This week was incredibly eventful, thus generating numerous trading opportunities. Let’s take a look at some of them.

UK Elections

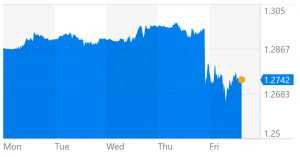

This week Great Britain decided which party deserves to lead the country into the future. The elections had barely begun when increased volatility for currency pairs including the GBP has been witnessed. Tories lost 13 seats, while their prime competitors from the Labour Party picked 32. The Conservative party is still the largest but it doesn’t constitute a majority, a situation called a hung parliament. Introducing new laws and editing the existing new ones will now become considerably harder. As a result, the British Pound has depreciated against other major currencies, losing almost 2 percent against the USD.

International ostracism of Qatar

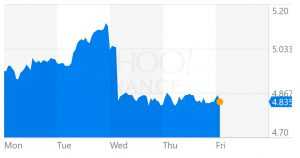

Nobody saw a major international scandal coming just days after the US President’s visit to the Middle East. Yet it happened and now poses a threat to the well-being of Qatar, a tiny yet extremely prosperous Gulf country. Saudi Arabia — and a number of its allies — accused Qatar of collusion with Hamas and the Islamic State, international terrorist organizations. All air, sea and land roots between the countries have been cut off. Certain experts believe that it is not terrorism that made the Saudis angry but rather an independent foreign policy of Qatar. Whatever the motive behind this decision, oil prices saw a steep rise on Monday followed by a sharp decline on Tuesday and a relatively flat market for the rest of the week.

Comey Testimony

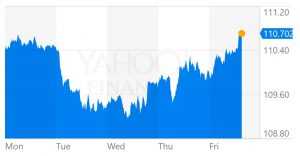

Ex-FBI director James B. Comey testified on Capitol Hill on Thursday. At this moment, there is no evidence to claim that Donald Trump is connected to Russia, or that he forced Comey to abolish the Flynn investigation. Jared Kushner, Trump’s son-in-law and senior adviser, drew the attention in connection with the ongoing investigation.

The dollar regained a portion of its lost value as political inconsistencies surrounding the 45th President of the United States are shading away.

WWDC 2017

On June 5 Apple announced iOS 11, new versions of iMacs, MacBook Pros, and MacBooks, as well as HomePod to the public. The market reacted to the event with a slight growth in Apple stock prices. WWDC 2017, however, failed to surprise the public and motivate the investor to rush for Apple’s equity, as it happened in the past. Nonetheless, AAPL shares have witnessed a steady growth during the last year, adding more than 50 percent over the course of 12 months.

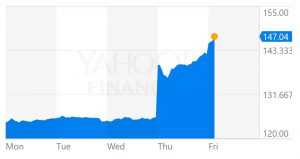

BABA Stock Can’t Be Stopped

The Chinese e-commerce giant pleased the investors on Friday, saying company’s sales are expected to soar 45 to 49 percent in 2007. Company’s shares grew more than 40 percent since the beginning of this year. Experts believe that the focus on cutting edge technologies and Alibaba’s ecosystem of products and services are behind the explosive growth.

Bitcoin Bubble

The king of all cryptocurrencies has been steadily growing since its most recent correction on 27 May. Bitcoin is predicted to get even higher with certain experts even believing there is no ceiling for it at all. The whole situation, however, resembles a bubble, with a lot of regular people jumping the Bitcoin train. When the intrinsic value of an asset is forgotten and the focus is shifted towards its “trading” value the bubble can be expected to burst. The question is when will it happen?