The two indicators, Stoller Average Range Channel (STARC) and Bollinger Bands may look very similar when applied on the chart. They consist of upper and lower bands, with the indicator line in the middle. Both of the indicators create support and resistance levels and their interpretation is quite similar, however, they work in slightly different ways on the chart. Let’s see what the difference between them is and how each of them may be used.

STARC vs Bollinger Bands

The two indicators differ in the way they are calculated. Bollinger Bands is a highly popular indicator that is used by many traders, as it is quite simple to read and displays signals in a straightforward way on the chart. Bollinger Bands consist of a Moving Average and two accompanying bands, placed one standard deviation away from the moving average. This indicator shows the possible trading opportunities that come with volatility: the higher the volatility of the asset, the further away from each other are the bands.

Unlike Bollinger Bands, the Stoller Average Range Channel is not based on standard deviation. The middle line is a Simple Moving Average, while the upper line (also called STARC Band+) is created by adding the ATR (average true range) to the moving average. The lower band (STARC Band-) is created by subtracting the ATR from the moving average. So this indicator essentially combines two trading systems in one: a Moving Average and the ATR indicator.

Which one you may choose?

As the principle of both indicators is quite similar, it is really the trader’s preference that plays a role here. However, certain features of both indicators may swing a trader towards one or the other.

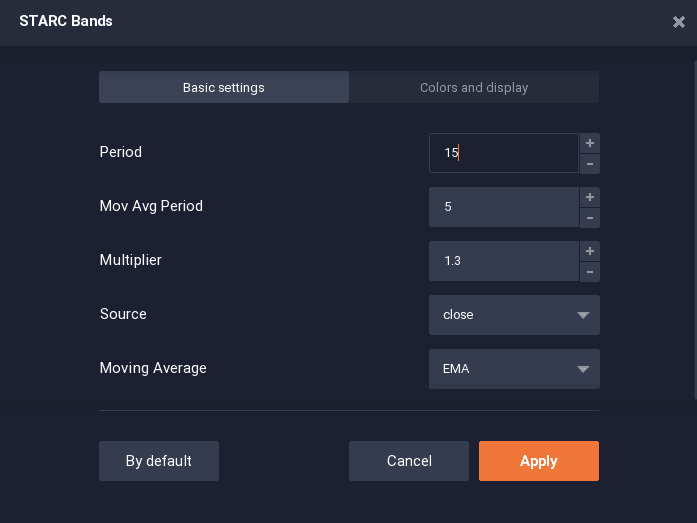

For instance, with the STARC indicator, one may change the type of the Moving Average band and set it to the Simple MA, Exponential one or any other from the list. A trader may also change the multiplier – the value that increases or decreases the deviation of the upper and lower bands. Increasing the deviation may be helpful for long-term traders, while short-term traders may decrease it in order to potentially receive more signals from the indicator.

How to read the indicators?

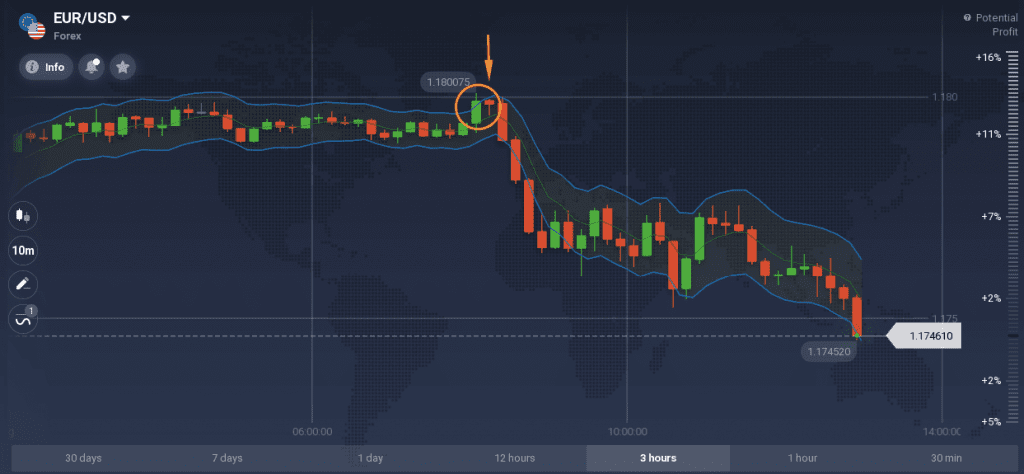

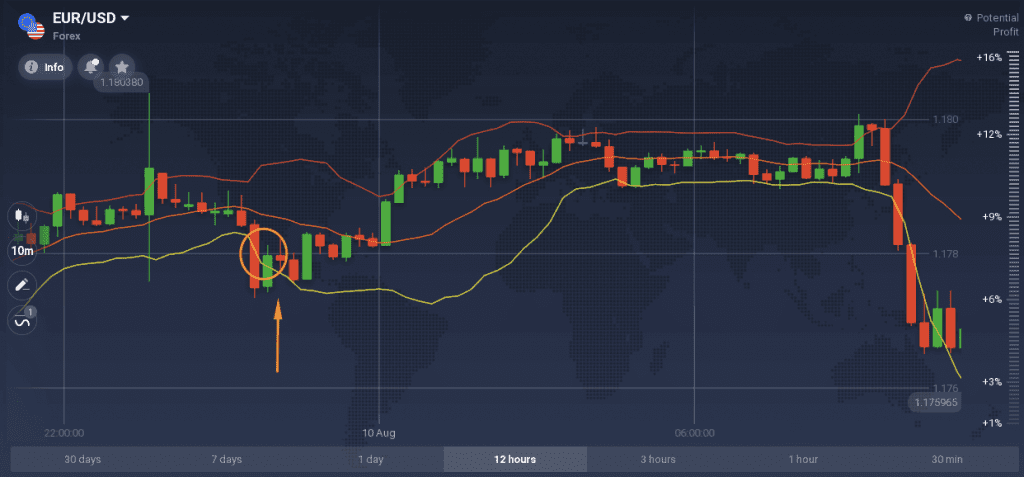

Both indicators create the overbought and oversold levels for the asset, and both of them display the volatility range. A trader may find that the indicators display a Selling signal when the candlesticks approach the upper band and reverse downwards. That could mean that the asset reached its overbought level.

A Buying signal is received when the chart touches or breaks through the bottom band and reverses upwards.

The two indicators may be helpful tools in finding entries and reversal points, however, they work best when combined with other indicators in order to help confirm the received signals. One may combine STARC and the Bollinger Bands with such momentum indicators as RSI or Stochastic. It may also be useful to implement a stop loss or a trailing stop loss with the strategy, as all indicators may give out incorrect signals from time to time.

Note that no indicator gives a 100% guarantee so a good risk management strategy is necessary every time.

Have you used these indicators before? Which one do you prefer? Let us know in the comments and if you still haven’t tried them – feel free to apply them on the Practice account!