If you haven’t already heard the term Proof-of-Burn you soon will. Proof-of-Burn is a next-generation blockchain mining technique that is gaining traction within the cryptocurrency space. It is, in effect, a means of turning one coin into another and a reason why Bitcoin prices will move higher.

Proof-of-Burn is the concept of transferring value through the destruction of value. Sat for instance you had one Bitcoin worth $6,500 and you wanted to start a new cryptocurrency. You could take that one Bitcoin and “burn” it to use its value to fund a new cryptocurrency we’ll call Token X. Token X is started with 1,000 in circulation making them worth about 0.1538 BTC each.

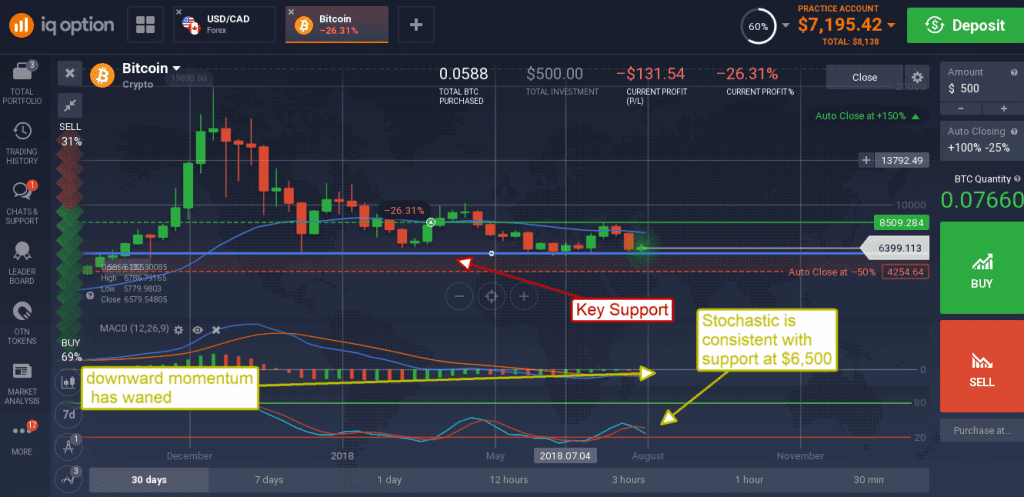

How do you “burn” a token and why is that important to Bitcoin? Because it means demand for Bitcoin and dwindling supply. Burning a token is simple, you create a transaction in which Bitcoin is sent to an unrecoverable address in a public fashion. It’s a way of showing the community at-large that a value has been deposited into a permanent escrow account in which no person, computer or entity has access to.

Instead of an ICO a new blockchain could get started with a coin burn; instead of selling tokens the start-up community would all burn an established cryptocurrency to stake the new. After that new miners would have to follow the new blockchains core protocol to participate. When it comes to burning cryptocurrency, Bitcoin is the best because it is the most widely accepted, has the largest market cap and dominates the cryptocurrency market. This means that as new PoB blockchains are started, regardless of their success, more Bitcoins will disappear from the market.

This concept is especially important regarding Proof-of-Stake blockchains. Proof-of-Stake is the concept that miners must put up a deposit, stake, to participate. This means no need for complex algorithms and constant rehashing of useless information which ultimately means less use of electricity, sustainable block-chain network support and eco-friendly mining. . . and proof-of-burn is growing in popularity as a means of starting a health proof-of-stake blockchain.

As of November, 2017 there were an estimated 4 million Bitcoins lost or unrecoverable. That is nearly 25% of the circulation supply at the time of this writing and almost 20% of the total supply.

This perspective makes it clear PoB is a serious catalyst for Bitcoin prices as it could easily result in the complete destruction of the world’s reserve cryptocurrency however unlikely that is. As the supply dwindles BTC’s price will go up making other currencies, perhaps ETH or LTC, a better choice.