Losing a trade is always possible, — even after you have done your research, found the optimal entry time and executed your strategy precisely, and this can be incredibly discouraging. It is even more annoying if the deal was supposed to close according to your prediction, but something went wrong.

What is the reason for this and what can potentially be done? The answer is simple: it is quite likely that the trade was not closed on time.

So, when to exit a deal? And what are the reasons traders may often miss the right moment to close trades? Let’s take a look at the main issues and potential solutions.

Why trade exits are important

Say, all circumstances align, and you have opened a trade, which is performing well. The price is going in the predicted direction, and you are expecting it to reach your expected outcome target soon. But when it reaches your target of, say, 20%, you hesitate to close the trade, expecting even better results. What is wrong with that?

☝️

What is better — to receive the smaller outcome, or to lose everything in hopes of earning more? Greed is one of the obstacles that drives traders to keep their deals open longer than planned.

Another example is when traders keep a losing deal open, instead of accepting the loss and moving on. Often traders set a stop loss, but then remove it, hoping that the price might reverse. They wait, meanwhile, the trade goes deeper in loss, until the trader is left with a wiped out balance. A fear of losing a part of the investment might be another reason why traders lose all of it in the end.

This is why sticking to your plan of exit is crucial. This will protect you from yourself, and it might help you manage the risks more effectively. Let’s look at the possible ways of closing a trade timely.

1. Stop-Loss and Take-Profit

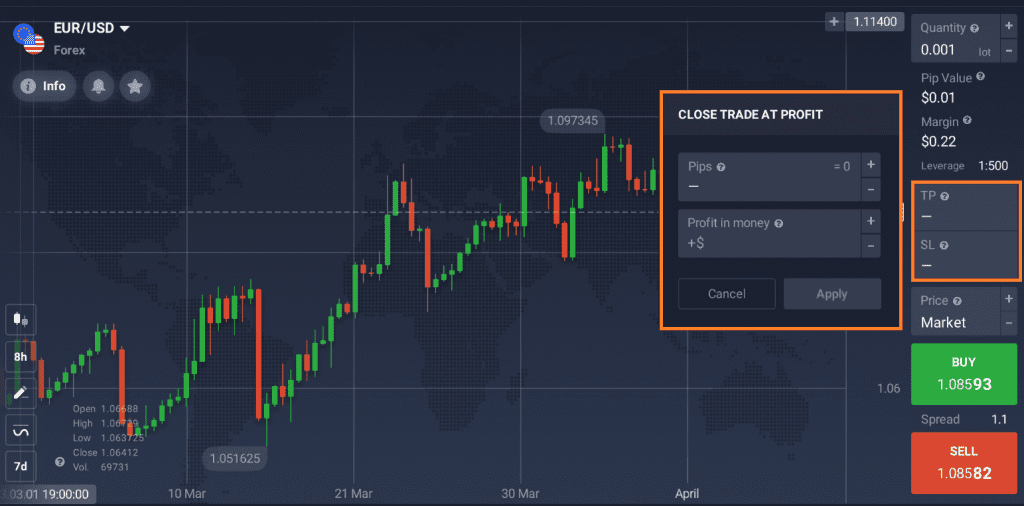

These two levels are effective tools of risk management. The Stop-Loss is set in order to keep the trade running, unless it reaches the loss amount that the trader considers acceptable for them. This way, it allows the trader to manage losses and attempt to control their funds flow.

Similarly, Take-Profit allows a trader to set a profit benchmark that they wish to secure. Unless it is triggered, the deal will stay open.

Implementing these tools may help traders understand when to exit a trade. The ratio at which these levels should be set depends on the trader and their personal strategy. However, each trader has to learn the basics of Stop-Loss/ Take-Profit usage. Check our extensive article on these tools to learn how to use them.

2. Trailing Stop-Loss

A Stop-Loss with a little tweak, the Trailing Stop-Loss allows traders to manage their possible losses, while also optimizing potential positive outcomes.

It works like this: a trader sets the Stop-Loss level and enables the “Trailing stop” feature. The Stop-Loss level will automatically shift in case the price of the asset moves in the chosen direction. If the price is moving against your prediction, the Stop-Loss will not shift. Please keep in mind that this feature may not be available for margin accounts.

3. Timed exits

Planning to close the deal after a certain amount of time is another approach that traders may consider using. For instance, it can be applied in flat market conditions, or in case the deal is at a loss.

While it might be a simpler technique, traders need to be prepared to cut the trade at the exact time that they’ve established, without any doubts. It might be too easy to forget about the running trade and miss the right time, so this approach is better suited for more experienced traders. To get additional information on how to choose the optimal exit time depending on your trading approach, check out this video.

No matter which approach you use to exit your deals, make sure that you always stick to it and never give into the “a little more” mentality. Not closing trades on time might be one of the main reasons traders lose their funds. Stick to your risk management strategy and manage unnecessary losses by knowing when to exit a trade.