Morgan Stanley (NYSE: MS) quarterly earnings announcement is scheduled for July 19 before the opening bell. Stock price fluctuations can be expected right after the report, at the beginning of the trading session on Wednesday. The consensus EPS forecast for the quarter is $0.76. The reported EPS for the same quarter last year was $0.75. A slight increase can be perceived by the market as a sign of positive dynamics. Share price movements will also be defined by the following factors.

1) Stretched Valuation

When the stock performs ‘too good’ for a certain period of time, it goes up in price. It means that as an investor you’ll have to pay move to receive the same return. Not all investors are willing to buy stocks with a premium. Price-to-book ratio (which is most often used to evaluate banks) for Morgan Stanley is currently equal to 1.21, almost the highest in a five-year period. Therefore, it can be hard for an already overvalued company like Morgan Stanley to increase in price.

2) Cost-saving Initiatives

Project Streamline, a company-wide cost-cutting initiative, is destined to cut down the expenses. No matter how big or professional the business is, there is always room for improvement. Morgan Stanley’s top management found a way to reverse the trend and shorten the expenses in 2015 and 2016. The company is on track to achieve the $1 billion expense saving target.

3) Financial CHOICE Act

President Donald Trump made clear it would be in America’s best interest to let the commercial bank choose the assets to invest, once again. The Dodd-Frank Act is expected to be repealed soon and replaced with a Financial CHOICE Act. The latter will increase the number of financial options and likely stimulate the investing activity in the bank.

4) Weakening Trading Revenues

A substantial portion of the company’s revenue comes from trading activities, which in turn depend on the macro market trend. Due to higher risks and lower returns less people want to trade during the recession. Conversely, more people turn to trading when the economy is booming and returns are high. The US stock market demonstrated decent performance in the first half of 2017 but expected to slow down in the upcoming months. If so, Morgan Stanley’s trading revenues can be negatively affected.

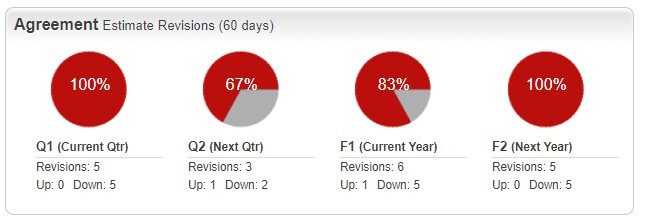

5) Negative Earnings Revision

Earnings per share (EPS) is one of the key elements in stock valuation. After all, most investors purchase shares of a particular company due to its ability to generate stable and decent cash flow. When the company is no longer able to sustain high growth rates, some investors will switch to better options, creating selling pressure and bringing the stock prices down. It can possibly happen to Morgan Stanley, as well. In the last 30 days, the company’s EPS has been negatively revised.

Ranked ‘Sell’ by Zacks, MS shares are a tricky asset to evaluate. On the one hand, the company just had a fantastic year, demonstrating a 68 percent increase in the market capitalization. On the other one, there are still enough problems both within and outside the company that can bring the stock price down. Morgan Stanley’s shares will react to the data released in the upcoming report.