While financial professionals and traders discuss the rebound of the cryptocurrency market, there is another issue everyone seems to ignore. And the problem is the ICO bubble. China has recently introduced regulation that will ban all ICOs within its national borders. It does not, however, solve the bigger problem. Local action in one particular country is not enough to prevent the ICO bubble from growing and eventually bursting on a global scale.

In the rest of the world ICO startups, both real and scammy, attract multimillion investments without the need to demonstrate a working prototype, using their white papers as the only proof of ‘unlimited profit potential’. With the number of backers growing daily, it is only a matter of time when the ICO bubble will burst. The cryptocurrency market will surely be affected when it happens, and not in the positive way. Exchange rates of bitcoin and Ethereum, two cryptocurrencies most often used to fund ICOs, can be expected to go south.

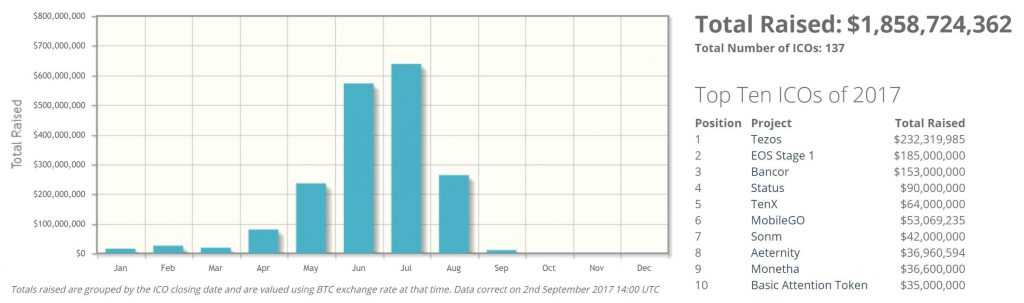

How does one determine a financial bubble? When regular people quit their jobs in order to trade cryptocurrencies or participate in ICOs, that very well might be a bubble. When the amount of money collected by a single ICO campaign exceeds $200 million, that very well might be a bubble, as well. As if that were not enough, there is yet another indicator. Over the course of only 30 days, initial coin offerings have collected $600 million, which is a little bit too much even for an overheated market.

What should indicate the near end of the ICO frenzy, however, is this little event that could have gone unnoticed. The most recent tweet by none other than Paris Hilton may be the perfect clue for people who still believe in the never-ending earnings opportunities, created by ICOs.

When people far from the world of finance in general and cryptocurrencies in particular express their willingness to capitalize on ICO, it is definitely a bubble. There are still plenty of opportunities on the cryptocurrency market but from now on all ICOs should be approached with great caution.