Most traders don’t fail because they use the wrong strategy. They fail because they use a strategy that doesn’t fit how they live, think, or manage risk.

In 2026, the strategies that still work fall into three clear groups: trend-based strategies, range-based strategies, and technology-assisted execution. Everything else is just a variation of these ideas.

This guide breaks down 10 trading strategies worth testing in 2026, explains who each one actually works for, and helps you avoid wasting time on approaches that don’t match your personality or schedule.

Quick List: Trading Strategies Worth Testing in 2026

Before diving deep, here’s a simple shortlist you can scan in under a minute:

- Trend Following

- Swing Trading

- Breakout Trading

- Mean Reversion

- Scalping

- AI-Driven Portfolio Rebalancing

- News & Event-Driven Trading

- Pullback (Retracement) Trading

- Statistical Arbitrage (Pairs Trading)

- Price Action Trading

You don’t need all ten. In fact, trying to trade all of them is one of the fastest ways to fail. The goal is to test a few, then commit to one or two.

1. Trend Following (The Strategy That Refuses to Die)

Trend following is old, boring, and still works — which is exactly why professionals love it.

The idea is simple: when price is moving clearly in one direction, you don’t argue with it. You look for opportunities to join the move, not predict reversals.

In 2026, trend following works especially well on higher timeframes where algorithmic noise matters less. It’s slower, calmer, and easier to manage emotionally.

Best tools:

Moving averages (50 & 200), trendlines, market structure

Who it’s for:

Traders who value consistency over excitement

2. Swing Trading (Trading Without Living on the Charts)

Swing trading sits comfortably between day trading and long-term investing.

Instead of watching price every minute, swing traders look for setups that can play out over days or weeks. This makes it ideal for people with jobs, school, or businesses.

The key here is patience. You wait for price to reach important levels, then act — not the other way around.

Best tools:

RSI, Fibonacci retracements, candlestick patterns

Who it’s for:

Part-time traders who want flexibility

3. Breakout Trading (Catching Momentum Early)

Breakout trading is about timing.

Markets spend a lot of time doing nothing — moving sideways, frustrating everyone. Breakout traders wait for those quiet periods to end and jump in when price breaks free with volume.

The mistake most beginners make is chasing every breakout. In reality, many breakouts fail. Experience teaches you which ones are worth taking.

Best tools:

Support/resistance boxes, volume, Bollinger Bands

Who it’s for:

Traders who like fast movement but controlled risk

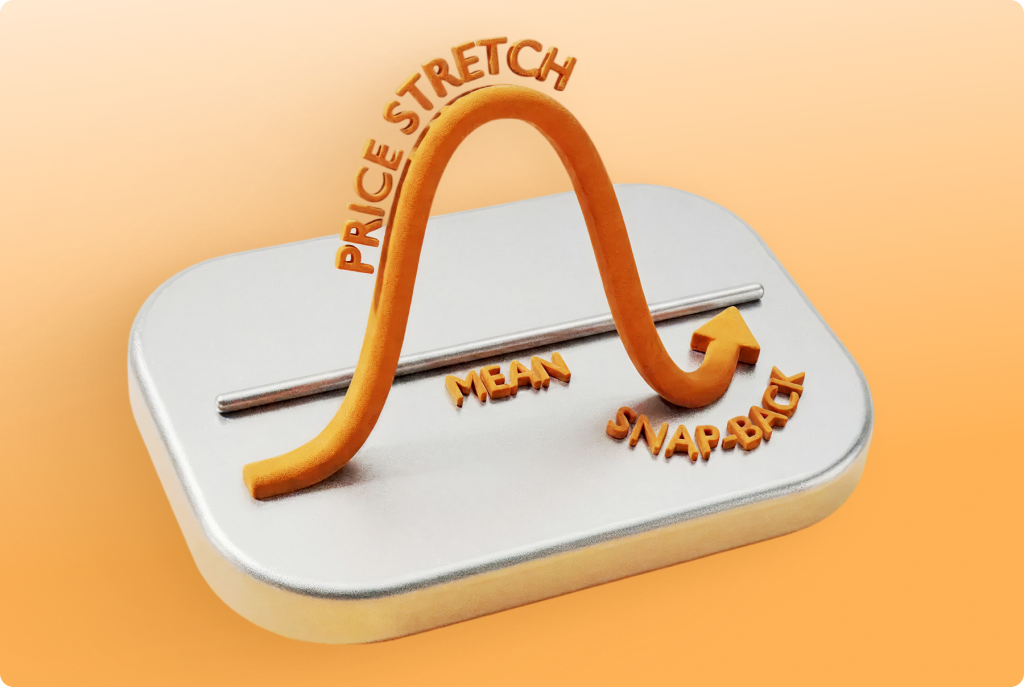

4. Mean Reversion (When Price Goes Too Far)

Mean reversion is built on one idea: markets tend to overreact.

When price moves too far from its average too quickly, there’s often a pull back — not always, but often enough to be tradable.

This strategy works best in range-bound markets, which still exist even in an algorithm-driven world.

Best tools:

Bollinger Bands, RSI extremes, statistical deviation

Who it’s for:

Analytical traders who like probabilities

5. Scalping (Not for Most People)

Scalping looks attractive because profits come fast — but so do losses.

Scalpers make many trades a day, aiming for small gains. The margin for error is tiny, and emotional control is critical. In 2026, scalping is dominated by speed and execution quality.

It’s not impossible for retail traders, but it’s unforgiving.

Best tools:

1-minute charts, tight spreads, fast execution

Who it’s for:

Highly disciplined, experienced traders

6. AI-Driven Portfolio Rebalancing

This is one of the biggest shifts in recent years.

Instead of manually adjusting trades, many traders now use AI tools to rebalance exposure across assets. AI can spot correlations and volatility changes faster than humans.

The key is not letting AI make emotional decisions — but letting it handle data-heavy tasks.

Who it’s for:

Investors and traders managing multiple assets

7. News & Event-Driven Trading

News still moves markets — sometimes violently.

Interest rate decisions, inflation data, geopolitical events — these create short bursts of volatility. News traders focus on timing and execution rather than prediction.

The danger here is slippage and emotional overreaction.

Who it’s for:

Traders comfortable with fast decisions and risk

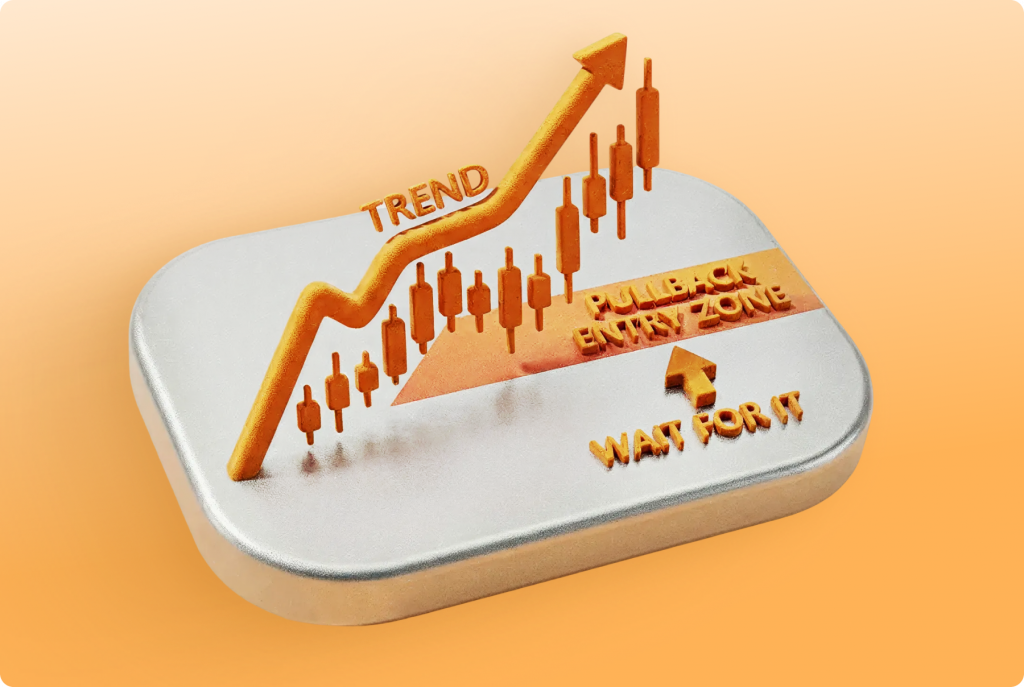

8. Pullback (Retracement) Trading

Pullback trading is what many professionals quietly use.

Instead of chasing price, you wait for a controlled pullback within a strong trend. This improves risk-to-reward and reduces emotional entries.

It’s simple, but not easy — patience is required.

Best tools:

EMA 20/50, Fibonacci levels, support zones

Who it’s for:

Trend traders who want safer entries

9. Statistical Arbitrage (Pairs Trading)

This strategy is more mathematical.

You trade the relationship between two correlated assets instead of market direction. When their usual relationship breaks, you bet on it normalizing.

It’s less emotional, but requires testing and discipline.

Who it’s for:

Data-driven traders and quants

10. Price Action Trading (Less Noise, More Clarity)

Price action traders strip charts down to the essentials.

No indicator clutter. Just structure, levels, and candles. In noisy markets, this clarity can be powerful.

The challenge is that price action takes time to truly understand.

Who it’s for:

Traders who want a clean, intuitive approach

Choosing the Best Trading Strategy for You

Before picking a strategy, answer these honestly:

- Can I watch charts all day, or only a few times?

- Do losses make me emotional?

- Do I prefer fast feedback or slow, steady results?

Your answers matter more than market conditions.

Simple Matching Guide

| Your Style | Best Strategy Type |

| Limited time | Swing / Pullback |

| High patience | Trend following |

| Fast decision-maker | Breakout |

| Analytical thinker | Mean reversion |

| Data-focused | AI-assisted / stats |

The best strategy is the one you can follow on your worst day, not your best.

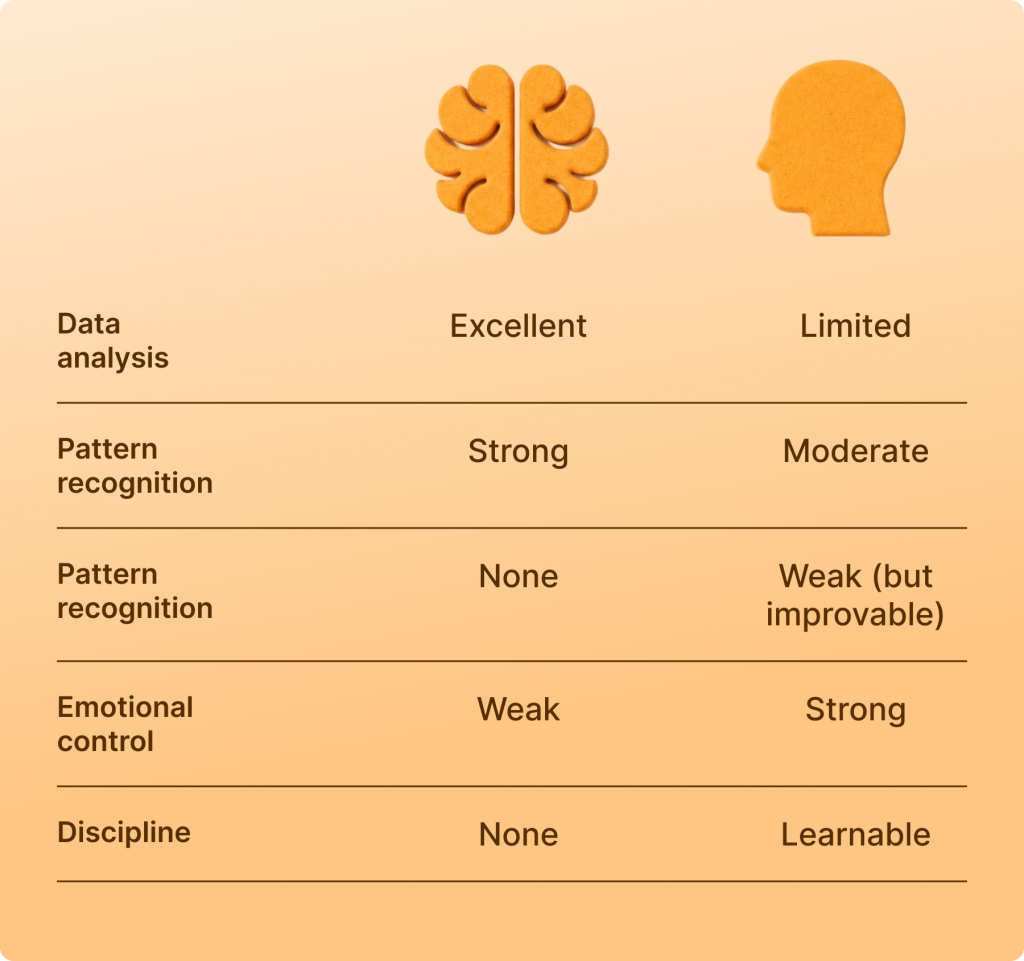

Can AI Help You Trade Better?

AI can help traders — but only if you understand what it’s good at and what it’s terrible at.

A lot of beginners think AI means “automatic profits.” That’s not how it works. AI doesn’t remove risk. It removes manual workload and data blindness.

Where AI shines is in tasks humans are bad at: scanning large amounts of data, spotting patterns across markets, and tracking behavior over time.

Where it fails is exactly where most traders already struggle: discipline, patience, and emotional control.

What AI Is Actually Good At

AI tools in 2026 are commonly used for:

- Backtesting strategies across years of data

- Detecting correlations between assets

- Measuring volatility and adjusting position size

- Trade journaling and mistake detection

Used properly, AI becomes a decision-support system, not a decision-maker.

Where AI Hurts Traders

AI becomes dangerous when traders:

- Follow AI signals blindly

- Stop understanding why trades are taken

- Overtrade because execution feels “easy”

AI doesn’t feel fear or greed — but you still do.

AI vs Human Trader (Simple Comparison)

| Task | AI | Human |

| Data analysis | Excellent | Limited |

| Pattern recognition | Strong | Moderate |

| Emotional control | None | Weak (but improvable) |

| Strategy creativity | Weak | Strong |

| Discipline | None | Learnable |

Best approach: Human decides what to trade. AI helps decide how and when.

Why 90% of Traders Fail (The Real Reasons)

The 90% failure rate is real — but not for the reasons most people think.

It’s not because markets are rigged.

It’s not because trading is only for geniuses.

It’s not because indicators don’t work.

Most traders fail because they break a few basic rules consistently.

1. They Risk Too Much, Too Soon

This is the biggest reason accounts blow.

New traders often risk 10–30% per trade because they want fast results. One or two losses later, the account is done.

Professional traders think in hundreds of trades, not single outcomes.

2. They Strategy-Hop Constantly

One loss → new strategy

One drawdown → new indicator

One bad week → new mentor

No strategy works if you abandon it before understanding its strengths and weaknesses.

3. They Trade Emotionally, Not Systematically

Revenge trading, fear-based exits, chasing price — these aren’t rare mistakes. They’re daily habits for failing traders.

Trading rewards consistency, not intensity.

4. They Treat Trading Like Entertainment

Many traders trade out of boredom, not opportunity.

Markets don’t pay you for being active. They pay you for being selective.

Why the 10% Survive

The traders who last:

- Risk small

- Trade less

- Track performance

- Accept boredom

- Focus on process, not daily profit

That’s it. No secrets.

Final Thoughts: Strategy Is Only the Beginning

In 2026, trading rewards clarity, not complexity.

Pick fewer strategies. Trade less. Track more. Use AI as support, not authority.

The goal isn’t to trade everything — it’s to trade what fits you.