The Swing Index indicator was invented by Welles Wilder, who is well-known for his extensive work in technical analysis. Such popular indicators as Relative Strength Index (RSI), Average True Range (ATR) and Parabolic SAR are all his creations. He is the author of the book “New Concepts in Technical Trading Systems” where Swing Index (SI) is described and explained.

Swing Index Indicator

In his work, Wilder contemplated the thought that among the Open, Close, High and Low levels, there is a line that reflects the state of the real market. In order to determine the line of the “real” market he decided to compare each day’s action within the day and with that of the previous day and relate this action to an absolute. It resulted in a complex calculation, which was presented by Wilder in his book, that allows to make predictions about the future short-term price action of the asset. As any indicator, the Swing Index does not give 100% accurate signal, however, it is considered a useful tool in trading.

The Indicator is used to define the strength and direction of the market by analysing the high, low and close prices of the stock.

How to trade with it?

You may find the Swing Indicator in the “Other” tab. The Indicator is placed below the chart, as most oscillators are.

The indicator gives a Buy signal when the SI line crosses above the zero line from below. A Sell signal can be detected when the SI line crosses below the zero line from above.

The indicator can be paired together with RSI or other Trend or Oscillator indicators to define the direction in which the trade is reversing more precisely.

Accumulative Swing Index

Wilder did not stop there and came up with the Accumulative Swing Index (ASI). ASI is a variation of the Swing Index, however it plots a running total of the swing index value of each bar and falls within the range of 100 to -100. It is suitable for a more long-term trading.

If the long-term trend is up, the accumulative swing index is a positive value. Similarly, if the long-term trend is down, the accumulative swing index is a negative value. In case the long-term trend is sideways (non-trending), the accumulative swing index fluctuates between positive and negative values.

The indicator will generally follow the candlestick pattern, however, it can be used to confirm the trend in case of divergence.

How to use in trading?

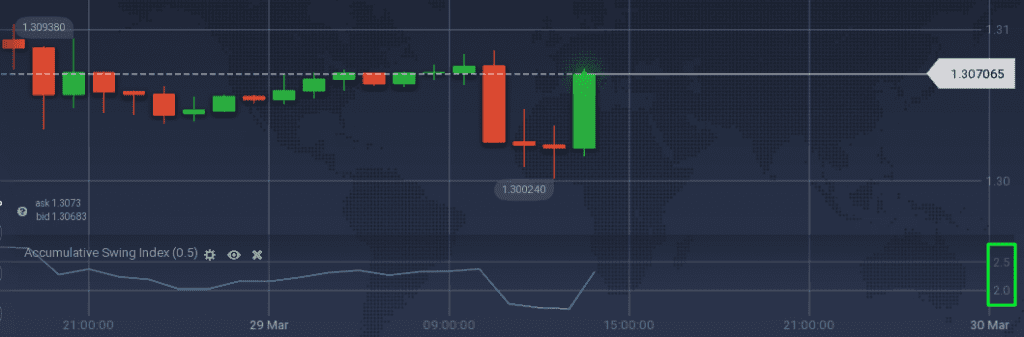

In order to find the ASI indicator, click “Other” tab and you will see it first in the list.

As the Indicator is used mostly for long-term trading, the signals you get from the indicator will help you confirm the trend on the more long-term distance.

When the indicator is in positive values, it means that it is a Buy trend.

Sell trend would be reflected in negative values.

If you see a fluctuation between positive and negative values, it is an indication that the market is currently flat and you may consider using other indicators.

Now at your disposal you have two new indicators, both for short-term and long-term trading. You can see which one you like and use them to build your own trading strategy. Do not overlook the importance of a good trading plan, as a consistent approach is just as important as good technical analysis.