Trump proposes U.S. tax overhaul | Banks go for blockchain payments | Facebook under further pressure

Royal Bank of Canada Using Blockchain for U.S./Canada Payments

Royal Bank of Canada is experimenting with blockchain to help move payments between its U.S. and Canadian banks. Martin Wildberger, RBC’s executive vice president for innovation and technology, said use of distributed ledger technology, or DLT, would improve the speed of payments, reduce complexity and lower costs.

The bank developed the system over the past six months at an RBC blockchain technology center in Toronto, deploying software developed by a cross-industry open-source blockchain consortium known as Hyperledger. The technology was integrated into RBC’s existing systems several weeks ago as a “shadow” to RBC’s primary ledger, letting the bank monitor payments in real-time as they travel between the United States and Canada, he said. “We wanted to set it up as a shadow ledger so that we can demonstrate our leadership in exploiting that technology while at the same time recognizing that the technology is still early in its adoption phase,” Wildberger said.

Investors have since put billions of dollars into developing blockchain, betting the technology could make banking operations faster, more efficient and more transparent. Although concerns remain about the legitimacy of bitcoin, which JP Morgan Chief Executive Jamie Dimon described as a fraud earlier this month, the credibility of the blockchain technology itself has increased. A growing number of senior bankers have said they believe it will eventually revolutionize the way payments are made across the industry, reducing complexity and costs of back-office processes. “Everybody recognizes blockchain will be transformative and critical,” said Wildberger. “At the same point in time, I think everybody recognizes these are early days.” RBC is looking to use blockchain to improve its rewards and loyalty offers and trade finance capabilities, he said. Canada’s central bank said in May that it had decided against using blockchain to provide the underlying infrastructure for the country’s interbank payment system after a year-long investigation, saying “too many hurdles” had to be overcome to make the approach viable.

Trump Proposes U.S. Tax Overhaul, Stirs Concerns on Deficit

President Donald Trump proposed the biggest U.S. tax overhaul in three decades, calling for tax cuts for most Americans, but prompting criticism that the plan favors business and the rich and could add trillions of dollars to the deficit. The proposal drew a swift, skeptical response from Senator Bob Corker, a leading Republican “fiscal hawk,” who vowed not to vote for any federal tax package financed with borrowed money. “What I can tell you is that I’m not about to vote for any bill that increases our deficit, period,” Corker, who said on Tuesday he would not seek re-election in 2018, told reporters. Trump said his tax plan was aimed at helping working people, creating jobs and making the tax code simpler and fairer. But it faces an uphill battle in the U.S. Congress with Trump’s own Republican Party divided over it and Democrats hostile.

President Donald Trump proposed the biggest U.S. tax overhaul in three decades, calling for tax cuts for most Americans, but prompting criticism that the plan favors business and the rich and could add trillions of dollars to the deficit. The proposal drew a swift, skeptical response from Senator Bob Corker, a leading Republican “fiscal hawk,” who vowed not to vote for any federal tax package financed with borrowed money. “What I can tell you is that I’m not about to vote for any bill that increases our deficit, period,” Corker, who said on Tuesday he would not seek re-election in 2018, told reporters. Trump said his tax plan was aimed at helping working people, creating jobs and making the tax code simpler and fairer. But it faces an uphill battle in the U.S. Congress with Trump’s own Republican Party divided over it and Democrats hostile.

Read also: Trump’s Tax Plan And Yellen’s Comments Send The Dollar Moving Higher

The plan would lower corporate and small-business income tax rates, reduce the top income tax rate for high-earning American individuals and scrap some popular tax breaks, including one that benefits people in high-tax states dominated by Democrats. Forged during months of talks among Trump’s aides and top congressional Republicans, the plan contained few details on how to pay for the tax cuts without expanding the budget deficit and adding to the nation’s $20 trillion national debt. The plan still must be turned into legislation, which was not expected until after Congress makes progress on the fiscal 2018 budget, perhaps in October. It must then be debated by the Republican-led congressional tax-writing committees. Analysts were skeptical that Congress could approve a tax bill this year, but that is what Republicans hope to achieve so they can enter next year’s congressional election campaigns with at least one legislative achievement to show for 2017. Financial markets rallied on the plan’s unveiling, an event long anticipated by traders betting that stocks would benefit from both faster economic growth and inflation.

Facebook, Google, Twitter asked to testify on Russian meddling

Executives from Facebook, Alphabet and Twitter have been asked to testify to the U.S. Congress in coming weeks as lawmakers probe Russia’s alleged interference in the 2016 U.S. election, committee sources said on Wednesday. A Senate aide said executives from the three firms had been asked by the Senate Intelligence Committee to appear at a public hearing on Nov. 1. The leaders of the House of Representatives Intelligence Committee said the panel would hold an open hearing next month with representatives from unnamed technology companies in an effort to “better understand how Russia used online tools and platforms to sow discord in and influence our election.” Representatives for Facebook and Google confirmed they had received invitations from the Senate committee but did not say whether the companies would attend. Twitter did not immediately respond to requests for comment.

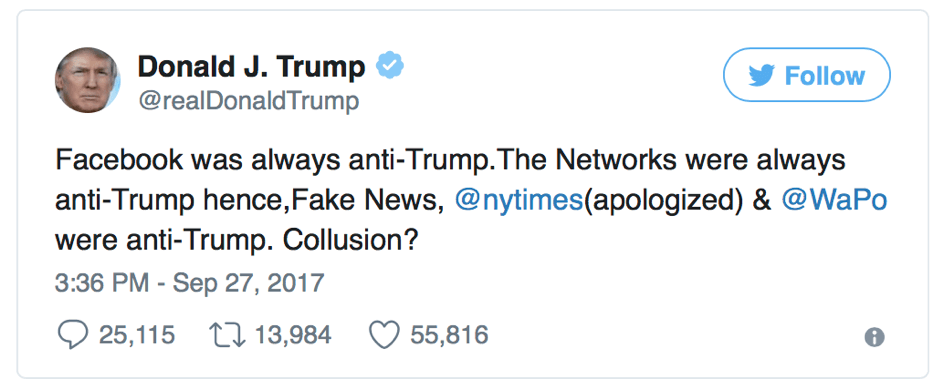

The House panel did not immediately identify any companies, but a committee source said lawmakers expected to hear from the same three firms the Senate had asked to testify. The requests are the latest move by congressional investigators to gain information from internet companies as they probe the extent of Moscow’s alleged efforts to disrupt last year’s U.S. election. Lawmakers in both parties have grown increasingly concerned that social networks may have played a key role in Russia’s influence operation. Facebook revealed this month that suspected Russian trolls purchased more than $100,000 worth of divisive ads on its platform during the 2016 election cycle, a revelation that has prompted calls from some Democrats for new disclosure rules for online political ads. On Wednesday, Trump attacked Facebook in a tweet and suggested the world’s largest social network had colluded with other media outlets that opposed him. The president has been skeptical of the conclusions of U.S. intelligence agencies that Russia interfered in the election and has denied his campaign colluded with Moscow. Time to short Tech companies?

Toyota cooperated for electric car technology venture with Mazda

Toyota is establishing a new venture to develop electric vehicle technology with partner Mazda, seeking to catch up with rivals in an increasingly frenetic race to produce more battery-powered cars. Policymakers in key markets like China are aggressively pushing a shift to electric cars over the next two to three decades, pressuring traditional automakers to crank up their electric vehicle (EV) plans – just as declining battery costs enable more power to be packed into cars.Toyota said in a statement the new company will develop technology for a range of electric cars, including minivehicles, passenger cars, SUVs and light trucks. Toyota will take a 90 percent stake in the joint venture, called EV Common Architecture Spirit, while Mazda and Denso Toyota’s biggest supplier, will each take a 5 percent stake.

Toyota is establishing a new venture to develop electric vehicle technology with partner Mazda, seeking to catch up with rivals in an increasingly frenetic race to produce more battery-powered cars. Policymakers in key markets like China are aggressively pushing a shift to electric cars over the next two to three decades, pressuring traditional automakers to crank up their electric vehicle (EV) plans – just as declining battery costs enable more power to be packed into cars.Toyota said in a statement the new company will develop technology for a range of electric cars, including minivehicles, passenger cars, SUVs and light trucks. Toyota will take a 90 percent stake in the joint venture, called EV Common Architecture Spirit, while Mazda and Denso Toyota’s biggest supplier, will each take a 5 percent stake.

Important events:

10am – eurozone business confidence (September): forecast to rise to 1.1 from 1. Market to watch: EUR crosses

1pm – German CPI (September, preliminary): expected to hold at 1.8%. Markets to watch: eurozone indices, EUR crosses

1.30pm – US GDP (Q2, final), initial jobless claims (w/e 23 September): GDP expected to be left unrevised at 1.2% QoQ. Initial jobless claims expected to fall to 236K from 259K. Markets to watch: US indices, USD crosses