US President Donald Trump announces $200 billion in new tariffs on the eve of second quarter earnings season.

Trade fear or earnings growth, you be the judge

The announcement sent global equities ducking for cover but the knee-jerk reaction sell-off is most likely another buying opportunity for speculative and long-term traders.

The latest news, the Trump administration has announced a 10% duty on $200 billion in Chinese goods. The tariffs are not intended to go into immediate effect, there is a hearing/review process slated to begin mid-August to determine if and how the new duties will be implemented. China responded saying the US was “bullying” and that it, China, would fight back.

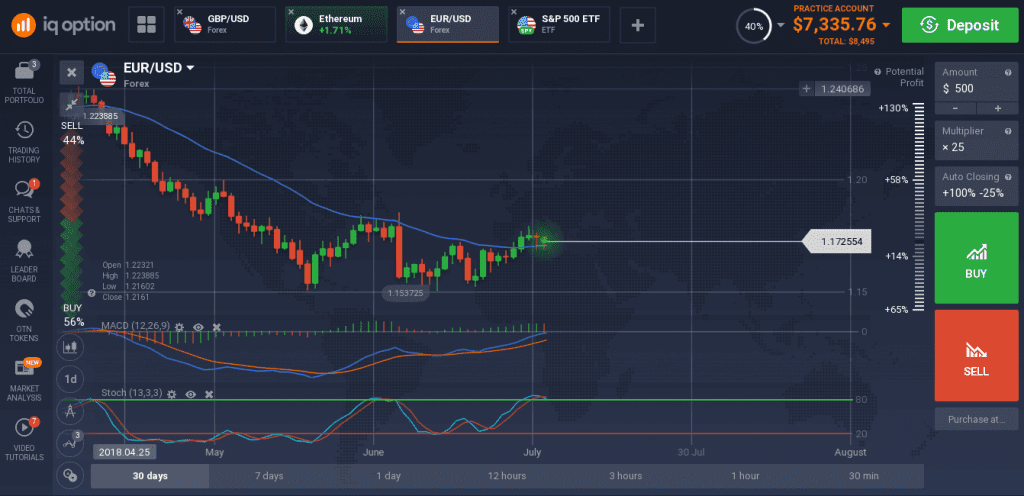

The news slammed stocks ranging from international industrial giants Boeing and Caterpillar to tech stocks like Nvidia, Intel and AMD as traders fear further escalation will hamper global growth. Adding to the turmoil are allegation from Trump that EU/NATO allies are not toeing the line. Trump is attending a two-day NATO summit and has already insulted at least one major trading partner claiming that “Germany is totally controlled by Russia”. The EUR/USD fell on the news, but support is holding at the 30-day EMA.

Earnings Trump trade

What traders need to keep in focus is the 2nd quarter earnings cycle which begins in earnest on Thursday. Reports from big banks JP Morgan and Citigroup lead the cycle and the expectations are high. The financial sector is expected to post earnings growth better than 25%, any deviation from that will have a far-reaching impact on the broader market. The rally in equities is driven by earnings growth, if the trade war has a discernible effect on outlook the market is likely to see a major decline.

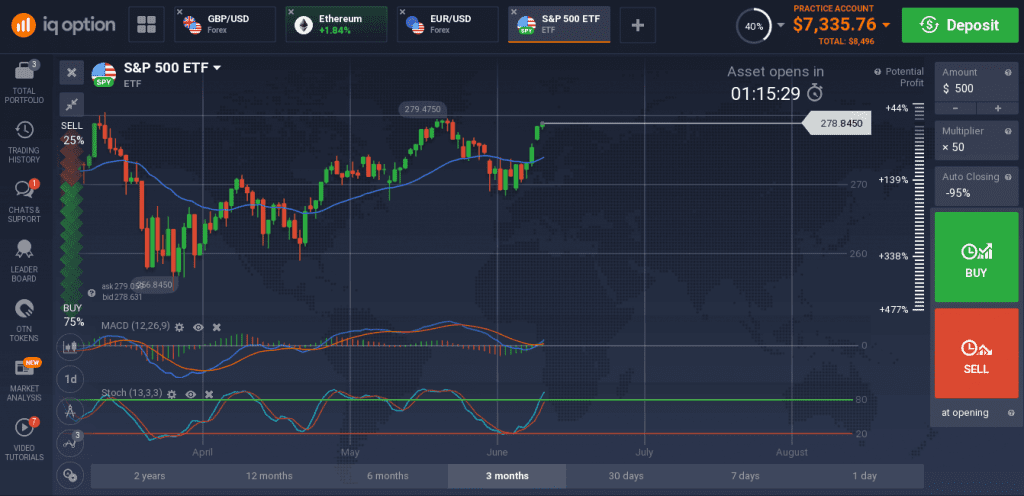

The SPY S&P 500 Index Tracking Stock, available to trade on IQ Option CFD platform, moved up to set a five-month high in Tuesday trading as the market prepared for earnings season. The trade war news caused futures to pull-back sharply, indicating an open near 20 points lower on Wednesday. While the futures decline is a red-flag, the decline was negligible in relation to recent price action and left the index trading well above the 30-day EMA.

The 30-day EMA will be the make or break level for near-term trading, trading over the next few days or weeks, and should be closely watched over the latter half of this week. A move below the 30-day EMA will be bearish and likely take the index down to 2,690 or lower. A bounce from the EMA, especially if it coincides with strong earnings from the big banks, will be bullish for the broad market and likely lead to a retest of the all-time highs.