Ethereum is on the cusp of major catalysts that will improve efficiency, lower transaction fees, increase scalability, and drive ETH to new highs. What am I talking about? Upgrades and hardforks and the Constantinople hardfork specifically. Constantinople, the second phase of the Metropolis Upgrade, follows last year’s Byzantium fork which was unanimously accepted by the mining community.

The Constantinople fork is designed to increase efficiency and lower transaction fees. Along with that developers think it could also aid in scalability, the ability to handle a growing volume of work, which is the number one problem with blockchain systems today. The real bonus is that Constantinople will be performed sometime in late October, before the implementation of Sharding and Plasma.

Both Sharding and Plasma are protocols intended to reduce strain on the Ethereum network and increase scalability to a point where Ethereum’s transaction speed and cost were far superior to Visa and Mastercard. Today, Ethereum can process about 14 transactions per second compared to Visa’s thousands. Once Plasma and Sharding are incorporated Ethereum’s transaction speed could run into millions of transactions per second.

In addition to increased efficiency Constantinople will increase the mining difficulty for ETH. This is a negative for miners who will earn less for their work but is a net positive for the community and ETH holders. Increasing the difficulty will help ensure there are ETH to mine far longer than previously, important while Ethereum makes the transition from Proof-of-Work to Proof-of-Stake, it will also decrease availability of tokens and help support prices.

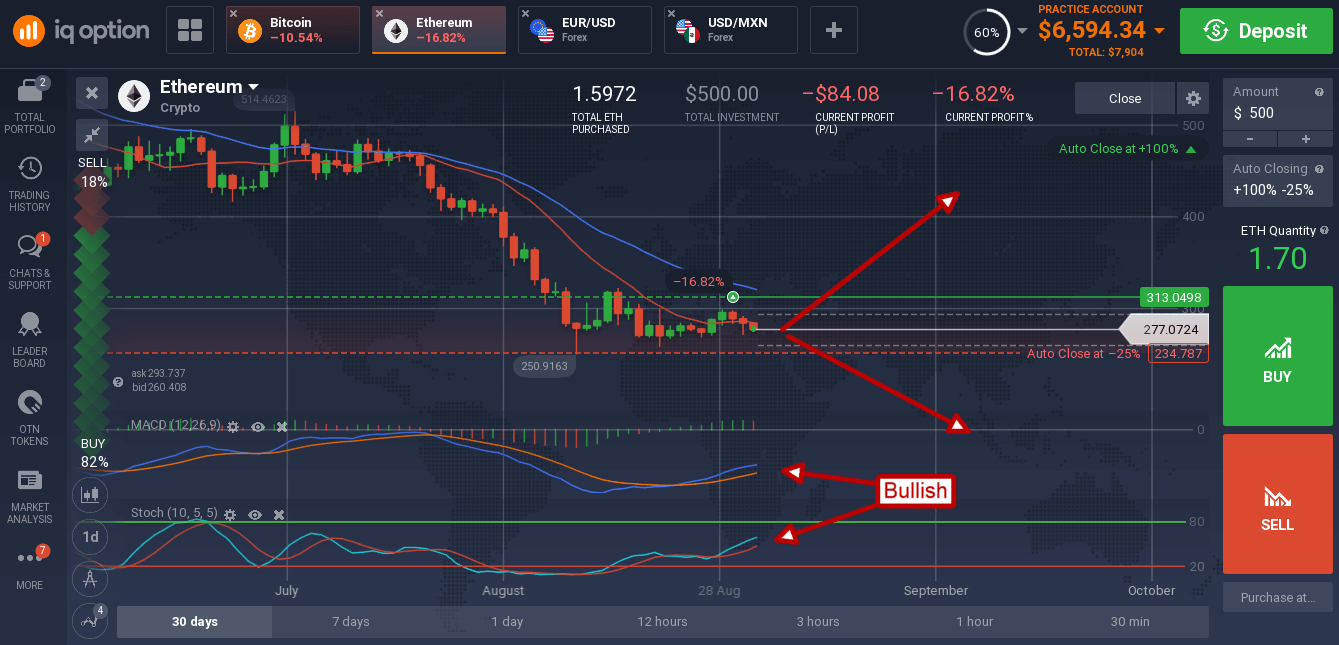

Ethereum is currently trading near long-term lows and below a key point of resistance. The token has been consolidating at this level and may be forming a bearish triangle although the indicators do not agree. Both MACD and stochastic are pointing higher and giving strong bullish indications that prices will rise. If prices are able to move above the $295.00 level it will still face resistance at the short-term moving average, a break above that would be bullish and could take it up to the $400 level fairly quickly. Longer-term I expect to see ETH continue to trend higher and shoot up to new highs following the Constantinople hard-fork and Sharding/Plasma upgrades.