The earnings season is not yet over! Several well-known and promising (in terms of financial performance) companies are expected to deliver their earnings reports in the upcoming days. One of them is Sysco Corporation (NYSE: SYY) Stock, with an earnings report due 8 May 2017.

Sysco is a Houston-based multinational company involved in the distribution of food to restaurants, educational and health facilities, as well as food services and hospitality businesses. Another sphere of company’s interest is management consulting. Sysco is the world’s largest foodservice distributor with more than 400 000 clients. The consensus EPS forecast for the quarter is $0.51. The reported EPS for the same quarter last year was $0.46.

Sysco outperformed the industry and showed solid results in the last one quarter. Read the article to learn what to expect from SYY shares?

Performance indicators

| 52 Week High-Low | $57.07 – $46.79 |

| Dividend / Div Yld | $1.32 / 2.50% |

| EV/EBITDA Annual | 14.75 |

| Consensus EPS forecast Q1/17 | $0.51 |

| Reported EPS Q1/16 | $0.46 |

| Forward PE | 21.45 |

Accomplishments and goals

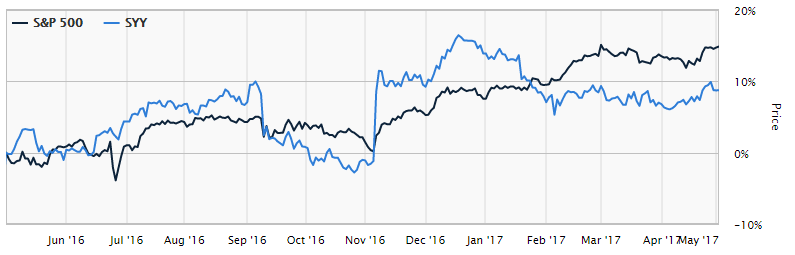

Strong performance. Not only the company has outperformed the industry in the last one year, providing a 10.8% increase in the shareholders’ value (compared to the industry’s humble 0.3%). Sysco is also well positioned for the long-term growth, as indicated by the company’s strong fundamentals. It can be expected that growth momentum is here to stay. More than that, company’s return on equity — an important metric for wholesale food distributors — is equal to 40.9%, higher than company’s peers.

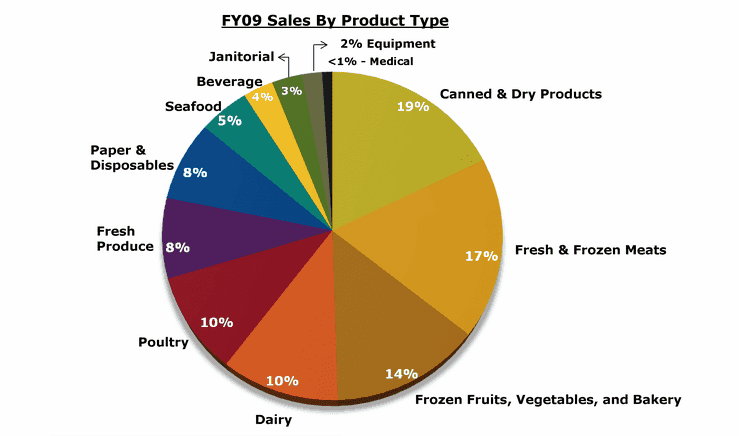

Strong portfolio. Sysco is offering a wide range of products to its customer base, utilizing each opportunity to capitalize on product diversification and broader portfolio. With a focus on e-commerce, rare and innovative products, the company has demonstrated revenue growth in the eleventh consecutive quarter. In case of Sysco, more products mean higher sales. And higher sales apparently lead to increased bottom line.

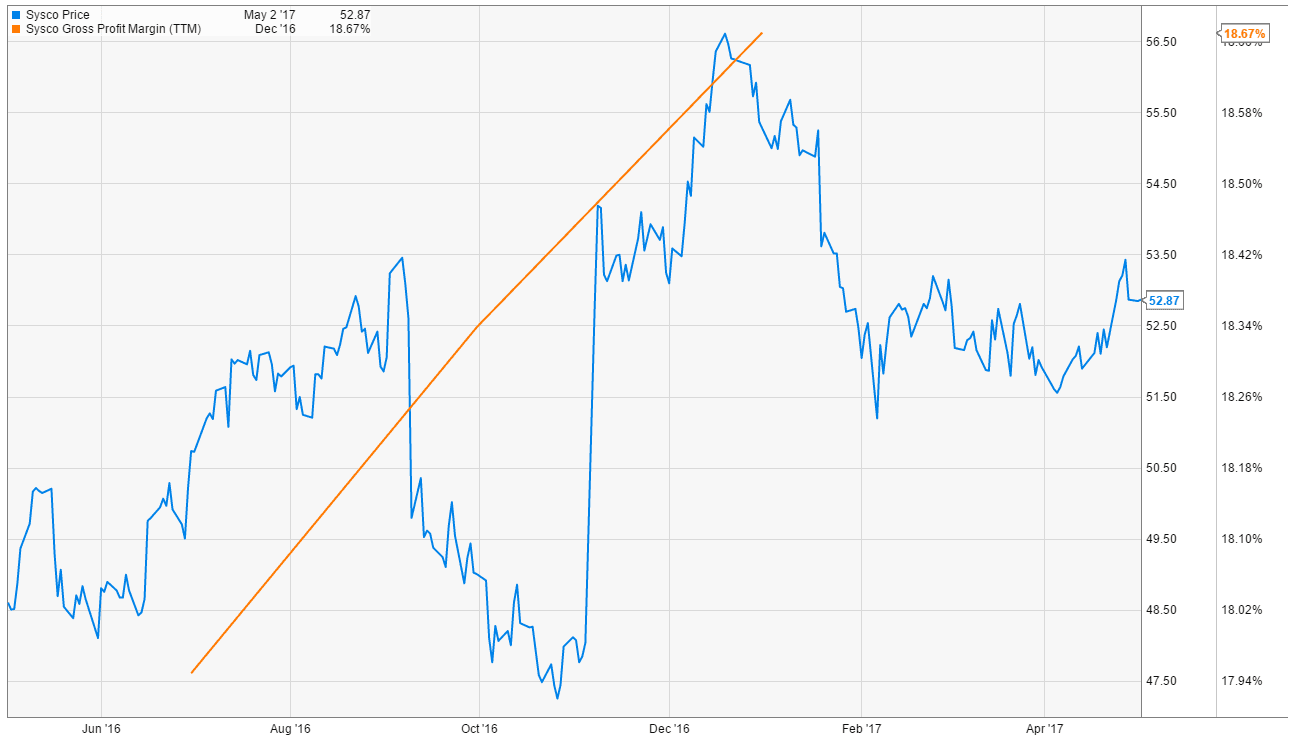

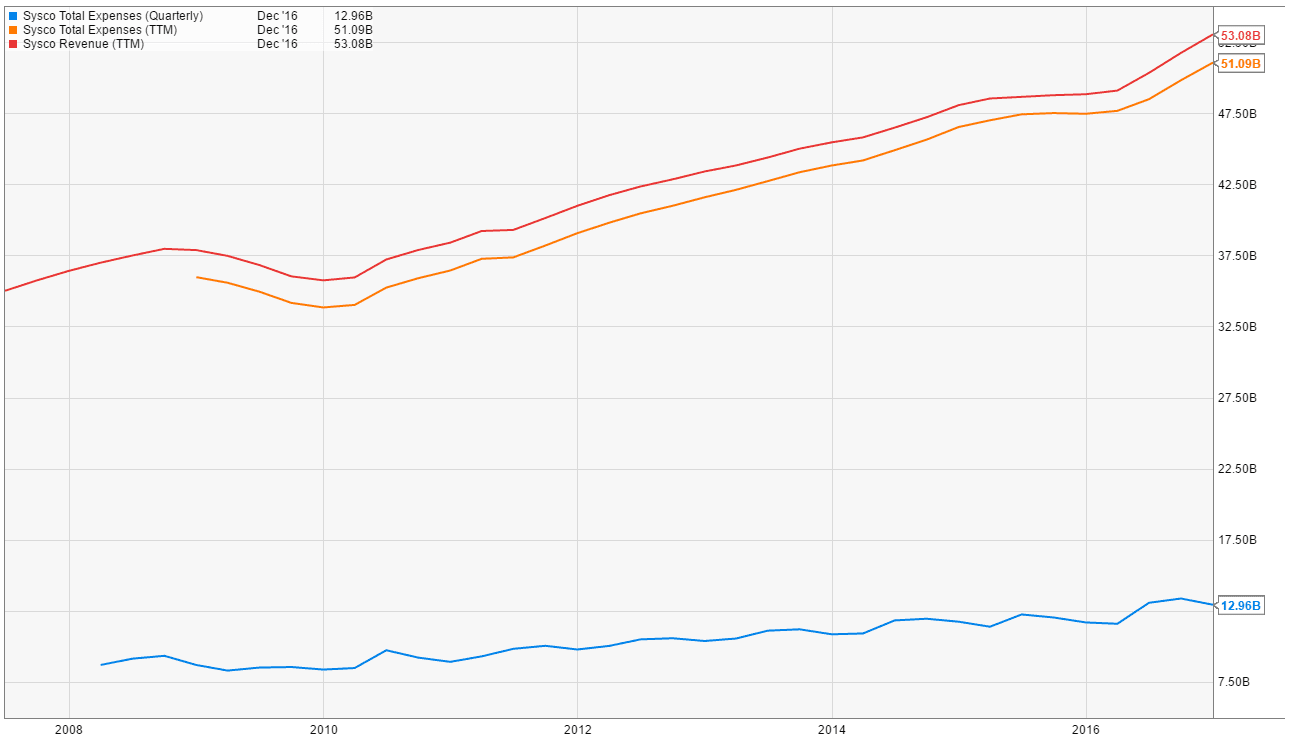

Cost-cutting initiatives bear fruit to the company. Sysco has vigorously focused on expense management in the last several years, stating that supply chain and SG&A are of prime importance for its financial performance. Cost-cutting programs turned out to be so effective that, as a result, operating income growth target has been adjusted to $650 million, up from $500 million. Gross margin is another metric that the top management of the wants to improve, and quite successfully. The indicators expanded in the last seven quarters.

Mergers and acquisitions. One of the ways for a big international company to grow is through acquisitions. Fast and simple. At least, when the Department of Justice does not interfere. Sysco has relied on this practice for years, believing that buying the competitors is easier than actually competing with them. And the company’s strategy turned out to be successful.

In July 2016 Sysco acquired London-based Brakes Group. The combined annual sales of two companies are expected to exceed $55 billion. Supplies on the Fly, an e-commerce platform aiming at revolutionizing the business, has been acquired in July 2016. Thanks to this deal, the only customers that will get access to its services are Sysco’s clients. And there are still plenty of investing opportunities out there.

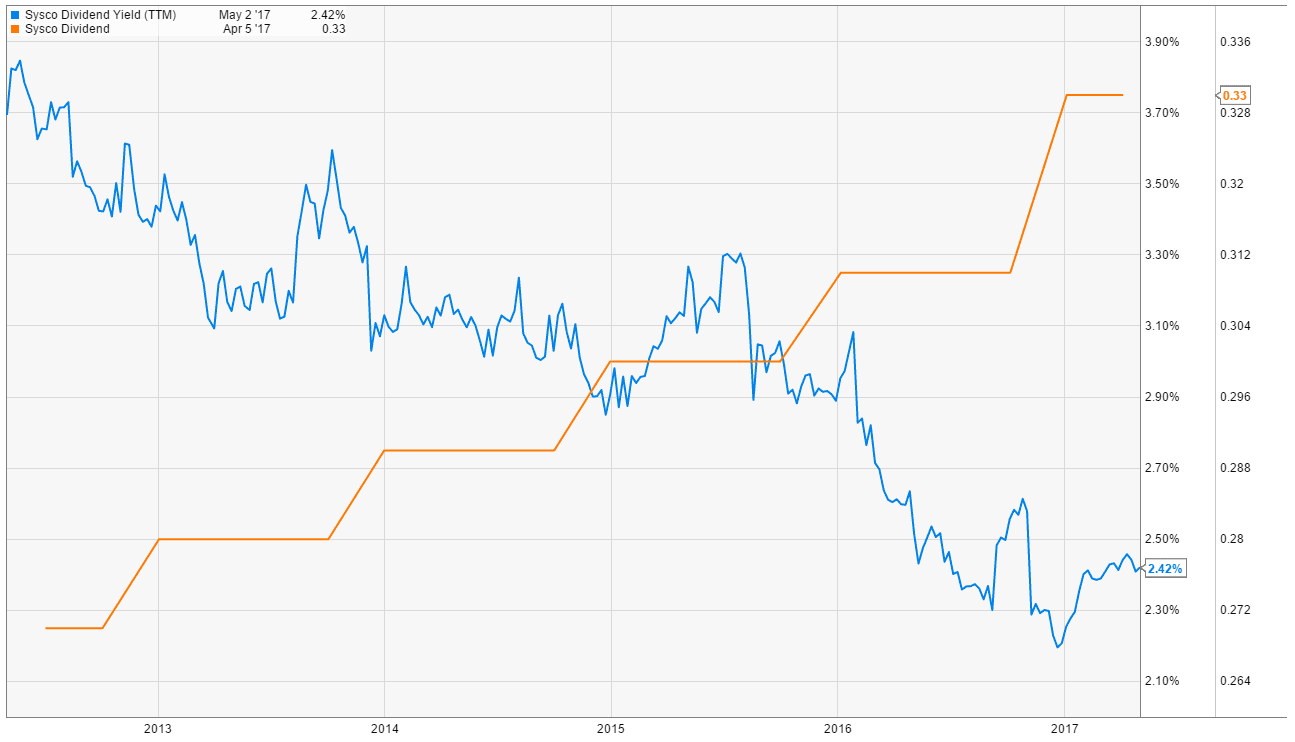

Dividend and repurchases. Sysco has enough cash to remunerate its shareholders with generous dividends and regular share buybacks. Since 1969, the year the company was established, its dividend per share grew 48 times. Quite a surplus. Company’s estimate of the future dividend growth is set at the 3 to 5% level. From June 2015 to July 2017 Sysco is expected to spend $3 billion on share repurchases.

Possible headwinds

Compared to the opportunities and strengths, possible headwinds are limited in number. However, underestimating the threats may be not in the company’s best interest.

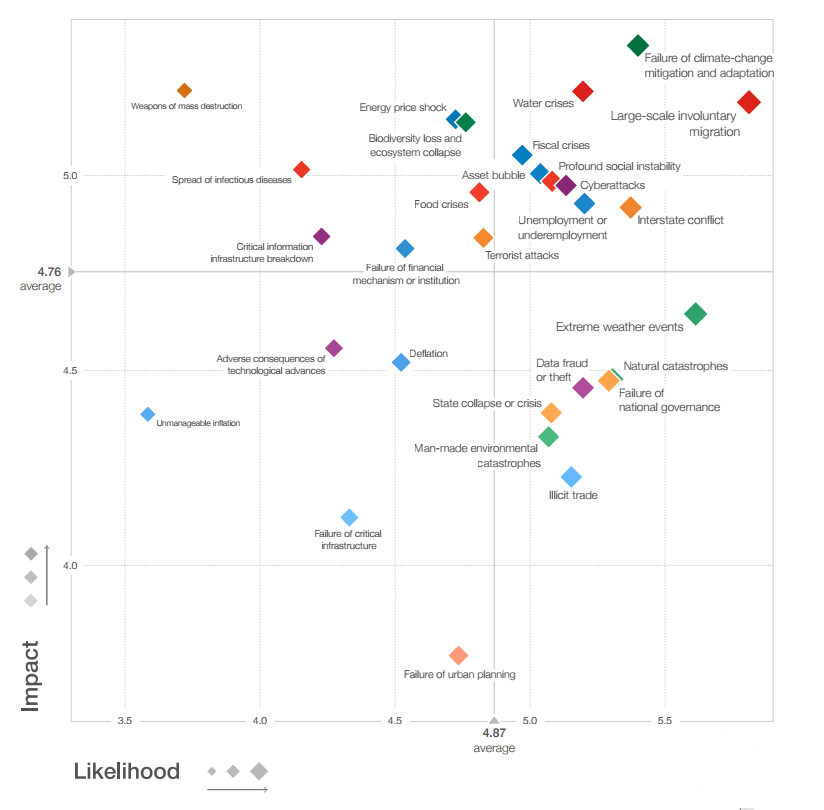

Macroeconomic conditions. Several experts have already noted worsening global economic conditions. Though American companies reported higher than expected earnings on the verge of the second quarter, political instability and challenging geopolitical situation in different corners of the Earth may substantially undermine the importance of away-from-home dining. Fewer restaurants — less Sysco clients. In the world where nuclear war is still possible no degree of concern is too high. First signs of the industry decline have already been witnessed. Restaurant traffic in general decreases YoY and this tendency is not expected to reverse soon.

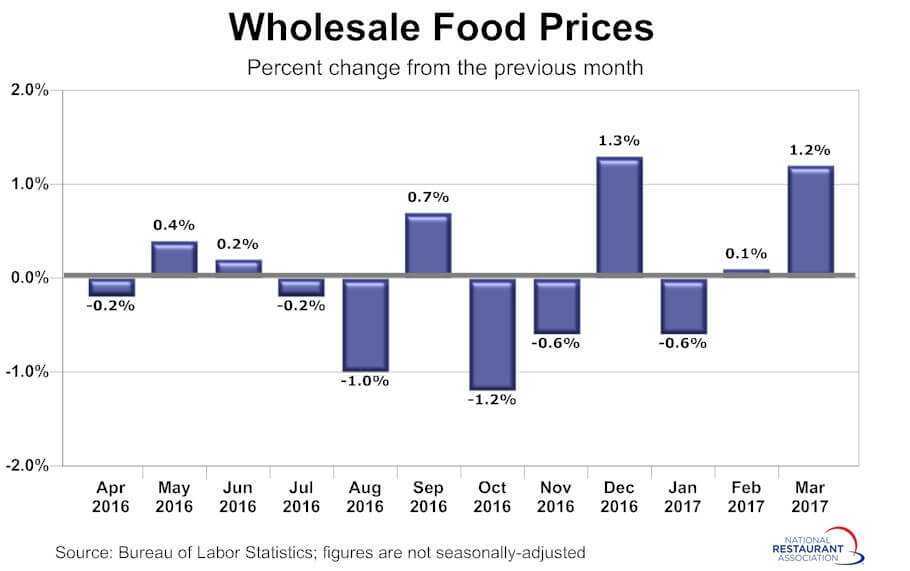

Falling food prices. Thanks to growing competition and improving production technologies food prices have been going down for quite some time already. The retail industry is trying to battle the tendency but so far without any tangible results. Meat, poultry, and dairy witnessed a particularly noticeable decline in prices, mostly due to the oversupply and stiff competition in the industry. Food cost deflation negatively affects the top and the bottom line of the company. The trend is likely to continue at least through the current year.

Final thoughts

Sysco Corporation is well positioned for future growth and showed solid growth results in 2016 and Q1/17. The outlook for the company in the second quarter, as well as the rest of the calendar year, is positive. Sysco can be expected to show steady growth and spoil the investors with dividends and share buybacks.

On the other hand, daunting macroeconomic situation and decelerating demand for restaurant meals pose a serious threat to the segment in which the company operates. Sysco is not expected to lose its market share in the coming years, but broad line food market can experience a contraction, which in turn will hurt company’s top and bottom lines.