The Momentum indicator is a technical analysis tool designed with the sole purpose of identifying the trend strength, which is the velocity of price changes. The Momentum is displayed as a single off-chart line and is easy to follow. The indicator can be used on any asset and any time frame — both novice traders and hardened veterans will find it useful. Read the full article to learn more about this tool and how to use the Momentum indicator for trading.

How does it work?

This indicator will compare the current price of the asset to its price from several periods ago. The bigger the difference between the two, the higher the indicator readings will be. If there is no difference at all, the indicator will remain at 0, pointing to a sideways market.

Four different quotes can be used: the indicator can compare maximum, minimum, opening and closing prices of the underlying asset. Closing prices are the most commonly used. However, the other three can be applied, as well, for different types of signals.

Momentum indicator settings

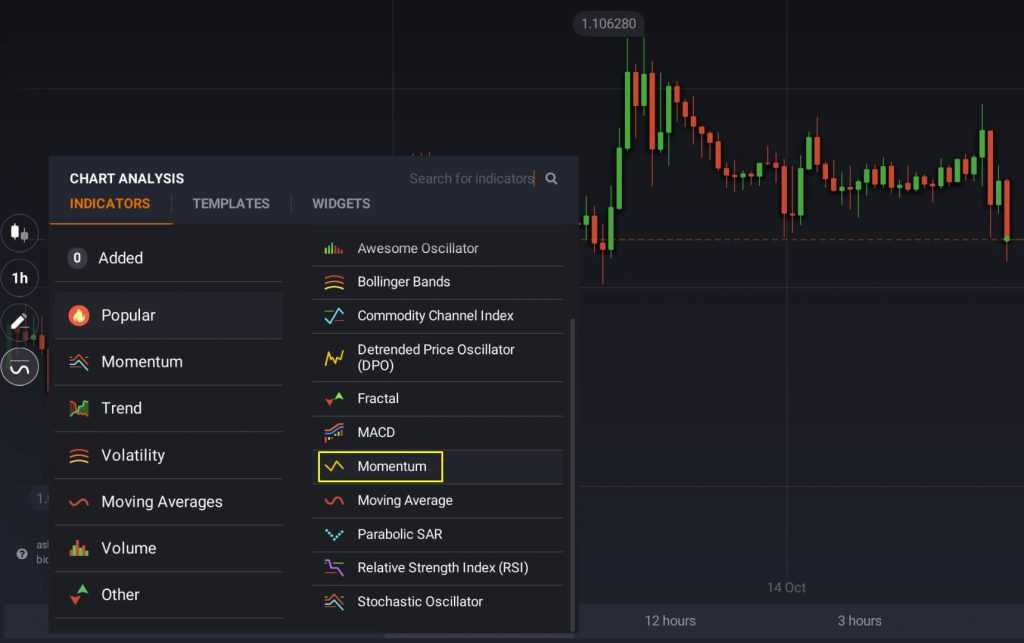

Here is what you want to do in order to set up the Momentum indicator:

Click on the ‘Indicators’ in the bottom-left corner of the trade room and go to the ‘Popular’ tab.

Choose ‘Momentum’ from the list of available options.

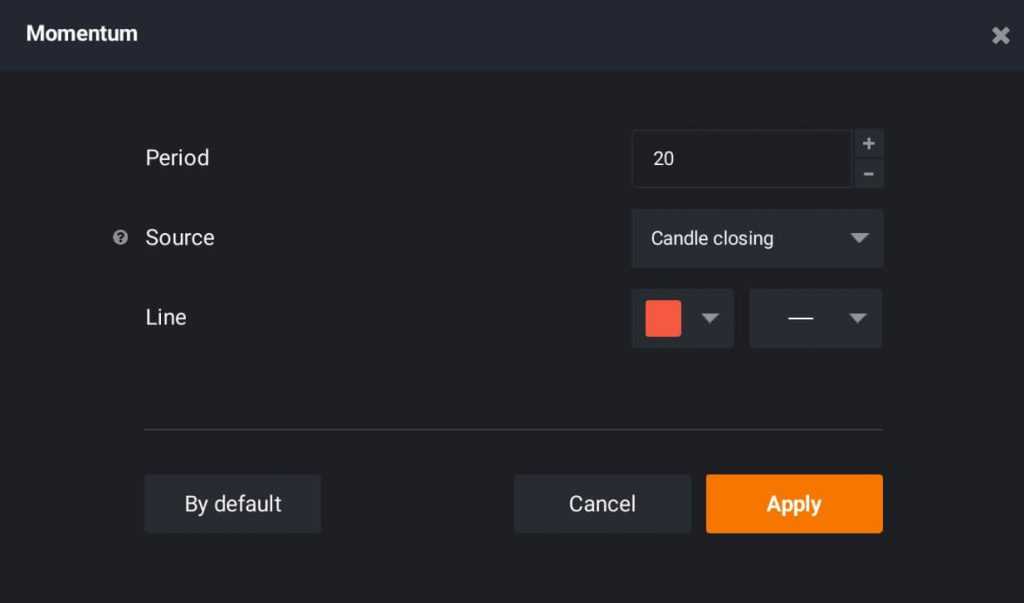

Click ‘Apply’ in the new window that will then appear.

The indicator is ready to use. Note that the period and the quote value can be adjusted in order to make the indicator either more sensitive or decrease the number of false signals.

How to use the Momentum indicator in trading?

The Momentum can be used for the purpose of receiving timely and accurate trading signals. It can also be utilized as an additional tool that can help you confirm signals received from other indicators.

The higher the indicator, the faster the upward price movement. The lower the indicator, the faster the downward price movement. When the indicator reading is equal to zero, there is no prevailing trend on the market (the market is flat).

There are several types of signals you can receive when trading with the Momentum.

1. It can be used similarly to MACD. In this case, it is possible to open a corresponding position (either buy or sell) when the indicator is at its maximum or minimum. When using this strategy, it is important to confirm the signal with another indicator of a different type.

2. It can also be used as an anticipatory indicator. This strategy is based on the premise of accelerating growth/decline at the end of the trend cycle. When the trend, either positive or negative, suddenly accelerates, it can be expected to run out of power soon enough. Although useful, this method is not 100% accurate, and should be used with care.

3. The Momentum can be used as a supplementary tool to confirm or disprove signals, provided by other indicators. Be it Fractals, the Alligator or Bollinger Bands, the Momentum can help you make the right decision when the need arises.

The Momentum is a simple technical analysis indicator that can become a valuable addition to the collection of your trading tools. It will suit both novice and experienced traders, as it can be tuned up and adjusted to your trading strategy and style. However, it should be noted that no technical analysis indicator is capable of providing accurate signals 100% of the time.