Five most important news to start your day. These events are very likely to influence the market and trigger exchange rate fluctuations. Read to stay informed.

1) Apple Suppliers Fight for Orders

For a long time already, Taiwan Semiconductor Manufacturing Company and Samsung have been in a clash over Apple chips manufacturing. The jewel of the XXI century technology, chips offer tremendous business opportunities, as well as revenues. The Taiwanese company was sometimes working along with Samsung. Other times, TSMC was solely responsible for the production of Apple chips (as it happened with the latest A10 and A11 chips).

Now, Samsung is back! The Korean manufacturer has recently reported to purchase the most advanced chip manufacturing equipment. If true, it would mean good times for Samsung and bad times for TMSC.

2) McCormick Buys Reckitt Benckiser Unit for $4.2 billion

McCormick & Co. has agreed to acquire a food division of Reckitt Benckiser Group for $4.2 billion. The deal, which will be completed by the end of 2017, is believed to result in cost synergy of $50 million. Despite increasing leverage ratio, the company is believed to maintain its dividend policy and capitalize on the acquisition by 2020.

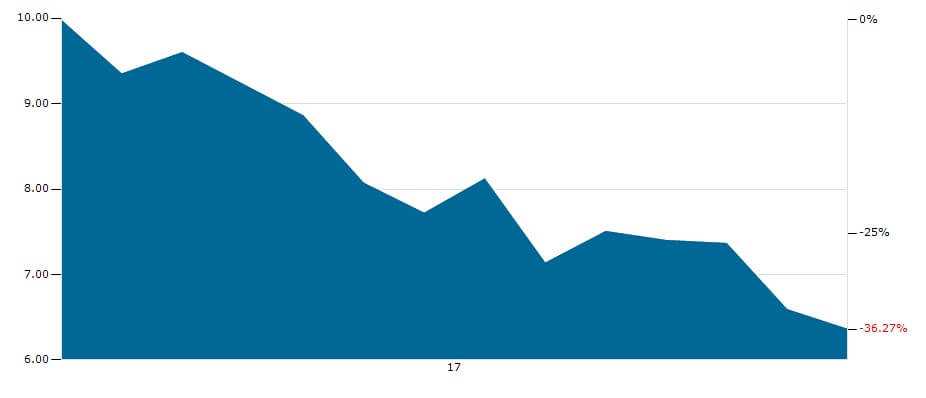

3) Is This the End of Blue Apron?

Amazon is known for disrupting any industry it enters. Blue Apron can very well become just another victim of the Internet giant. The meal-kit delivery company (NYSE: APRN) intended to initially offer its shares at a $15-17 price. However, news about Whole Foods Market being taken over by Amazon brought the price to $10. Now, APRN stock is traded even lower at $6.60. The market is scared by the news that Amazon has filed for a meal kit trademark.

Can it be the end of a promising start-up company?

4) Microsoft and Baidu Team Up on Electric Cars

The project was named Apollo and, apart from leading IT companies from the US and China, will include 50 more partners. They will be working together to deliver autonomous driving automobiles to the market. McKinsey believes that up to 15% of all new cars will be autonomous by 2030. Should the project be successful, shares of both companies can be expected to appreciate in the long-term.

5) Amazon Turns to Messaging

The depreciation of Blue Apron shares is not the only news involving Amazon.com today. The company is reported to be working on a messaging app called Anytime and there is probably no feature that won’t be included in it. Entering the messaging segment won’t be easy, even for a giant like Amazon. Apple, Alphabet (the company behind Google) and Facebook all have their own messengers. So why would the market want yet another one? Depending on how the market will answer this question, Amazon shares can go up or down following the official release.