The auto industry has experienced a period of higher volatility in the last few years due to supply chain disruptions, inflation and other factors. While volatility may not be a good sign for long-term investors, it might offer potential opportunities for traders. Let’s have a look at the 3 top players that may be competing for the title of best auto stocks for 2024.

Volkswagen

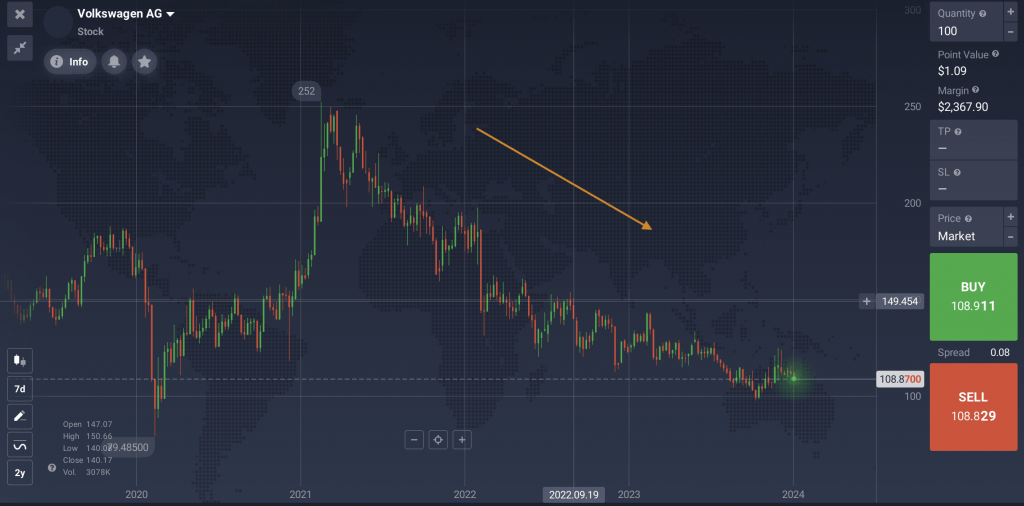

Volkswagen stock took a major dip following the 2015 scandal involving excessive levels of emissions – up to 40 times the limit in the US. This led to years of investigations, lawsuits and fines, negatively affecting the company’s stock price and reputation. Volkswagen faced more challenges during the Covid-19 pandemic and the following period due to semiconductors shortage. These issues negatively affected the production volume and cut into profits, keeping down the stock price.

The production volume returned to the 2020 figures in 2023 (up 11.8% year-over-year). Yet, the Volkswagen stock price hasn’t been able to gain the previous heights.

What’s next for Volkswagen stock?

The company has been focused on developing fully electric vehicles in recent years. Volkswagen successfully increased their sales of electric cars by 21% in 2023 and works towards growing its share of the sector. However, there’s intense competition, with Tesla, BYD and other large automakers racing for the lead in the electric car market.

It seems that now Volkswagen is trying to gain advantage by integrating the AI tech into their vehicles. The company has recently introduced an upgraded version of their voice assistant. It includes ChatGPT – an AI-based chatbot – to improve driver experience. Volkswagen is planning to make it a standard feature in their cars in 2024, which might distinguish it from some of the competitors. Will it make Volkswagen stock one of the best auto stocks for 2024? Only time will tell, but it may be worth keeping an eye on this asset in the coming months.

Tesla

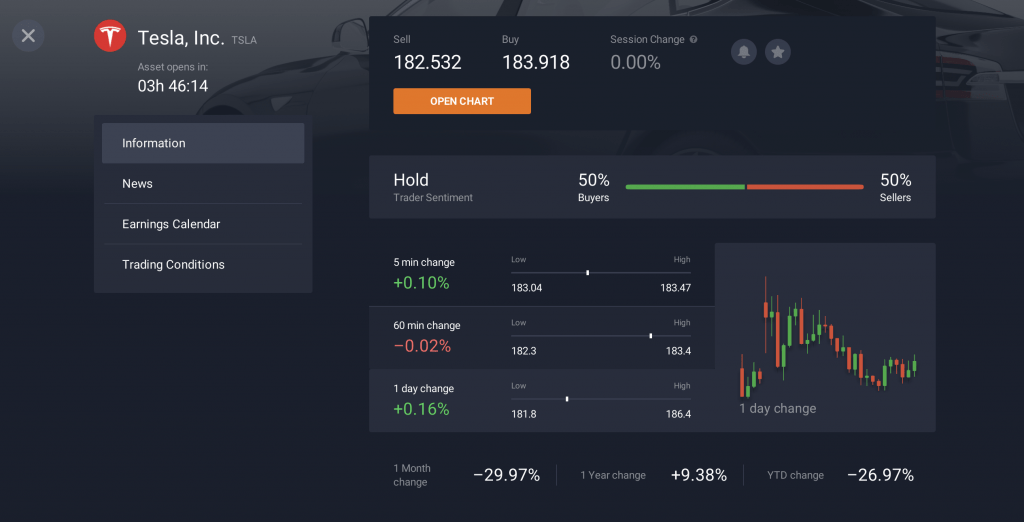

Tesla stock had some ups and downs: from doubling its value in 2023 to losing over 26% so far in 2024. The automaker had to deal with major vehicle recalls due to safety issues at the end of 2023, with over 2 million cars affected. And there may be more challenges in the future.

While the company managed to increase their production volume in the fourth quarter of 2023, this may not be enough to overtake competitors like Chinese automaker BYD. Tesla has recently reported its fourth-quarter earnings, which were lower than expected. They also suggested that the production volume growth in 2024 may be reduced from the previous year.

However, Tesla remains a key player in the electric car market, especially in the US. And if the company delivers fully autonomous cars they’ve been promising for a long time, it might be a game changer for the industry.

What’s next for Tesla stock?

Tesla may be facing more challenges this year, with growing competition in the electric car sector and slowing demand. They also had to cut prices for their vehicles in some regions to stay competitive and attract new customers. With price cuts decreasing profits and negatively affecting Tesla stock, we might see more volatility in the coming months.

BYD

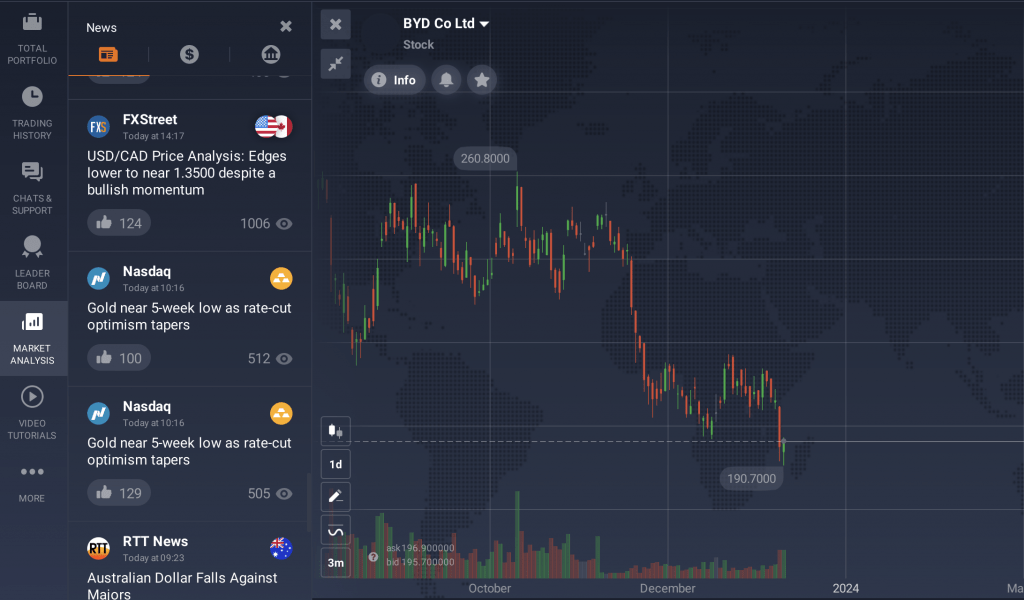

BYD has been steadily increasing its presence in the automotive industry, especially when it comes to electric vehicles. In 2020, the company introduced the Blade battery, which, according to BYD, offers more safety and longer lifecycle. Since then, this battery’s been an important part of the BYD’s success, along with the Chinese government’s growing support of the electric car industry.

What’s next for BYD stock?

This automaker managed to sell more electric cars in the fourth quarter of 2023 than any other company in the world, putting it ahead of Tesla. And they aren’t planning to stop there: BYD just launched a new AI-powered smart car system called Xuanji.

According to the automaker, this new tech “seamlessly perceives changes in the internal and external environment of the car in real-time” and “swiftly adjusts the state of the vehicle, significantly enhancing driving safety and comfort”. Will this system become a game changer for the electric car industry, making BYD one of the best auto stocks for 2024? It may be worth keeping an eye on the news from this company to stay on top of the latest trends and catch potential opportunities.

You may track the most important market news for your CFD assets directly from the IQ Option traderoom. To learn more about market analysis instruments, read this detailed guide with the best tools: IQ Option Traderoom: Top Features You Need to Know.

Final Words

There are many global companies competing for the title of the best auto stocks for 2024. With the electric car sector rapidly developing and offering new AI-driven solutions, new players might emerge to take over from the current leaders. However, these 3 top auto stocks may have the potential to stay ahead. So if you’re looking for auto stocks for trading, these companies might be worth a look.