The great amount of trading instruments provided on the platform may seem confusing, especially in the very beginning, when you are trying to figure out how to start trading. But once you know the principle of trading on each instrument, it will become clearer for you. One important thing that differentiates trading instruments is their expiration time. Let’s see what the difference is and how it influences the trading process on various instruments.

Trading with expiration time

The expiration time can be found on FX Options. It is the period between buying the option contract (opening a deal) until it closes. The expiration time can vary, for instance, the expiration time for FX Options is 1 hour.

The main idea of trading with expirations is to trade shorter timeframes and get a payout percentage, based on the investment amount. FX Options also have the strike price which determines the outcome of the deal. The more time there is left until expiration, the more time there is for the asset to reach the strike price and go beyond it. To trade such instruments, you need to choose the investment amount, strike price and choose the direction — Higher or Lower. Note that there is no Stop Loss for instruments with expiration — the deal will close at the time of expiration.

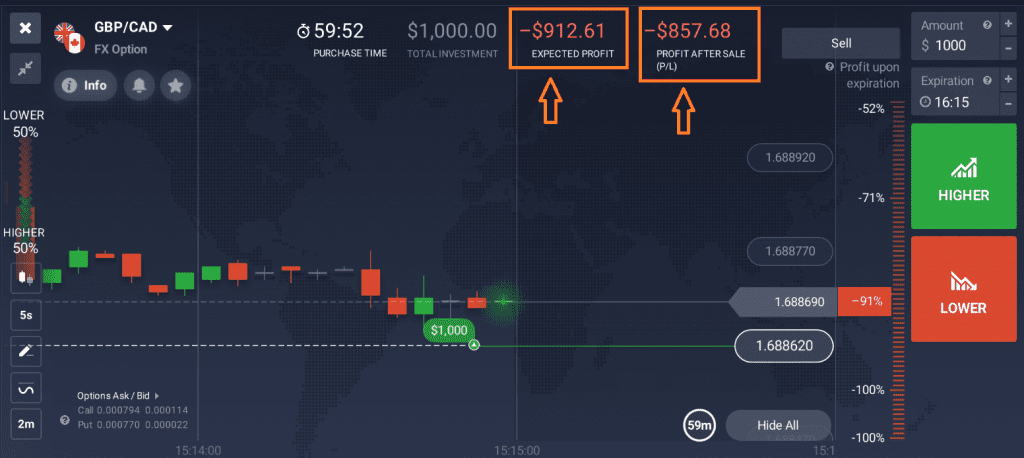

Assets with an expiration time also have the buyback feature — possibility to close the deal before the expiration time. If for some reason you do not want to wait until the expiration, you may use this option. You will see a Sell button and two profit numbers written next to it.

Expected profit is the current expected outcome of the deal, if it closes at expiration time.

Profit after sale is the outcome of the deal if it is closed with the use of the Sell button.

Once you click the Sell button, the deal will close and there is no way of reopening it again.

Trading without expiration time

The assets that are traded without expiration are Forex and CFDs on Crypto, Stocks, Commodities, Indices and ETFs. To trade these instruments, you need to choose the investment amount, leverage, set the Stop Loss and Take Profit levels and make a prediction about the direction of the price movement— upwards (Buy) or downwards (Sell).

Depending on your strategy, you may leave your deal open for as long as you prefer. You can always check the current profit or loss on the screen, it is specified both in a percentage and in the currency of your account (for instance, USD). Once you decide to close the deal, you may click Close.

Note that there is no fixed payout on such instruments. It means that the payout will depend on the investment amount, multiplier and asset price.

As you may see, trading with and without expiration differs. Each style of trading has its benefits but also has its disadvantages so you could try both of them to see what you prefer.