The UK is now officially only the 6th largest economy in the world, losing the 5th spot to France. The news was not surprising to many observers who have warned that the Brexit effect would slow down investment and GDP growth. It however significantly dents the UK government’s assertions that Great Britain will be better off outside of the EU. Furthermore, the ongoing weakness of the pound versus the euro since June 2016 has further increased the lack of confidence of the markets for the future performance of the British economy.

The UK is now officially only the 6th largest economy in the world, losing the 5th spot to France. The news was not surprising to many observers who have warned that the Brexit effect would slow down investment and GDP growth. It however significantly dents the UK government’s assertions that Great Britain will be better off outside of the EU. Furthermore, the ongoing weakness of the pound versus the euro since June 2016 has further increased the lack of confidence of the markets for the future performance of the British economy.

What are the reasons that have made this happen and what are the consequences for the long-term?

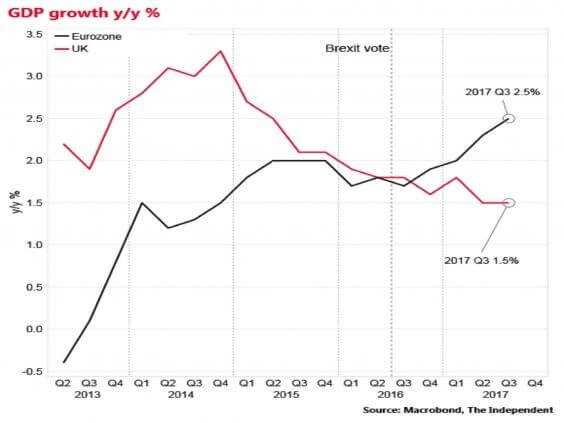

GDP numbers for Q3 2017 showed EU growth continuing to outdo the UK’s, with a 0.6% QOQ figure compared to 0.4% QOQ for the latter. On an annualized basis, the divergence in Q3 was even more noticeable, with the EU registering 2.5% GDP growth vis-à-vis 1.5% for the UK. The divergence in performance manifested itself in the aftermath of the June 2016 referendum and has continued since:

Estimates are the Brexit vote has cost the UK £20 BLN so far in foregone GPP growth, or the equivalent of £330 MLN a week since June 2016.

Despite the economic slowdown, the UK’s inflation rate hit a 5-year high in September to 3% YOY, on account of stagnating wages coupled with ongoing weakness in the pound. Food and transportation costs constituted to the bulk of the increases. The British currency is still 15% below its June 2016 levels, although having rebounded slightly from a low of 1.08 to the Euro in August.

Recent news events have also not helped the sentiment regarding the pound. On November 5th leaked financial reports (also known as “Paradise Papers”) indicated that various major UK personalities, including the Queen herself, had millions located in offshore accounts in the Cayman Islands, Bermuda and Panama. This has increased doubts on how widespread tax avoidance and capital outflows are in the UK economy, in a very delicate political and economic environment.

The attractiveness of the UK as an immigration hub, which has driven both economic and population growth in the last 15 years, has also taken a hit. The figures from the Office for National Statistics show net migration to Britain fell by 106,000 to 230,000 in the 12 months to June. Almost 75% of those who have chosen to leave are EU citizens, particularly from Spain, Poland and France, who in most cases are returning to their home countries. The spectre of a “Brexodus” of workers from the UK has further tightened the labour market, as the unemployment rate remains at a 42-year old low. Worker shortages have been reported in the agricultural sector, in addition to retailing, small and medium-sized manufacturers and construction companies.

The political stalemate around Brexit negotiations has continued to fuel investor uncertainty. The UK government has gradually ceded ground to EU demands on many issued regarding the divorce, including EU citizen rights, the €40-45 BLN in financial commitments to the EU and the free movement of people. Chief EU Brexit negotiator Michel Barnier announced on December 1st that British banks will lose their ‘passporting rights’, which allow them to serve clients across the EU without the need for licences in individual EU countries. Commercial realtors in Frankfurt are reporting strong sales volumes and price increases on as financial institutions continue the partial relocation of their banking staff from London.

A deadline of December 4th has been set by the EU for the UK to present a proposal on its final trade demands, prior to the European Council meeting on December 14th. EU observers are expecting the EU to be given a free trade agreement similar to the one with Canada, rather than a fully bespoke one as desired by the UK. At this stage, if the European Council declares that “sufficient progress” has been made it will thus allow talks on future relations and the transition to start early in 2018. If this were not to happen, the UK economy and the pound are likely to start the new year with renewed volatility and continuing investor uncertainty.