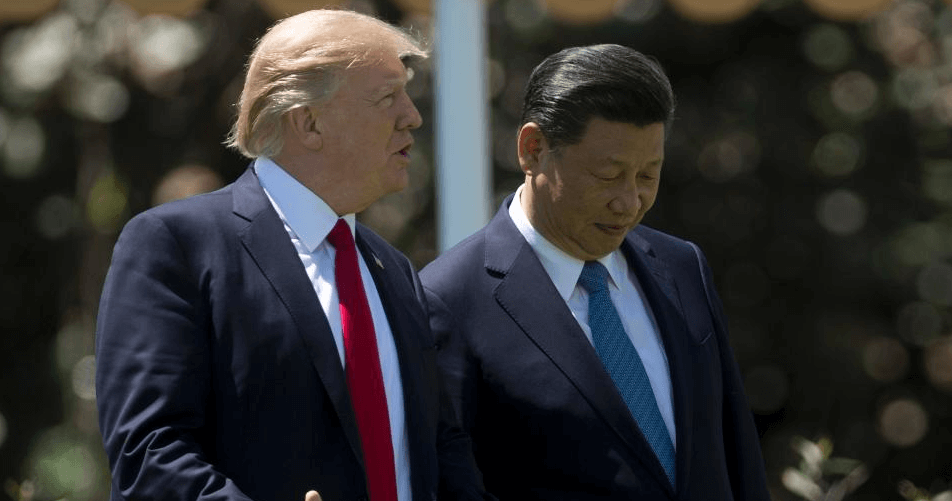

Just as it seemed a global trade war was all, but inevitable Chinese Leader Xi Jinping announced China would back off the rhetoric and begin acting to open its economy to the world. The news came as a welcome surprise early in the Tuesday trading session and helped lift global indices.

In an address to the Boao Forum, an event hailed as the Asian Davos, President Xi pledged to significantly reduce tariffs on autos, decreasing duties on a wide range of other products, enforcing intellectual property on foreign products, taking steps to protect the intellectual property of Chinese businesses and improving conditions for foreign businesses operating in China; all issues targeted by US President Donald Trump.

In addition to easing economic barriers Xi has also pledged to “work hard” on improving imports and specifically items needed by the Chinese people. He did go on to say that other global powers, no names were used, would also need to stop using unfair trade practices targeting technology coming from China.

While still a long way from smoothing out all trade related tensions the news is a step in the right direction. Not only does it take China down a path that will improve global relations it will also help boost global economics and support equity prices.

“China does not seek trade surplus. We have a genuine desire to increase imports and achieve greater balance of international payments under the current account,” Xi said. We must all “stay committed to openness, connectivity and mutual benefits, build an open global economy, and reinforce cooperation within the G-20, APEC and other multilateral frameworks. We should promote trade and investment liberalization and facilitation, support the multilateral trading system. This way, we will make economic globalization, more open, inclusive, balanced and beneficial to all.”

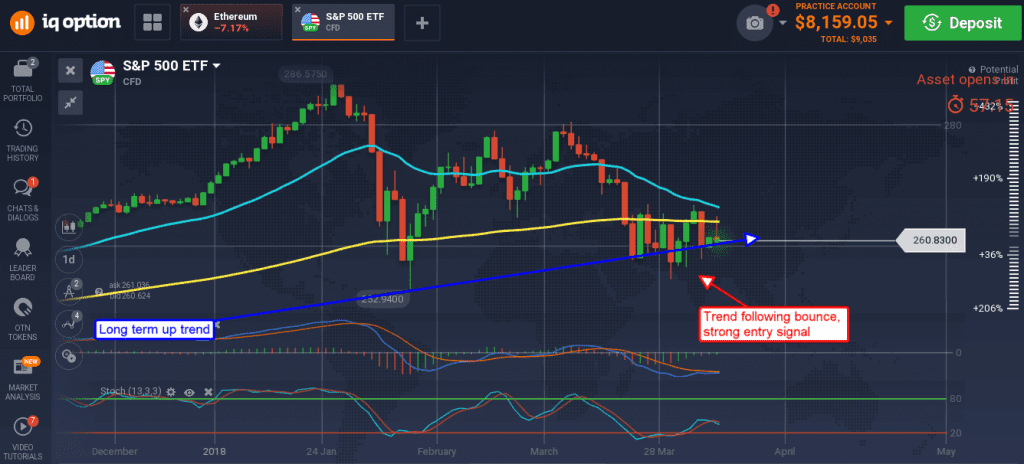

Global stock indices surged on the news with the Hong Kong based Heng Seng index gaining more than 1.5%. European indices followed suit, but trading was more subdued as market participants waited on remarks from the US president. Futures trading in the US was euphoric sending the broad market S&P 500 up more than 350 points, a move that confirms support at a major uptrend line.

Traders are advised to go long global equities with an expectation for significant gains in the next few weeks. The global indices have been in a correction driven by trade war fears that are now evaporating. With trade war fears falling to the wayside traders can now focus on fundamentals, fundamentals which are now expected to improve on the back of increased openness in China.