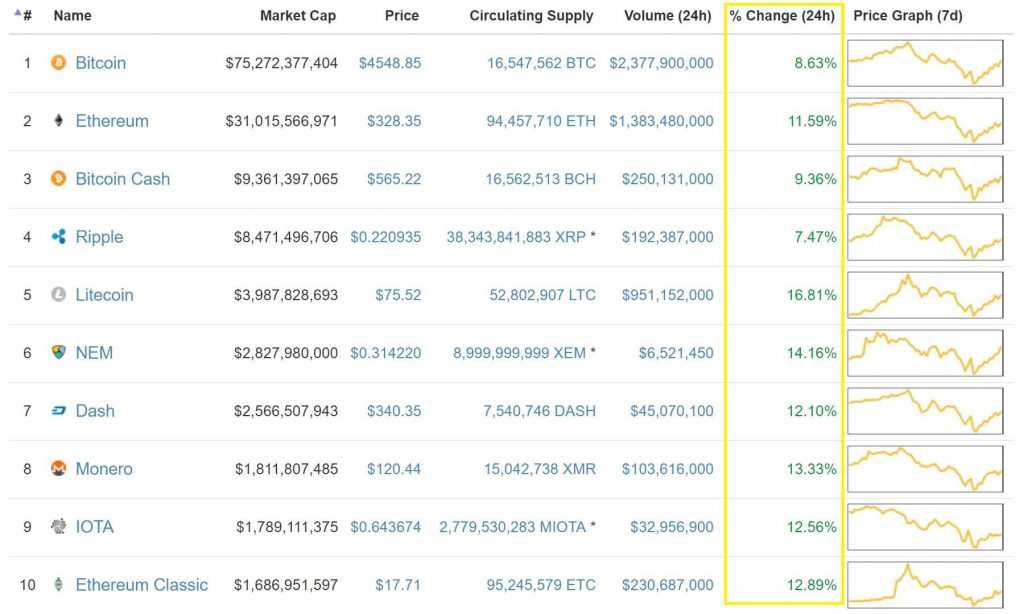

As predicted, the market capitalization of the cryptocurrency market is returning to the pre-plunge level. It should be noted that certain coins do it faster than the market in general. Litecoin grew 16.8% over the course of the last 24 hours, while Bitcoin added ‘only’ 8.6%.

The most recent plunge, presumably caused by the ICO ban in China and overheated cryptocurrency market, turned out to be a temporary setback for crypto investors. Lower prices — during the short-live recession Bitcoin depreciated 25% — created an ultimate buying opportunity for bullish investors.

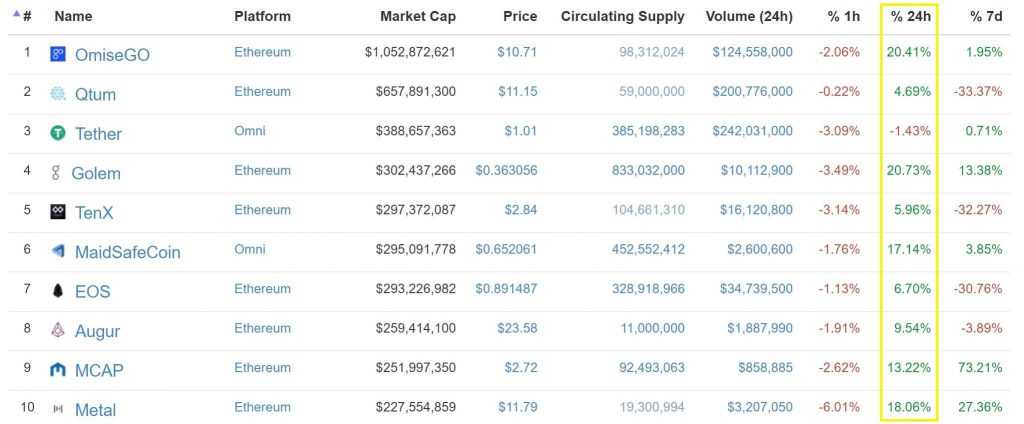

After a $134 billion dip on Tuesday, the market is back in the green with a capitalization of $159 billion, regaining $20 billion of its lost value in 24 hours. The recovery can be expected to continue. The Chinese ICO ban contributed to the downward dynamics but only for a short period of time. The market of the crypto assets is recovering from the most recent decline, as well. Over the last day it did manage to recover $1.5 billion, effectively growing 20%.

Temporary downfalls of the cryptocurrency market are a natural part of its growing cycle. For assets that add to their value hundreds and thousands percentage points in a matter of months, a 25% decline is notable but still far from devastating. The market rebounded quickly and another round of growth can be expected now.