Media giant Netflix (NYSE: NFLX) Stock reports Q1 2017 earnings today (17th April 2017). Let’s take a look at the 7 key factors to consider.

1) Price – Trigger watch

Netflix shares have had a great start to 2017 – gaining 8% YTD.* We have seen moderate price softening action into this quarter’s earnings announcement which indicates that the financial reports are likely to act as a trigger for the price movement into the next quarter.**

2) Financial Performance

Wall Street analysts forecast Q1 2017 earnings of 37 cents a share – which would be an impressive 6 fold YoY improvement from Q1 2016 EPS which was reported as 6 cents per share.

YoY growth in revenue is furthermore estimated at an impressive 34.9% level. The company posted a strong Q4 earnings report – beating Wall Street estimates substantially – which has created a surge in positive sentiment and momentum for the company over the last quarter and is feeding continued strength for the remainder of 2017.

3) Subscription Outlook

Subscription numbers are the key parameter for investors and stakeholders to watch – and is a leading indicator of the company’s future growth.

The number of subscriber additions has the power to send the share price flying higher if the numbers are strong and tumbling if we see subscription declines. Management has indicated total subscribers additions of 5.2 million for the quarter, of which 1.5million are from the US.

4) Geographic Expansion Plans

Netflix has generated growth from an expanding portfolio of original content. The company has announced strategic measures to focus on international expansion whilst contending with slower rates of US domestic subscription growth. In particular the company has plans to solidify a wider subscription base in the markets of India and Korea.

5) Product Enhancements

The company is continually adding enhanced features to maintain and grow the subscriber base. Features such as offline viewing and the ability of viewers to skip opening credits have led to enhancements in the Netflix user experience. These enhancements are a delicate balance that Netflix has managed well through 2016 – creating growth and value without costs spiraling beyond competitive levels.

However, these costs need to be managed carefully to continue achieving growth. In this sector it is easy for expenses to grow at an accelerating pace with the “arms race” taking place between Netflix and its key rivals of Amazon and YouTube (Google) to deliver the best media content and capture the dominant market share. The competition remains fierce.

6) Outperformance

Netflix shares have been outperforming the broadcasting sector throughout the course of H2 2016. This outperformance is predominantly attributed to the company’s continuing growth in subscriber numbers combined with an aggressive approach to expanding the portfolio of original content.

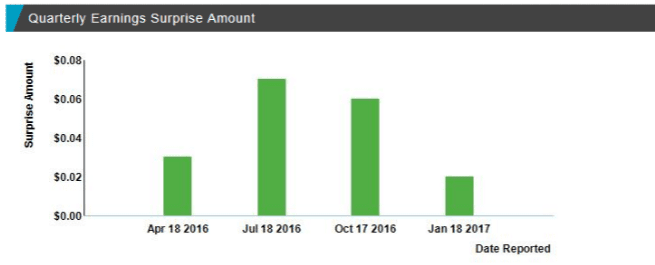

7) Earnings Surprises

Although the consensus forecast for EPS is 37 cents, given the track record of 2016 (of delivering consistent earnings surprises quarter on quarter), there are street expectations that the company could post an EPS of up to 40 cents a share.

Overall, the key figure to watch is subscription numbers. This will determine the fate of Netflix shares for the remainder of 2017 – especially given the fierce competition the internet media industry is currently experiencing.