As the AI revolution continues to gain momentum, traders may be interested to learn more about the most traded AI stocks. So let’s explore 4 top AI stocks to watch and try to assess their potential.

Microsoft Corporation (MSFT)

Founded in 1975, the Microsoft Corporation is now one of the largest and most influential global tech companies. Its stock price grew 43% this year alone, with over 230% growth over the last 5 years.

What Do We Know So Far?

Microsoft has been at the forefront of the AI revolution since 2019, when they invested $1 billion in OpenAI – the company behind the created of ChatGPT. In January 2023, Microsoft invested another $10 billion in OpenAI, proving their continued support of this technology.

Microsoft has recently launched the updated version of the search engine Bing that is now powered by AI. The company suggests that by combining language models like OpenAI’s GPT-4 with their search index, they can offer a better and more effective search experience. The results so far seem to support their claim: since this launch, the number of daily users for Bing has exceeded 100 million.

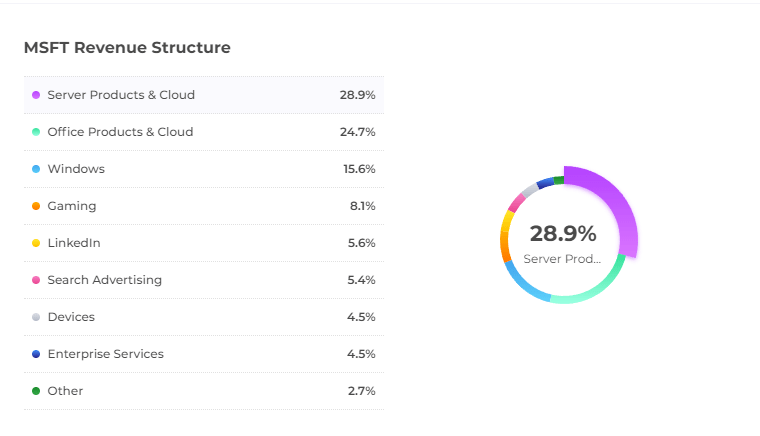

The company has an impressive portfolio of products covering different sectors. Here’s a breakdown of its main revenue streams, which may provide important insights into Microsoft’s business model.

What’s Next for Microsoft?

The company is planning to apply the AI-powered features to other products in their portfolio, such as Office, Edge browser and Azure (a cloud computing service). Considering Microsoft’s extended partnership with OpenAI, it may be considered one of the top AI stocks to watch.

It may sometimes be helpful to see how the stock market has changed over the years to identify potential patterns. You can check out the price fluctuations of the most traded AI stocks in the past few years in this video. Keep in mind that past performance isn’t an indicator of future performance, as there are many other factors that might affect the market at any given moment.

NVIDIA Corporation (NVDA)

Founded in 1993, the company started by producing graphics processing units (GRUs) for the gaming industry. They continue to be the flagship product for NVIDIA. However, their use has extended to many other fields, including engineering, construction, manufacturing, science and architecture.

The company is also making mobile processors used for phones and tablets, as well as applied in car navigation and entertainment systems. Apart from that, NVIDIA produces AI-powered software for audio and video processing.

What Do We Know So Far?

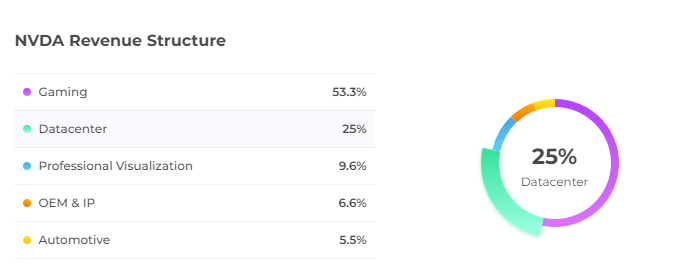

Having shown 195% growth so far this year, and a whooping 577% increase in the last 5 years, NVDA may be considered one of the most traded AI stocks out there. Here is an overview of the company’s revenue structure, which largely focuses on the gaming industry.

The company has recently introduced a new AI-powered solution for game developers. It’s called Nvidia Avatar Cloud Engine and its goal is to revolutionize game production. One of its features is using natural language models (similar to ChatGPT) in creating game characters. It’s supposed to make the dialogues with NPSs (non-playable characters) in games more engaging and realistic.

What’s Next for NVIDIA?

NVIDIA is working hard to stay on top of the AI game. In May 2023, the company announced a partnership with Microsoft to integrate its AI enterprise software into Microsoft’s Azure machine learning technology. This collaboration might help businesses to use AI in their work to boost productivity and efficiency.

The company is also working together with ServiceNow to develop an AI-based solution to improve business processes and help desk customer service.

NVIDIA’s ambitions go beyond maintaining its leadership in AI chip production, where it currently has over 80% market share. The company is planning to use AI across different industries, including self-driving vehicles. This definitely makes NVIDIA one of the top AI stocks to watch in the coming months.

Alphabet Inc. (GOOGL)

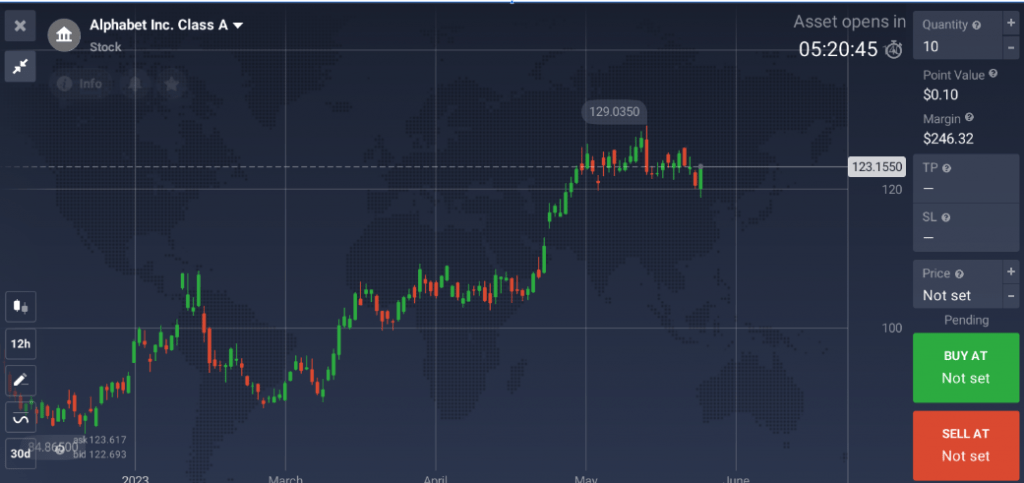

The parent company of Google, Alphabet may be considered one of the largest and most influential global tech companies. Its share price has climbed almost 40% so far this year, continuing its 115% growth over the last 5 years.

What Do We Know So Far?

Alphabet unveiled its own AI chatbot called Bard in February 2023, several months after the launch of ChatGPT. It’s powered by Google’s own advanced large language model (LLM) PaLM 2, different from the one used by the majority of other AI chatbots, such as ChatGPT and Bing. This model is supposed to improve the chatbot’s performance and efficiency.

Bard had a rough start, providing an inaccurate answer during the first demo video. However, it may have the potential for quick improvement, as it can look for information online and update its knowledge base with new content.

What’s Next for Alphabet?

The company is planning to integrate its generative AI to other products, including search engine, Google cloud, maps and Android devices. Considering that Google’s search engine market share amounts to about 93% (compared to around 2.7% for Bing), it may have some advantage at this stage.

The company is also looking to apply AI tools in its advertising business. This may help offer better conditions with more targeted ads, improved efficiency and higher returns both to advertisers and Alphabet itself.

Amazon.com, Inc. (AMZN)

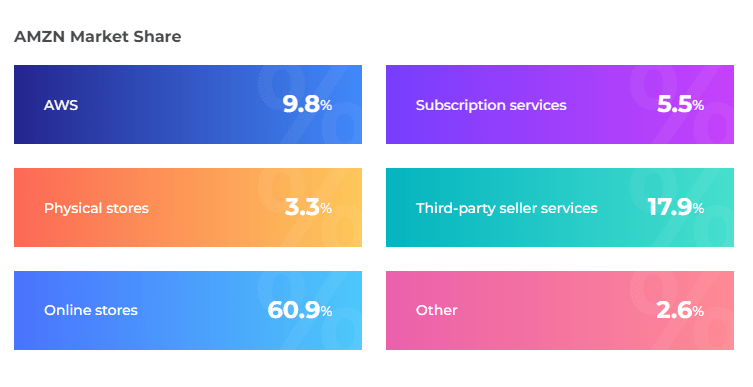

Amazon stock price has had its ups and downs in the past few years: from the dramatic growth during the pandemic in 2020 to a significant decrease through 2022. However, it seems to be gaining momentum: the stock price has increased 48% this year so far. Amazon maintains a large market share across several industries, making it one of the most traded AI stocks.

What Do We Know So Far?

Amazon hasn’t been at the forefront of the AI race, falling behind some of its competitors from the tech world. However, it may be catching up soon. The company has recently announced a $100 million investment in a Generative AI Innovation Center that is supposed to help companies and entrepreneurs apply AI tools in their businesses.

It has also introduced Bedrock – a service aimed at developers who want to build generative AI apps. They are offered the foundational models and tools on Amazon’s cloud computing platform. This makes building AI applications easier and faster – and brings more users to the Amazon platform.

What’s next for Amazon?

The company has been using some AI-powered tools in its online stores, creating targeted ads and personalized shopping suggestions for customers. It’s now testing a new feature in its shopping app that summarizes customer reviews for products. They may also introduce tools to generate photos and video materials that sellers can use to advertise their products on Amazon.

In Conclusion

As the AI race continues, other players may come up with more advanced solutions and new AI-powered tools. However, these 4 companies have already introduced their AI technologies, making their shares top AI stocks to watch. You may find these stocks and other popular assets traded via CFDs on the IQ Option platform.