Every trading method has its pros and cons. So it may often be a good idea to test different approaches to find the most suitable one for you. For instance, some traders don’t have the time and patience to apply several technical analysis tools and look for potential indications. Instead, they may consider turning to the Moving Average bounce approach, which involves just one indicator to monitor the CFD asset price.

How does the Moving Average bounce work?

This approach goes beyond short-term highs and lows to determine the overall direction of the trend. It monitors the “bounces” to find potential trading opportunities as the asset price moves back and forth in the direction of the trend. By applying this approach, traders may track certain activity on the chart. Once the price moves away from the moving average line, reverses, and then bounces, they may consider entering a trade.

Let’s look at it more in depth to understand how it works.

Asset prices naturally fluctuate up and down throughout the day (or over a longer period of time). However, these fluctuations usually remain within a certain range, resulting in an overall upward or downward trend.

The Moving Average bounce works both for long (“Buy”) and short (”Sell”) deals. It uses an exponential moving average that gives more weight to recent price movements. This might allow a trader to track where the price is moving. And potentially point to a moment when the price jumps, colliding with the Moving Average line.

☝️

While this method is widely used by many traders, both novice and experienced, it does not give a guarantee of a perfect indication. To become better acquainted with this approach, let’s have a look at its setup.

How to set up the Moving Average bounce?

This method is based on a specific setting of the exponential MA. Using a moving average may eliminate short-term fluctuations in the chart and show the overall direction of the trend. This means that this method may be used on any asset, such as CFDs on Forex, Stocks, or Commodities.

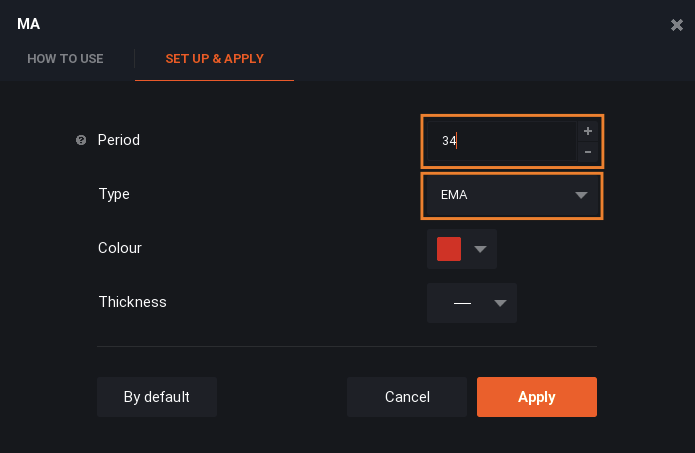

To set it up, find the Moving Average indicator in the indicator list on the IQ Option platform. Make sure to pick the EMA type and change the period of the indicator to 34. Traders may change the settings of the indicator in accordance to their personal preference and trading plan. Generally, the higher the period of the indicator, the smoother the line will be, and vice versa.

The candle time period on the chart may be at 1–5 minutes. Short timeframes may allow traders to apply this method several times during the day if they choose to do so.

How to apply the Moving Average bounce in trading?

Before going into the details, it is important to highlight that, as with any indicator, divergences may occur and this method may not work 100% correctly every time. This means that having a strong risk-management plan (for example, setting stop-loss and take-profit levels) is crucial.

To use this method, traders may look for a sequence of indications for a potential entry opportunity.

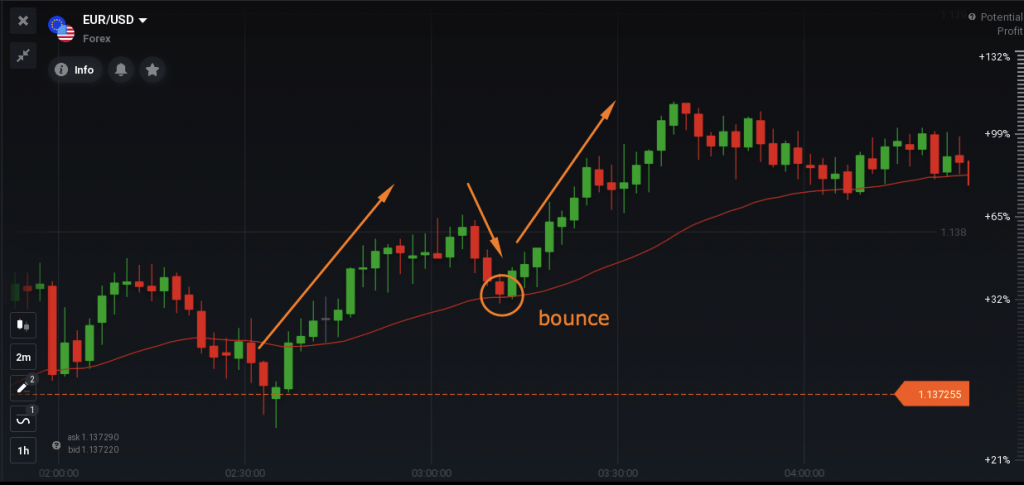

A long deal (possible “Buy” indication)

- The price chart is trending in an upward direction, moving further away from the exponential moving average.

- The price then reverses, moving down toward the indicator line and touches it, or plunges slightly below it.

- After the following candlestick fails to make a lower low and the price breaks through the indicator upwards, it may be considered a potential indication for an entry.

As an example, have a look at the chart below. The chart moves upwards, then reverses and touches the indicator, bouncing back in the same direction. Some traders may consider the moment of the bounce as a potential opportunity to enter a long deal.

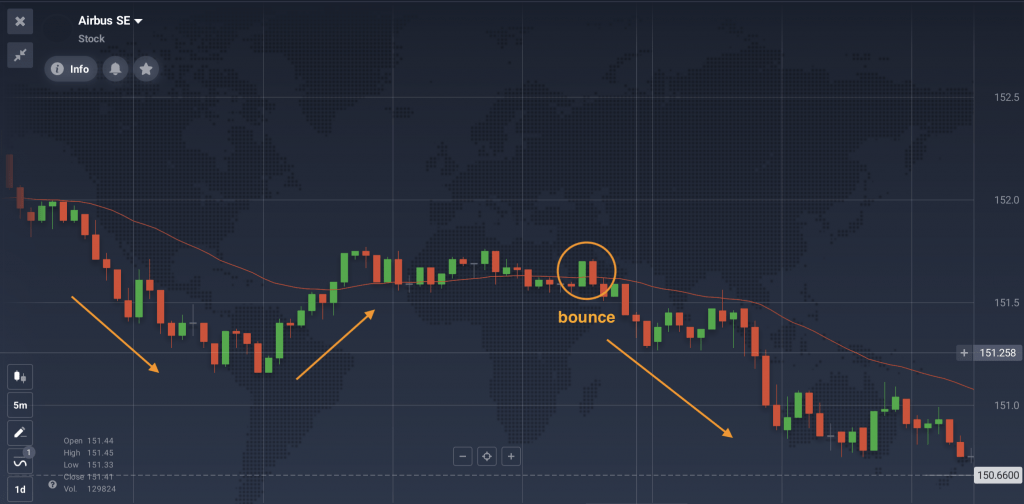

A short deal (possible “Sell” indication)

- The price chart is trending downwards, moving further down and away from the indicator line.

- The chart reverses, making higher highs and touches the moving average, or goes slightly beyond it.

- After the following candlestick fails to make a higher high, the price reverses and breaks through the indicator downwards, continuing the downtrend. This may be a potential indication for a possible trade entry.

In the example below, the chart shows the moment when the chart is bouncing off the moving average downwards.

As specified above, the candlestick timeframe within the Moving Average bounce approach may be set at 1 to 5 minutes. This makes this method potentially suitable for short-term trades. It might also be applied with other short-term trading approaches, such as the Stochastic.

However, there is no 100% guarantee that the indications are correct, so you should always act based on your trading approach.

The bottom line

The Moving Average bounce method is popular among traders who prefer working with short timeframes and look for potential indications of the trend. This approach looks at the highs and lows of price action to create an average trend line for price movement. This may help traders catch possible rebounds against the indicator line. Still, as with any trading method, it may be more effective to apply this approach with appropriate risk-management tools for optimal money management.