What makes a strategy effective? A good balance of knowledge, practice and risk management, experienced traders would say. To get there, it is important to remember about several components that can make or break one’s trading approach. Here are the four essential steps that every trader may consider before investing funds.

Pick your assets

To a novice trader, the amount of different assets to trade can be overwhelming. It is understandable: there are many options out there and deciding on the right asset can be complicated. You may pick the assets to trade like you pick your vegetables: inspect them closely and only choose the best ones.

But how to decide if the asset is good to trade or not? Well, of course, it is subjective: every trader has their preferred instruments, some like to trade stocks, some prefer crypto or any other available instrument. It mostly depends on the trader’s preference. But generally, experienced traders, for example, tend to look for the assets that are moderately volatile (too much volatility can be risky, while no volatility makes it hard to trade). Fundamental analysis also helps to answer the question of how to choose the assets for trading.

Fundamental analysis

Paying attention to the fundamental factors and economic news may be the basis for an effective trading strategy. Major economic events are the ones that create massive price swings, so following the news may result in good opportunities. However, traders need to be attentive as the news influences the market extremely quickly and the price swing may be over by the moment when the trader decides to act on it.

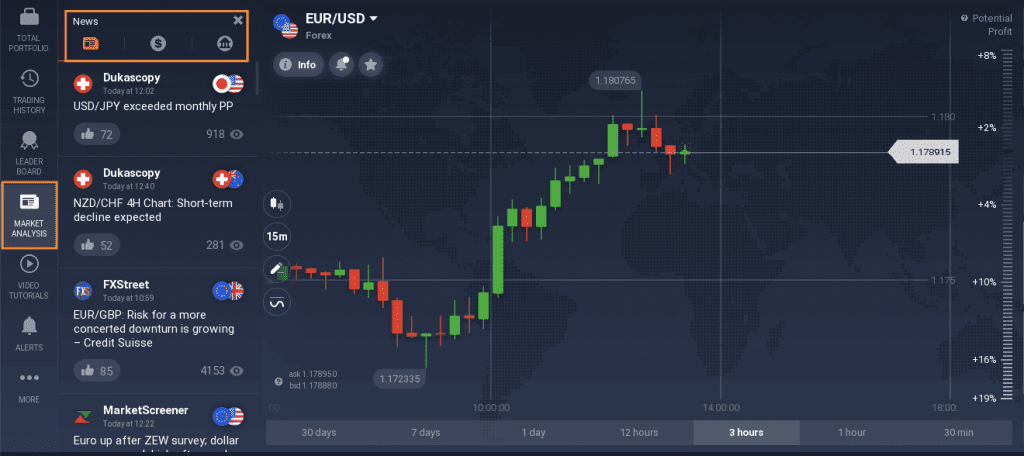

A convenient way to follow the news regarding certain assets is the Market analysis tab on the platform. It offers insights on Forex pairs, cryptos as well as stocks. Moreover, it shows the biggest changes within a day and gives further information about well-performing assets.

This tab not only displays the news, but also explains how they influence the currency pair or stock, so that even novice traders could use it to their benefit. The Market analysis tab is a good way to learn about how the economic events reflect on the trading charts. The fundamental method doesn’t have to become one’s strategy, but they need to be aware of it and know how to utilize such an approach.

Technical analysis

Another way of analyzing the situation on the price charts is using indicators. With indicators, the focus is shifted from the future to the past events that had already taken place and changed the asset price in a certain way. Based on this evaluation of the past performance, a trader may make up their mind regarding future price development. Traders that favor technical analysis believe that price fluctuations are not random and try to find certain patterns and trends with the help of indicators. However, past performance is not always an indicator of future performance.

To start applying indicators, one may check out the Popular section of indicators on the platform. Each indicator from this list has a description and a lot of them include a video that explains the indicator’s purpose.

Risk management

No matter what trading approach one may be using: there is never a 100% strategy that works perfectly well every time. Trading is complicated and it should be treated so. An experienced trader, for example, is one that is not risking their whole capital: reducing the investment reduces the possible loss amount. Other risk management techniques involve market assessment, emotional and psychological control, prepared trading plan as well as such technical features as a stop-loss level. Implementing risk management is probably the most important step that any trader may take to improve their trading outcomes.

Conclusion

It is clear that in trading, as in many other fields, there are several crucial basic concepts. Each trader should spend time learning about them in order to possibly improve their trading habits.