Colgate-Palmolive Company will deliver its second-quarter 2017 results on July 21 before the market opens. In the last seven quarters, the company has met the investors’ expectations or surpassed them. But every winning spree has to end sometime. Is it finally the time for Colgate to fall short of expectations?

Here are the five most important factors that are likely to move the CL stock once the earnings report is released.

1) Brand Recognition

Millions of people all over the world know and use Colgate products daily. The company holds a leading position in the segments of oral and personal care. Being number one in a particular industry has more benefit to it that many can imagine. People tend to believe the absolute leader and occupying all the sweet spots in a supermarket doesn’t hurt the sales, as well.

Colgate’s dedication to R&D, high quality of its products and thought-out marketing strategy is expected to cement its place as a worldwide leader and generate additional revenues in the future.

2) Strategic initiatives

Many companies have turned to cost-saving initiatives and eco-friendly practices recently in an attempt to bring down the expenses and at the same time please the environmentally aware customers. And Colgate is not an exception. By introducing two cost-cutting initiatives — Global Growth and Efficiency Program and Funding the Growth — the company managed to increase the adjusted gross margin by 70 bps!

3) Innovation and R&D

In the XXI century, when even microwaves and fridges have to be ‘smart’, it is extremely important for the company to keep up not only with the competitors but also with the technology, as well. Innovation and R&D work in Colgate’s favor, letting the company occupy 32.7% and 43.8% of the toothbrush and toothpaste market respectively. Actively working on new product recepies and innovative approaches to sales, the company is capable of attracting new customers and retaining the existing ones.

4) Soft sales

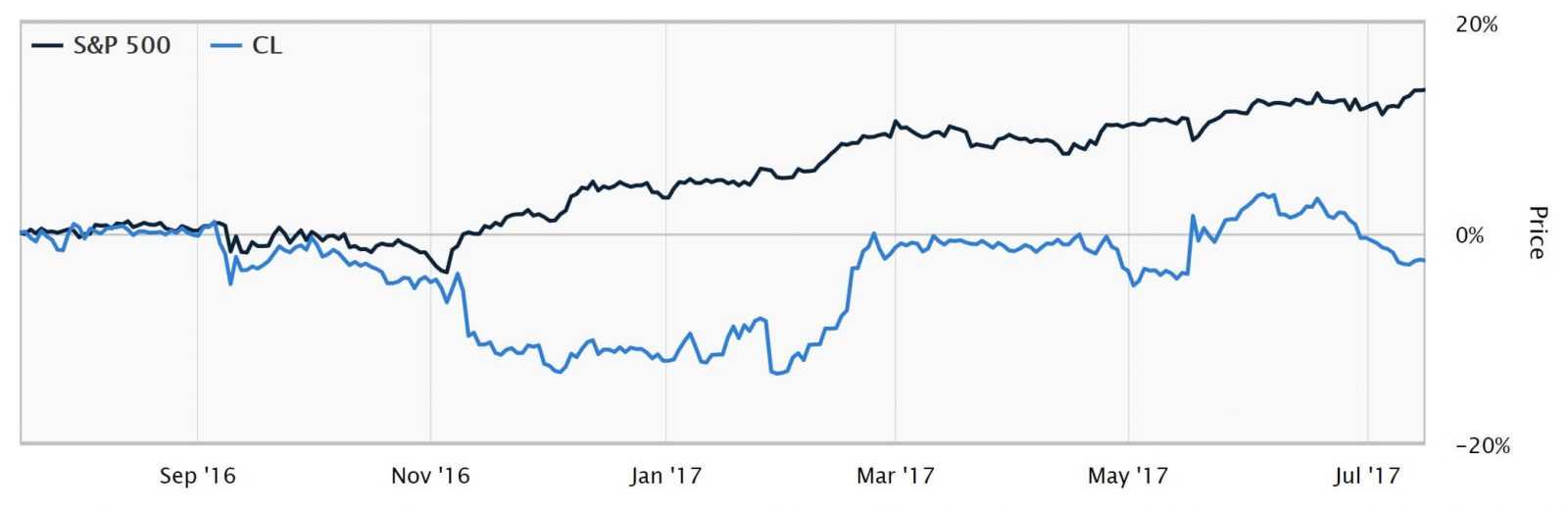

Few factors can negatively affect the stock price with a magnitude comparable to soft top line. Colgate sales figures did not meet the estimates in 15 out of 16 last quarters. Should the company demonstrated sub-par sales performance once again, the market can react with a negative correction. Considering the not-so-impressive performance of CL shares in the last three months, soft sales can further enhance the negative trend.

5) Negative currency translation

When doing business globally companies face a whole galaxy of risks, ranging from political to legal and macroeconomic ones. There is one risk, however, that is most commonly observed and has tremendous potential to hinder the growth. This risk is negative currency translation. Colgate generated over 75% of its revenue outside the United States. Considering the appreciating USD, company’s bottom line is in serious danger, especially in case of future currency fluctuations.

The overall outlook for Colgate-Palmolive shares is moderate to positve. The company managed to beat the estimates for seven quarters. However, Colgate has underperformed the industry in the last three months, while CL shares demonstrated a 2.6% decline. Should the results demonstrated in the earnings report come in line, the stock can be expected to appreciate.