The world of trading never stays the same, as financial markets are constantly being affected by different factors. Some of these factors are hard to predict, as they happen unexpectedly. Others might be easier to anticipate because they follow a certain cycle or seasonal changes. The latter include popular holidays that may influence some assets and provide potential trading opportunities. It is especially true of the end-of-year events that last nearly a whole month, starting from Black Friday in November and finishing with the New Year celebrations.

In this article, we’ll take a look at the key players of the upcoming holiday season rally. Keep reading to learn about the potential market occurrences during the next few months and 3 factors you may consider when trading on Black Friday and the rest of the holiday season this year.

Trading on Black Friday and around New Year: Key assets

Holidays often start with increased spending, as people do their shopping for the upcoming Christmas and New Year. Global online sales during the holiday season in 2023 reached $1.17 trillion. This means a rise in revenue and stock growth for many businesses during this period. Some traders may consider the holiday season rally as an opportunity to expand their portfolios and look for new trading opportunities.

Let’s have a look at 3 types of businesses that may be worth special consideration when searching for Black Friday trading opportunities and ideas for trading around the New Year.

1. Retail companies

The holiday season often involves shopping as people buy presents for their friends and family. This all starts with Black Friday, which is traditionally the day after Thanksgiving. Black Friday is often considered one of the most profitable periods for retail companies, positively affecting their revenues and stock prices.

It’s not difficult to guess which companies are most likely to profit from the upcoming holiday-related spending. Here are just some of the sectors that may be especially active when trading on Black Friday 2024 and during the rest of the season.

- Fashion and beauty: L’Oreal, LVMH, Adidas, etc.

- Electronics: Apple, Microsoft, etc.

- Automotive: Volkswagen, BMW, Ford, etc.

- Large retail chains: Walmart, Best Buy, Costco, etc.

- E-commerce: eBay, Shopify, Etsy, and more.

2. BNPL (Buy now, pay later)

With the cost of living constantly increasing in many countries, Buy now, pay later (BNPL) services are attracting more and more clients. BNPL allows people to buy goods without paying the full price right away. Instead, they make a small payment during the purchase and then pay off the rest in parts over a period of time, usually without any interest or fees. Many retail companies offer BNPL as a payment method, as it helps attract more customers and increase spending.

PayPal launched its BNPL services back in 2020 and has since become one of the industry leaders, so its stock may be one of the assets that are worth a look this holiday season.

3. The supply chain

With electronics being one of the most popular types of products during the seasonal sales, it’s important to bear in mind their production cycle. It all begins with chips and other components that are essential for the manufacturing of laptops, smartphones and other electronic devices. Some of the stocks that represent this sector are Qualcomm, Micron, Nvidia and AMD.

Keep in mind that while stocks from this sector tend to perform better during certain periods, there may be other factors affecting specific stocks. So it is important to check other factors that might affect a stock’s performance. For instance, corporate earnings reports often include information that may be useful in analyzing a stock’s condition and its potential.

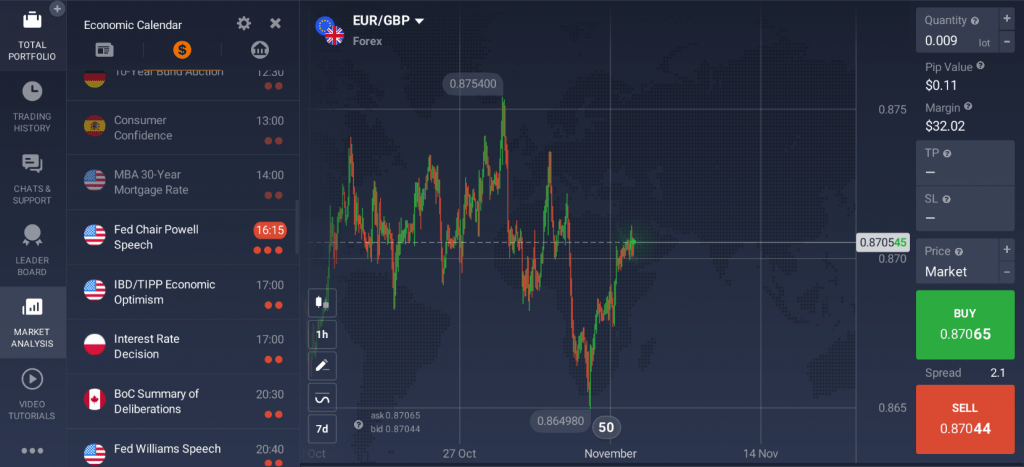

You may keep an eye out for any news related to these companies to stay informed and act according to your trading approach in the event of sudden changes. You can track the most important financial news directly from the IQ Option platform. Just go to the ‘Market Analysis’ section of the traderoom and stay on top of market trends.

Trading during Black Friday and the holiday season: 3 factors to consider

There are a few key factors traders should keep in mind when choosing assets for trading on Black Friday 2024 and the rest of the holiday season. Let’s break down the top 3 things you might find most useful.

1. Be aware of volatility

Volatility during the holiday season trading is one factor that should not be overlooked. This is usually the period of lower trading volume, which often leads to wider spreads and significant price fluctuations. Technical indicators that measure volatility, such as the ATR, might come in especially useful during this period. Check out this article to learn how to apply it in your trading: Trading with ATR (Average True Range) — Unique Volatility Indicator.

2. Consider the timing

Choosing the best possible time to trade is always important, but it becomes even more critical around the holidays. One thing you may want to pay special attention to is the trading schedule. Be sure to check the market hours for specific assets. For instance, US stocks don’t trade on Thanksgiving Day, while other assets might close earlier than usual. Another example is Black Friday, which is a half day for the stock exchanges.

3. Assess the trading volume

Normally, trading volume tends to decrease around the middle of December and stay low until the New Year. However, there is also a phenomenon called “the holiday effect”. According to it, the day before a holiday there might be an increase in trading volume, which might offer potential trading opportunities. Still, keep in mind that trading activity and asset prices might also be affected by other factors unrelated to seasonal fluctuations and therefore, there is no guarantee on the performance of the assets.

The bottom line

Trading during Black Friday and the holiday season has its pros and cons, so it’s important to consider them before entering the market. Learning about the main sectors that might be influenced by the pre-holiday spending rush may be helpful in finding potential trading opportunities. It might also be a good idea to bear in mind the main factors that can affect trading on Black Friday and the rest of the holiday season, such as volatility, timing and trading volume.