More than ever before social media plays a central role in everyday life – acting as a vital component to doing business in nearly every industry across the globe and creating connections far and wide. Let’s take a look at the latest developments for 3 key players in the social media sector – Facebook, Snapchat and Twitter.

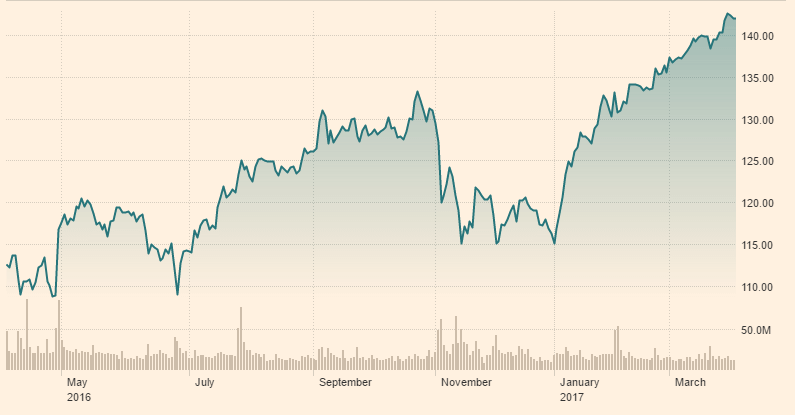

Facebook (FB:NSQ)

Up almost 25% over the past 12 months and 21% since the start of this year, Facebook is on a mission to capture the growing Snapchat user-base.* The company recently updated the FB app to include similar features as their social media rival.

The release has since seen the FB share price take a small knock while Snapchat shares soared 22% higher over the course of the previous week.* With a massive 1.86billion monthly active users FB still leads the way by far compared to SnapChat.

Meanwhile, FB continues to dominate in the digital advertising space and revenues are forecast to grow 37 percent in 2017.** In particular higher revenues will be generated by improved monetization rates.

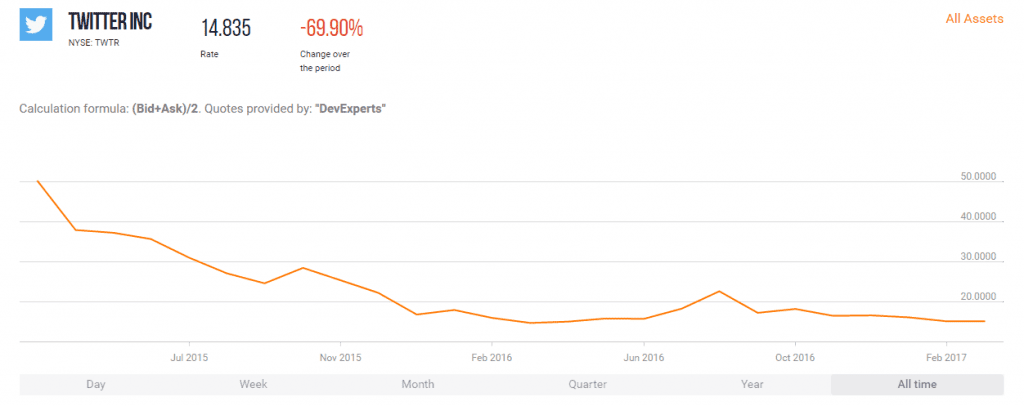

Twitter (TWTR:NYSE)

Twitter shares have had an abysmal track record of performance and based on intrinsic value analysis Twitter shares appear expensive even at current levels.* Twitter shares are down a whopping 67% since IPO, 12% over the past twelve months and 6% since the start of the year.* There are no strong indications of a turnaround and investors would be wise not to buy into the stock at the moment. The best set of circumstances for Twitter investors will be if a buyout occurs – but this is a risky expectation.**

Furthermore, recently released research indicates at least 15% of Twitter users are in fact bots and not people – further worsening the chance of effective monetization. The use of Twitter, for example via President Trump, is increasing in its functional role as a disseminator of news and information. However, company leadership have yet to establish a clear profit making dynamic which makes the outlook of the shares unclear, if not negative, for the medium term.

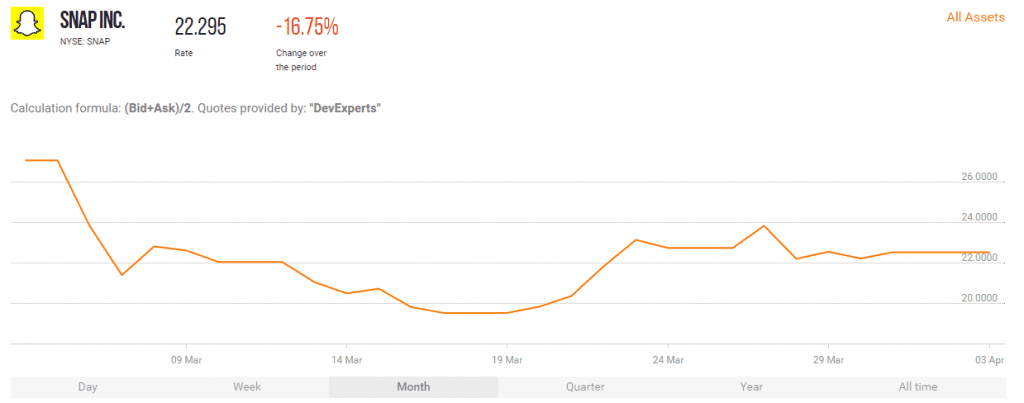

Snapchat (SNAP: NYSE)

Bolstered by the latest releases from Facebook – Snap shares have been drifting higher over the past five days.* The market has concluded that Facebook is recognizing Snapchat as a threat – giving bullish drive to the Snap shares.*

After months of Facebook copying features that made Snapchat a hit, Snapchat finally has the last laugh. For April Fools’ Day, Snapchat added a new filter that makes any image look exactly like an Instagram photo.

Snapchat is in a strong financial position and has been building their advertising business systematically.* With 158 million active daily users the company has resilient fundamentals to drive future growth – based on deep engagement and application of robust user data.** The messaging app owner, Snap, had its IPO early March 2017 – valued at 30USD billion by close of business that day, making it the biggest US IPO since Facebook in 2012 (104 USD billion).* However, the Snap share price has since drifted lower from IPO levels.*

Future success will hinge on improved monetization as well as continuing their strategy of driving growth whilst limiting capital expenditure – with many elements of infrastructure outsourced to Amazon and Google. Continued innovation and cost control are expected to generate increased revenues this year.**

The stakes are increasingly competitive and lucrative as the role of social media grows in our everyday lives and business transactions. The success rates of monetization are growing and the race to capture market share is speeding up. Key to success for each company will be capturing the largest markets –the US and China – as well as innovating fast enough to keep pace with evolving user demand.

* Past performance is not a reliable indicator of future performance.

** Forecasts are not reliable indicator of future performance.