Over the past 2.5 months, stocks, major currencies, and cryptocurrencies, have exhibited a high level of price volatility. This scenario presents both opportunities, and risks, for investors, as they plot their next moves.

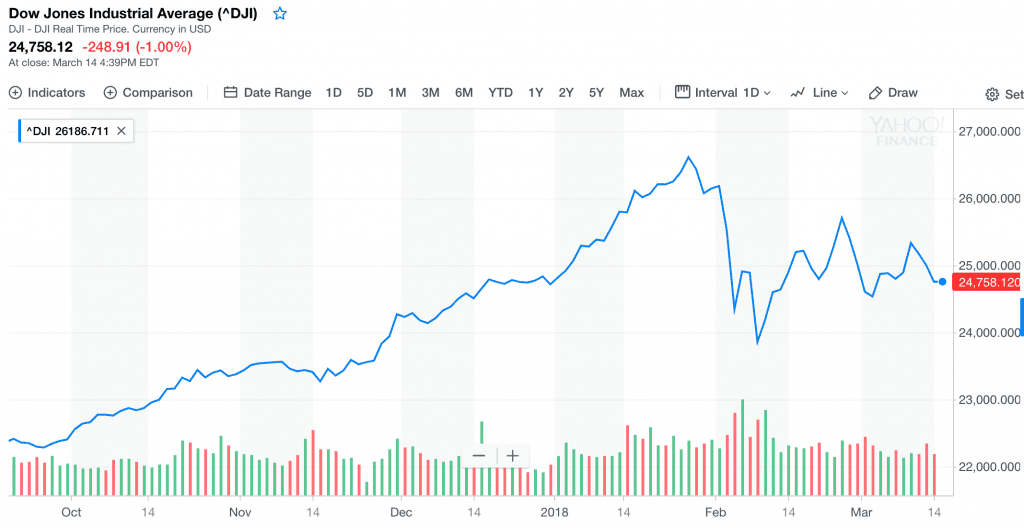

Stock Markets Slide, Rebound, and Slide Again

The following chart shows the Dow Jones Industrial Average’s (DJIA) slide, which began in mid-January. It was followed by a recovery, and another slide. Most major stock markets have paralleled this trend.

Dollar Falls, Then Rises and Falls, Twice

The next chart displays the U.S. Dollar Index (DXY), falling from mid-December. It then rose, and fell again, twice.

Cryptocurrencies Buckle, Then Recover

The ensuing chart traces the fall in Bitcoin’s price, from mid-December. It then changed course, and has been rising since early February. Most of the principal cryptocurrencies have been in line with this trend.

High Volatility Diminishes Fundamentals, Prizes Momentum

When investors seek to exploit the short-term price movements of highly volatile assets, the role played by these assets’ fundamentals is greatly diminished. Assets’ fair market value takes a back seat to the behavioural effects of market psychology.

The question for investors gravitates towards how to position themselves to take advantage of rapid steep changes in assets’ prices. The answer lies in momentum investing, and the need for investors to set themselves position size and limits, and then be disciplined about respecting them.

Momentum Investing as Strategy, Sequential Positions as Method

An investor can carry out a momentum investment strategy most effectively by setting up sequential positions, instead of a single position. The aim is to take advantage of either upward, or downward, movements, in a given asset’s price, while minimising risk.

In sequential positions, the first, and largest, should be placed to exploit price movements closest to a given asset’s current price. The remaining positions should be smaller, as they are riskier, farther removed from the asset’s current price, and subject to the inevitable price reversals that take place when momentum fades.

Bells & Whistles: Options

Options can be an additional component of the momentum investment strategy. Employing these financial instruments, an investor can protect himself or herself against abrupt turns in an asset’s price.

If options are not employed as hedging instruments, an investor must be very strict about selling out when a position sustains losses. Selling out of a given position at a predetermined price should be seen as a normal part of the investment strategy, an essential discipline to keep losses from blowing it apart.

Trading Volumes Forecast Price Inflection

The volume recently traded in a given asset is an important signal to consider in any momentum investment strategy. High volumes are an indication that market participants have executed their desired trades, and that a price inflection point may not be long in coming.

A forecast price inflection point affords excellent timing for the establishment of a new investment position. Conversely, it also offers good timing to exit an established position.

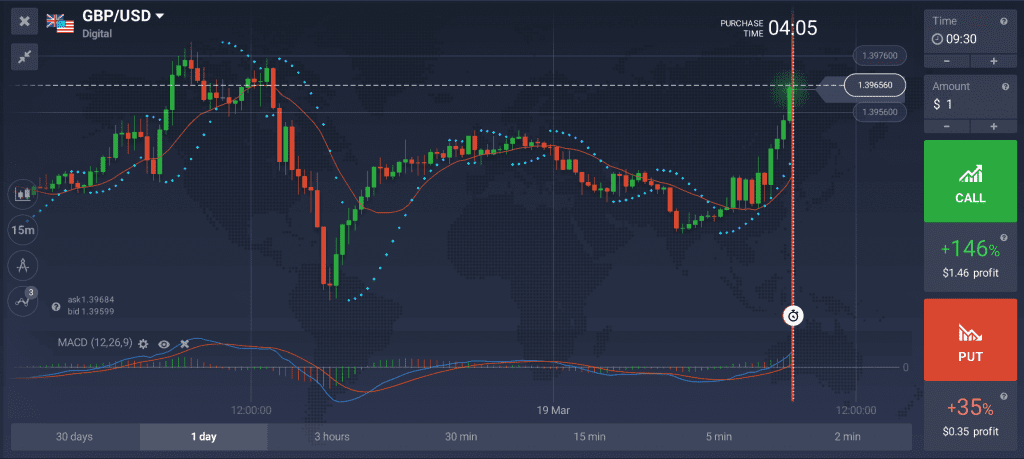

Technical Indicators Predict, Alert, or Confirm

Technical indicators are critical tools for the momentum investor. Technical indicators serve to predict price movements, alert to the need to study prices closely, or confirm the results of other technical analysis tools.

Trade War Fears Will Enhance Volatility

President Donald J. Trump’s announcement, threatening 25% tariffs on U.S. steel imports, and 10% tariffs on aluminium imports, as well as his subsequent blocking of Broadcom’s acquisition of Qualcomm, will very likely be a source of additional global market volatility. They presage a trade war between the U.S., and both allies and rivals.

The European Union, wonderful countries who treat the U.S. very badly on trade, are complaining about the tariffs on Steel & Aluminum. If they drop their horrific barriers & tariffs on U.S. products going in, we will likewise drop ours. Big Deficit. If not, we Tax Cars etc. FAIR!

— Donald J. Trump (@realDonaldTrump) March 10, 2018

The most obvious plays lie in steel and aluminium company stocks, and in the currencies of the nations affected by the tariffs, as they jostle for exemptions. U.S. steel and aluminium stocks over the coming weeks, will be subject to a complex dance, rising and falling, on different dates, against the steel and aluminium stocks of other international producers. Steel stocks to monitor for trading include U.S. Steel, Nucor, ArcelorMittal, POSCO, Tenaris, and Ternium. Aluminium stocks to monitor include Alcoa, and Aluminium Corporation of China.

The stocks of companies that are important steel or aluminium purchasers, will also present opportunities to trade events. This includes producers of automobiles, airplanes, domestic appliances, structural steel, and cans.

The E.U. has already announced it will impose retaliatory tariffs on selected American products. This may put the stocks of American commodities conglomerates, such as ADM, into play, as well as the stock of Harley-Davidson motorcycles. The E.U. is also contemplating the imposition of an “internet tax”. Facebook’s and Google’s stocks may react.

The U.S. Dollar will almost certainly fluctuate as announcements are made. Major currencies to trade it against include the Euro, the Canadian Dollar and the Japanese Yen.

Clearly, the direct and knock-on effects of U.S. tariffs on steel and aluminium, including retaliatory tariffs, will range far and wide. Momentum investors should have plenty of opportunities to exploit. Sequential positions, coupled where appropriate with options, can provide the means. Trading volumes, and technical indicators, should be observed at all times.

As to cryptocurrencies, the next few weeks will allow traders to determine how linked they are, or are not, to the overall stock and major currency markets. To the extent that they are, high volatility should afford the same trading opportunities.

In the next 3 articles, we will explore investment opportunities in greater detail. These will focus on the stock, major currency, and cryptocurrency, markets.