Cryptos have been on fire in the last 12 months. Bitcoin went up 20 times in 2017. Ripple by far eclipsed this, by rising from less than $0.01 in January 2017 to over $3.8 a few weeks ago (an investment of $1,000 would have turned into more than $300,000). Nevertheless, the upside has been accompanied by some very serious downturns along the way.

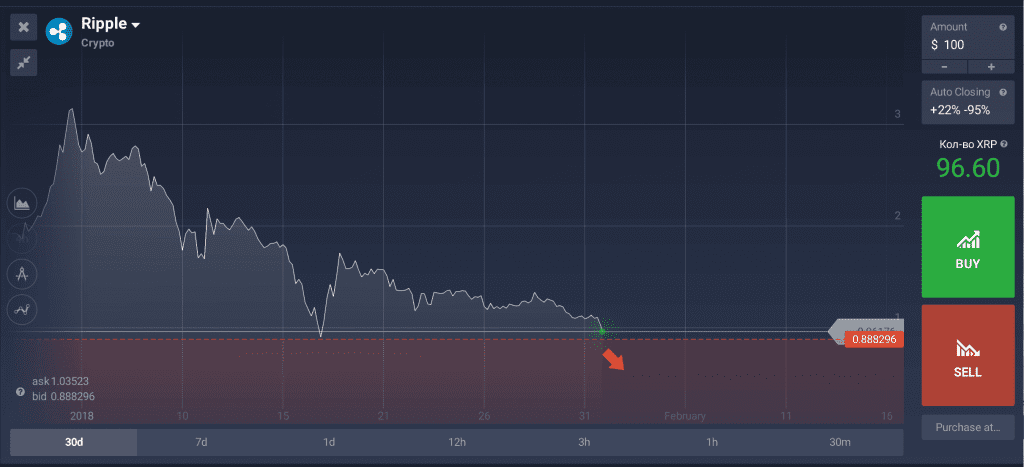

Bitcoin lost more than 30% of its value within days in September 2017 as the Chinese government cracked down on crypto exchanges. January 2018 has so far seen significant corrections, with Ripple down more than 60% and Bitcoin down 40% from their recent highs.

Volatility to the upside is known to be a friend of traders, as it magnifies their potential for profit. But what about the downside? Is it always a synonym of losses or also a potential venue for gains? The answer is that downtrends can be a significant money-making opportunity for investors thanks to shorting. Shorting an asset simply means betting on it to go down from a pre-determined entry price. In the case of stocks, the person who “goes short” borrows the stock from an owner, sells it, and buys it back with the proceeds, ideally at a lower price. The difference between the shorting price and buyback price is the profit.

Historically, very large amounts of money have been made very quickly with successful shorts. Famed trader Jesse Livermore made more than $100 MLN in 1929 shorting stocks before the crash. In more recent times, hedge fund legend George Soros made $1 BLN in less than 24 hours shorting the British Pound before its devaluation. Nowadays, shorting stocks is not the only option. Instruments such as futures and CFDs make shorting extremely easy and widespread. And although not technically considered to be shorting, options and digital options also allow investors to profit from downward moves.

When applied to cryptos, shorting can be extremely profitable. The recent correction in Bitcoin took it from more than $16,000 to less than $11,000, a fall of more than 30%:

Ethereum corrected by more than 40% from January 13th to January 17th:

It is difficult if not impossible to rely on fundamental analysis of cryptos to trade them. That is because there are no financial statements or other measures to determine whether a crypto is undervalued, fairly valued or overvalued. Rather, you must rely on technical indicators to identify the trend, support and resistance levels, volume spikes and volatility.

In addition, using technical indicators is of fundamental importance when timing a short trade. A famous market proverb says that markets take the escalator when they go up, but the elevator when they go down. That means that the same price move takes more time to complete to the upside than to the downside.

With cryptos, this is even more the case. Technical indicators can give you the necessary edge to pinpoint the best moment to get in and get out, down to the minute. An extensive study of what the best indicators are to do this is therefore important to increase your chances of creating a successful shorting strategy.

Having mentioned the upsides of shorting and how to do it, what are the risks?

Mainly that the asset in question moves against you after shorting. As the upside is theoretically infinite, you could lose more money than what you have in the account. On the other hand, your profit potential is limited to 100% – namely if the asset you have shorted goes down to zero.

- Shorted assets should be therefore monitored carefully and continuously for the safety of your account.

That said, if you are thinking of betting on a fall in prices of any asset, including a crypto, you should consider options and digital options. By buying a put you gain as the price falls, and your downside is limited to the premium paid. This allows you manage and limit your investment risk extremely efficiently.

As the market for cryptos continuously evolves, opportunities for profiting in the upside will undoubtedly continue to show up. On the other hand, a fine-tuned shorting strategy will help you protect your account or make money when the trend turns down. There are no signs of the volatility of cryptos decreasing any time soon. Creating and testing a short strategy on cryptos may therefore be the wisest thing to do right now to benefit in full of the next (inevitable) downturn.