coin went down to $0.188. But it pivoted in no time to reach its weekly peak. The coin, however, is facing a massive pullback from the peak and the dominating bear in the market made the downward force even stronger. In around 24 hours, the coin dipped to $0.192 and is currently looking for any support to stop the constant loss.

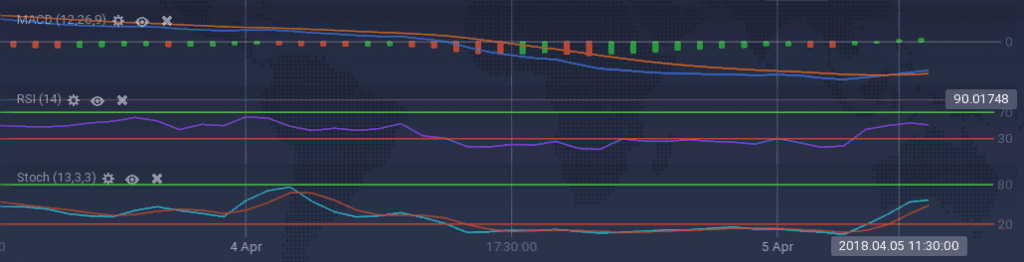

As the coin has found some support around $0.192 and trying to push its way to recovery, the technical indicators are going bullish. The oscillators – Stoch and RSI – have rebounded from the overbuying region it is on their way upward. RSI is maintaining a value around 55 percent. Similarly, MACD and ADX are also showing bullish signs, which might lead to a recovery of the coin.

Tron

Tron is an outlier in a bearish market. When most of the coins are shedding, TRX manages to gain in past 24 hours. However, this came after a long bearish week for the coin. Despite the gain of above 11 percent on the daily chart, TRX depreciated by 20.6 percent on the 7-day chart. Though the coin only captures 0.95 percent with its $2.4 billion market cap, the coin registered a trading volume of $329 million in last 24 hours – an impressive ratio of trading volume to market cap.

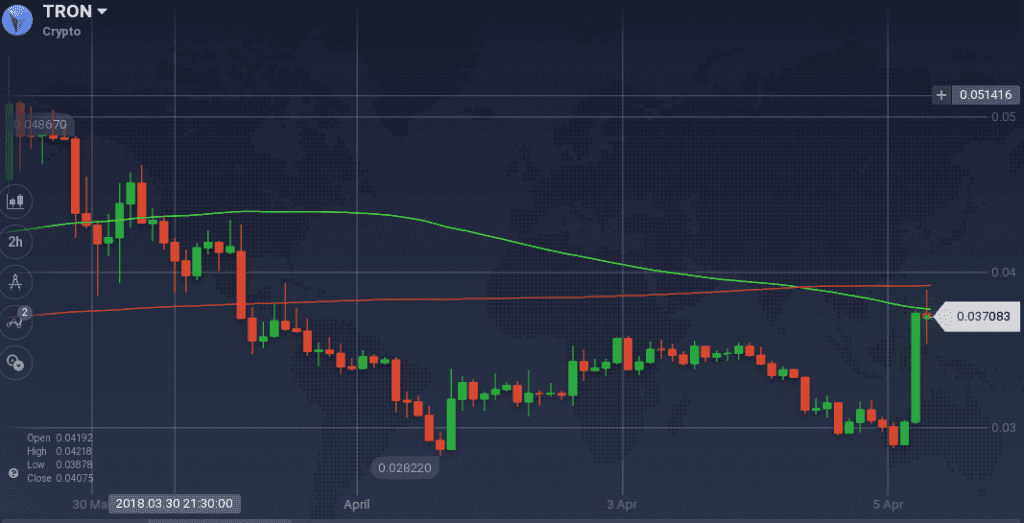

With a massive downturn in the initial sessions in the week, TRX went down from $0.049 to as low as $0.028 – a loss of 43 percent. However, in the mid-session, the coin tried to recover by adding some value to it, but was greeted with multiple resistance levels at $0.033 and $0.035. As the bear clutched the market recently, TRX too followed the mass and went down to $0.028, however, with a sudden rage among the buyers, the coin’s value shot above $0.037, where, currently, it is facing some resistance.

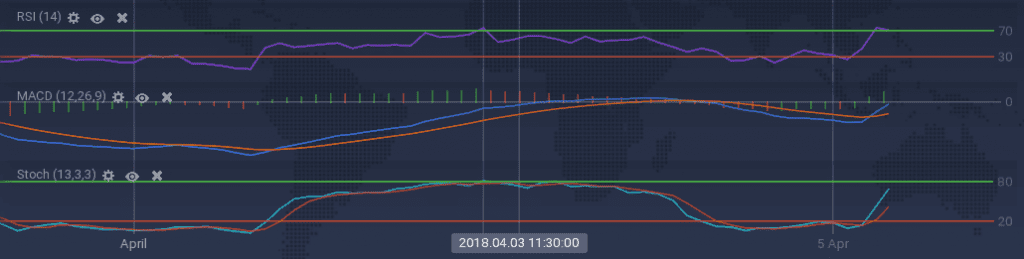

Due to the sudden rise of the coin, the indicators also reversed from a bearish momentum with a steep up boost. Being at 74 percent, RSI has even crossed the overbuying region. However, Stoch is still a bit lenient. Other indicators like MACD are also telling the same narrative.

Market Update

Australia’s new legislative guidelines for the operation of cryptocurrency exchanges were introduced on the 3rd of April 2018. From now on, Australian digital currency exchange businesses will be required to register and comply with anti-money laundering/counter-terrorism financing (AML/CTF) laws.

Okex has made another announcement regarding its decision to roll back futures contracts after clients were hurt by massive liquidations. The company apologized again for the inconvenience, tried to address rumors regarding the incident and threatened to sue anyone spreading them.

Conclusion

The crypto market has never faced a bearish phase of this scale. For a while now, a little recovery in the market value is followed by a massive bear. But the external factors which are driving this madness are prominent and soon will be solved.